I find it fascinating how much time, money and energy is spent looking for the next business advantage. I’m guilty of it. I’ve read countless books on business, leadership as well as hundreds of articles over the years in an effort to find the magic bullet…that one nugget that will separate me and our organization from the rest. We all know it’s never just one idea, one process, or one specific management style that separates one organization from another. Success is a result of many business layers which are refined and tweaked over the evolution of a particular business. The hope that drives me to find THE nugget is my educational driver. Over the past six weeks I’ve be reminded of something, and it may not be THE nugget, but it’s critical to the success of any business. It wasn’t anything I read. I was simply being introspective.

In my humble estimation employee engagement is one of the most critical drivers of success. Ask yourself, or think of your direct reports, how many times have you or your employees shown up for work in the last six weeks in body only? Physically present but mentally and emotionally absent. The past six weeks has made me realize that I was guilty of this in 2012. Yes, the entire year. As most of you are aware a MERIX/Paradigm management buyout was completed at the end of February. The management buyout process began well over a year ago, and if I factor in being Chair of CAAMP in 2012, I have to be brutally honest with myself and admit I that my focus and attention waned in 2012. I was not engaged in the business of running MERIX. I was there, I showed up but there were too many distractions. I only now realize the level of my disengagement in 2012.

My word, what a difference the last six weeks have been. I haven’t felt this invigorated in a long time. To arrive at work now and say, with conviction, today we get things done, and then actually get those things done, is an adrenalin rush. We’re starting to move that big concrete flywheel again at MERIX and Paradigm. To be able to speak to my partners about growth and future of our business is reminiscent of the way things were in the early years. Knowing my partners are engaged once again breeds confidence, and that’s contagious. All of this is happening because we’re simply paying attention and we have no distractions.

My advice to you is to be completely honest with yourself about your level of engagement at work. Ask yourself if you’re just showing up to work, mailing it in, and really is work a comfortable place to kill time? If you answer yes to any of these you need to eliminate the distractions and reengage. It’s better you deal with it yourself than your employer. I came across a saying recently, once again looking for that nugget, that speaks to a level of engagement at work, and at home. “Treat everyday day at work like it’s your fist day on the job, and treat every day at home like it’s your last day on earth”.

Until next time,

Cheers.

Read More Add a Comment

And how was your weekend? Surely it wasn’t so long ago that you’ve forgotten? I heard the weather across the country was nice so I suspect some of you may have spent time outdoors getting some fresh air. That’s exactly what I would have been doing if I didn’t have to be indoors for most of the weekend. Our lad’s house league teamed played in in the GTHL Canadian Tire Hockey Tournament, which officially marked the end of his house league season. How many games he would play, (meaning how many times I would have to drive back and forth to the arena?) would depend on how many games won, and points earned during the preliminary round. Three trips…pardon me – three games guaranteed. Including a 7:00 am start on Sunday morning; which meant we had to be at the arena by 6:15am. There are only two reasons to be anywhere at that ungodly hour on a Sunday morning, catching a flight or making your tee time. Adding to the fact of the less than optimal game time, was the fact that the result of the game was irrelevant – they already qualified for the semi-final. Yeah, this was a glorified practice. Making it to the semi-final was a surprise to many of the parents, and the coaches. You can only imagine our shock and disbelief when the boys made it to the final.

Watching Mack develop as hockey player has been a real joy; this is only his third year of playing organized hockey, and he got his fill this year by playing on two teams. One is house league team and he also made the select team. That’s a lot of hockey, for the parents. The kids playing? Put them on as many teams as you want and they’ll be fine with it; Mack loves playing. Unlike some other parents, Kathy and I do not live vicariously through Mack, with the hopes that he’ll make it to the pro’s one day. His mom is his biggest cheerleader, and she lets him know, sometimes rather loudly, that she’s pulling from him. It’s funny to watch him get set for the face off, look up into the crowd, and wave to his mom. At that age being cool doesn’t supersede acknowledging your biggest fan. The boy has a wonderful sense of humour, and he’s really grounded when it comes to the game. He knows who the stars are on the team, and the role he plays. He takes the  game seriously but not himself. Example, last year I tried to bribe him by saying “Mack, if you score a goal tonight I’ll take you to Tim’s and you can load up on sugar”. Upon reflection he looks at me and says, “Make it ribs”. Done! “If you score a goal tonight we’ll stop at Swiss Chalet and I’ll get you ribs, a full rack”. I kid you not ten seconds into the game he ends up on a breakaway, roofs it into the top corner. After high-fiving teammates he skates to center ice for the face-off, looks up at me into the crowd, and starts rubbing his stomach (the way you would when saying, mmmm…good). I just finished wiping the tears away from laughing so hard when he scores his second goal. Back to center ice for the face-off. He looks for me in the crowd, and when he sees me, he drops his stick and gloves and imitates someone eating ribs. I thought I was going to have to buy Depends because I couldn’t stop laughing.

