Florida

I’m writing this blog from Florida. Hey, where else does a guy from Toronto go to escape the heat? Florida, of course. It’s steamy hot down here as well, but the heat and humidity seem tolerable when you’re in vacation mode. I have to say that the state of Florida has really grown on me. I love it down here. Why? The weather is great all year round. Secondly, they have all the amenities you can ask for – beaches, great restaurants, fantastic cigar stores, golf courses galore, professional sports franchises. Thirdly, everything is cheap. The best part about buying anything down here is that you always feel like you got a good deal. The best deal you can get today is real estate. I think it’s a good time to buy down here. Distress means great value and flexibility by the home owner, be it the vendor or the bank. A word of advice, if you decide to explore what’s available you better pick one specific location. There’s just too much product available to bounce around from one side of the state to the other to check out homes. Secondly, if you decide to buy, the day after the deal closes forget about values. It’s going to take years before Floridians see any appreciable increase in values. If you’re looking for a second home, a place where the family can go, a place where your parents can go to escape the winter, it’s a great time to buy. I was speaking to a real estate agent yesterday and he said if it wasn’t for Canadian’s buying up product in his area he wouldn’t be busy. Great value, and good exchange rates, is attracting a lot of Canadians. What I don’t like about Florida? Old farts that drive on I-75 doing 15 miles under the legal speed limit, while in the left hand lane.

I’m writing this blog from Florida. Hey, where else does a guy from Toronto go to escape the heat? Florida, of course. It’s steamy hot down here as well, but the heat and humidity seem tolerable when you’re in vacation mode. I have to say that the state of Florida has really grown on me. I love it down here. Why? The weather is great all year round. Secondly, they have all the amenities you can ask for – beaches, great restaurants, fantastic cigar stores, golf courses galore, professional sports franchises. Thirdly, everything is cheap. The best part about buying anything down here is that you always feel like you got a good deal. The best deal you can get today is real estate. I think it’s a good time to buy down here. Distress means great value and flexibility by the home owner, be it the vendor or the bank. A word of advice, if you decide to explore what’s available you better pick one specific location. There’s just too much product available to bounce around from one side of the state to the other to check out homes. Secondly, if you decide to buy, the day after the deal closes forget about values. It’s going to take years before Floridians see any appreciable increase in values. If you’re looking for a second home, a place where the family can go, a place where your parents can go to escape the winter, it’s a great time to buy. I was speaking to a real estate agent yesterday and he said if it wasn’t for Canadian’s buying up product in his area he wouldn’t be busy. Great value, and good exchange rates, is attracting a lot of Canadians. What I don’t like about Florida? Old farts that drive on I-75 doing 15 miles under the legal speed limit, while in the left hand lane.

The U.S. Avoids Default

Well that was a shock – There was little doubt that an agreement would be hammered out. The only question is what the agreement would look like. What I read and hear down here is both the Democrats and Republicans are not happy. I guess in some ways that makes me believe that it’s an okay deal. If both sides aren’t happy it means there was give and take. As details come out about the deal, and is actually passed in Congress and the Senate, we’ll get a better idea if the agreement is a band-aide solution or something that has substance. My money is on political cover rather than doing what’s best for the country. Winston Churchill said this about U.S. politicians, “they always get it right but only after failing everything else they try first“.

Well that was a shock – There was little doubt that an agreement would be hammered out. The only question is what the agreement would look like. What I read and hear down here is both the Democrats and Republicans are not happy. I guess in some ways that makes me believe that it’s an okay deal. If both sides aren’t happy it means there was give and take. As details come out about the deal, and is actually passed in Congress and the Senate, we’ll get a better idea if the agreement is a band-aide solution or something that has substance. My money is on political cover rather than doing what’s best for the country. Winston Churchill said this about U.S. politicians, “they always get it right but only after failing everything else they try first“.