game seriously but not himself. Example, last year I tried to bribe him by saying “Mack, if you score a goal tonight I’ll take you to Tim’s and you can load up on sugar”. Upon reflection he looks at me and says, “Make it ribs”. Done! “If you score a goal tonight we’ll stop at Swiss Chalet and I’ll get you ribs, a full rack”. I kid you not ten seconds into the game he ends up on a breakaway, roofs it into the top corner. After high-fiving teammates he skates to center ice for the face-off, looks up at me into the crowd, and starts rubbing his stomach (the way you would when saying, mmmm…good). I just finished wiping the tears away from laughing so hard when he scores his second goal. Back to center ice for the face-off. He looks for me in the crowd, and when he sees me, he drops his stick and gloves and imitates someone eating ribs. I thought I was going to have to buy Depends because I couldn’t stop laughing.

Beyond the laughs I’m thankful for all the lessons Mack learned this year from hockey. The importance of working as a team, and embracing structure and discipline to achieve the ultimate goal, winning. He’s fortunate to play on teams with great head coaches. Improving skills and hockey I.Q. is important. But the life lessons learned are equally as important. It’s was disappointing to see two teams refuse to shake hands after losing to Mack and his mates. I can’t blame 11 year old’s for that. That responsibility is in the coaches hands. They should be embarrassed for what they’re teaching young and impressionable boys. Mack was fortunate to be led by men who taught them to win with grace and lose with dignity. Like the dignity they showed when the lost the championship game. They stood on blue line together and watched the other boys celebrate as they were presented the championship trophy. Not an easy thing for an 11 year old to go through but that’s life; he’ll be all the better for it.

Until next time,

Cheers.

Read More Add a Comment March is the month where we start to believe that winter may be finally coming to an end. March brings promise, unless if course you’re talking about the economy. Never mind the snow and cold temps that much of the country had to deal with. It pales in comparison to all the economic news as relates to the month of March.

March is the month where we start to believe that winter may be finally coming to an end. March brings promise, unless if course you’re talking about the economy. Never mind the snow and cold temps that much of the country had to deal with. It pales in comparison to all the economic news as relates to the month of March.

Here’s some of the low lights:

If you ever needed to make up an excuse to celebrate, you have one now. Make a toast over the weekend that March is behind us. I plan on suspending reality over the weekend because all of the above awaits for me on Monday.

Until next time,

Cheers.

Read More Add a Comment Now that the first quarter is in the review mirror, for those companies on a calendar year, we can now do our analysis to determine if the previous ninety days is a harbinger of things to come for the remainder of the year. The experience, results, of the first ninety days of the year was difficult to label. Changes to the mortgage rules, consumer confidence and weather had to be factored when trying to determine if this was the “new norm”. Speaking to many of my industry colleagues, no one could say with any certainty that the most recent results are now the “new norm”. That was my stock answer when I was asked but I think hard data is providing clarity.

Now that the first quarter is in the review mirror, for those companies on a calendar year, we can now do our analysis to determine if the previous ninety days is a harbinger of things to come for the remainder of the year. The experience, results, of the first ninety days of the year was difficult to label. Changes to the mortgage rules, consumer confidence and weather had to be factored when trying to determine if this was the “new norm”. Speaking to many of my industry colleagues, no one could say with any certainty that the most recent results are now the “new norm”. That was my stock answer when I was asked but I think hard data is providing clarity.

There’s an old adage that I’m rather fund of, the numbers are what you are. Rationalization or any form of sugar coating does not change the numbers. The same holds true for the industry.

Here are some facts courtesy of the Canadian Real Estate Association:

So what do these stats mean? Firstly, the numbers above shouldn’t come as surprise to anyone who has been in this industry longer than it takes to have a cup of coffee. We all felt it in the first quarter but waited on data to provide the proverbial exclamation point. Also, angst and misery loves company. “Ah, it’s not just me”. No, it’s not just you but when you get beyond that you start dealing with the matters at hand. The numbers provide a road map for all of us. The housing inventory today suggest we’re in a balanced market, supply and demand. Too much supply leads to equity erosion, and too much demand leads to irrational values. The elimination of both is good for our respective business, and the market as whole. According to statistics new listings are down sixty per cent; concerning at face but extremely positive relative to values. Home owners are not dumping properties by slashing pricing. Employment is stable, cheap money is available, therefore, home owners are less inclined to have a fire sale. I think it’s clear that cheap money will be available well into 2014, and if the bottom doesn’t fallout to our economy, directly impacting employment rates, home values should remain stable.