Volumes Decrease

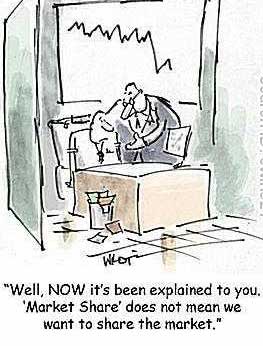

Over the last few weeks we’ve been hearing that volumes for Q2 are down year over year in the broker world. We know for a fact that submissions are down as of the end  of June. How that translates to actual volumes will become clearer when D + H publishes their market share report for Q2 in the second week of August. The market share report will probably validate what I’ve been hearing from brokers in the last 90 days, it’s slower and banks are still very aggressive. If the Ministry of Finance wanted to cool things down from a borrowing perspective, with the changes they made in April, mission accomplished. The only question is did the broker world take a bigger hit than the direct to bank world? We’ll find out soon enough.

of June. How that translates to actual volumes will become clearer when D + H publishes their market share report for Q2 in the second week of August. The market share report will probably validate what I’ve been hearing from brokers in the last 90 days, it’s slower and banks are still very aggressive. If the Ministry of Finance wanted to cool things down from a borrowing perspective, with the changes they made in April, mission accomplished. The only question is did the broker world take a bigger hit than the direct to bank world? We’ll find out soon enough.

Until next time,

Cheers.

This was a term we were all too familiar with back in August and September of 2008. It is also the name of a new HBO movie which chronicles what transpired at the beginning of the sub-prime mortgage meltdown. HBO assembled an outstanding cast, and given the subject matter the movie was rather entertaining. I would highly recommend watching the movie. It is a good reminder to all of us that the term boom and bust is as applicable today as it always has been.

This was a term we were all too familiar with back in August and September of 2008. It is also the name of a new HBO movie which chronicles what transpired at the beginning of the sub-prime mortgage meltdown. HBO assembled an outstanding cast, and given the subject matter the movie was rather entertaining. I would highly recommend watching the movie. It is a good reminder to all of us that the term boom and bust is as applicable today as it always has been.

In typical Hollywood fashion, a liberal bias amounting to revisionist history, the movie tried to blame George W. Bush and Ronald Reagan for the meltdown, and all other evil things. The truth is you can go back to the Jimmy Carter administration, and the passing of the Community and Reinvestment Act. That work of art stated that home ownership was a right, and not a privilege. This is where the slippery slope began. Then old Slick Willie, aka “which way are the political winds blowing today because that’s what I’ll stand for”, Bill Clinton, put that program on steroids. Suffice to say the responsibility for the meltdown, and the nuclear fueling of the problem, is equal parts Republican and Democratic.

The movie is a great reminder of how perilously close we came to an economic meltdown. How our standard of living was at the precipice. If you think this is hyperbole, because this was really a US issue, the reality is that this carcinogen (sub-prime mortgages) infected world markets. I can’t help but to think about the auto worker in Windsor and Detroit, the welder in Germany, the machinist in France, all, asking the same question: “Tell me again why my pension has taken a hit because of some mortgage problem?” No one from Wall Street could explain what happened in laymen terms. The average person cares little about default swaps, derivatives and mortgage-backed securities. All the layman cares about is finding out who the hell let this happen. That question has still gone unanswered.

The movie doesn’t deal with the who. The movie played up of the part about the moral dilemma the government faced. Who did the government decide to bail out, AIG, and who did they allow to fail, Bear Stearns and Lehman Brothers. All very fascinating and dramatic. But after watching the movie I couldn’t help but ask myself the following question: “How the hell has no one gone to prison over this?” I’m all for a free market system, and the pursuit of wealth, but reckless endangerment of our economy and standard of living should not go unpunished. There were individuals and institutions who knew full well they were passing on toxic assets. They were passing on the risk so they didn’t care. They could care less about the consequences. Yet none of the perpetrators of this ingenious fraud has ever been charged or convicted. You would think at least a couple of them should be experiencing the joys of being passed around in prison for a carton of smokes.

Until next time

Cheers

Read More Add a Comment