Factoring in B.C. –

The national home price average looks different if you remove the BC numbers. Statistically B.C. impacts the national numbers positively and negatively given the median price in B.C. So the impact of the “new norm” will depend largely in part on what region of the country you do business in.

Changes to mortgagee rules were intended to slow things down. Mission accomplished. Now we all have to deal with the reality of the market place. Banks will continue to invest heavily in their propriety sales forces, meaning even more competition for mortgage brokers. First time home buyers were impacted the most by all the changes to mortgage rules, and as we all know the first time home buyer is the mortgage broker’s sweet spot. Consumer confidence is an issue, and all the negative chatter has had an impact. So, this is now the “new norm” – to that I say, “fine”. Adversity and challenges leads to collaboration. If you’re a mortgage broker reading this, your issues are my issues because my business depends on yours. By working together we’ll overcome the challenges, and we’ll get our respective share by taking it from others.

Until next time,

Cheers

Read More Add a Comment“I wonder how you would feel if you received a call from the government saying we would rather you not buy down interest rates.”

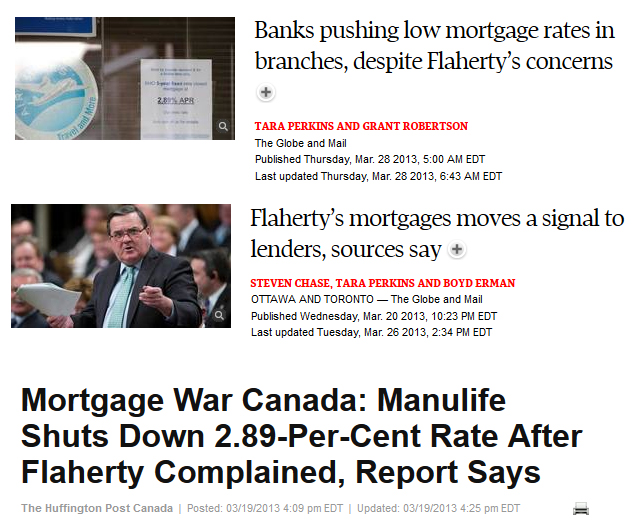

Ever run across something that doesn’t sit right. That nagging doubt that you can’t put your finger on, and it just hangs out there. I experienced that a few days ago after reading an article in the Globe. I decided to take few days and give the article one more glance to see if my original reaction would still be the same. Yup, nothing changed. The article in question appeared in the Globe on Wednesday, March, 20th. The headline read, “Flaherty Pushes up Lending Rates – Finance Minister called lenders to express displeasure at mortgage competition, raising bankers’ hackles“.

Few will or should care about a bankers disposition, but I think we should all care when big brother over reaches. I do not how else I can categorize the direct influence over pricing by the government in the private sector. As reported in the Globe, Minister Flaherty contacted Bank of Montreal to chastise them for lowering rates in an attempt to buy market share. A call also went out to Manulife, but the scolding was delivered by one of the Minister’s underlings. It’s easy to say who cares if faceless corporations get their wrists slapped. But any government encroachment of pricing in the private sector should give us all pause. Imagine you are a mortgage broker who has embarked on a strategy of rate buy-downs. The merit of such a strategy is irrelevant, what is relevant is that you have the right to earn or lose money based on your competency or incompetency. We live and work in a free market economy, and the state plays an important role; pricing of products should never be one of them. I wonder how you would feel if you received a call from the government saying we would rather you not buy down interest rates. I get it – that would never happen based on the actions of a handful of brokers. But entrepreneurs of all sizes share a common principals, and for it to be different based on the size of the enterprise alone undermines the fundamentals of competition.

Few will or should care about a bankers disposition, but I think we should all care when big brother over reaches. I do not how else I can categorize the direct influence over pricing by the government in the private sector. As reported in the Globe, Minister Flaherty contacted Bank of Montreal to chastise them for lowering rates in an attempt to buy market share. A call also went out to Manulife, but the scolding was delivered by one of the Minister’s underlings. It’s easy to say who cares if faceless corporations get their wrists slapped. But any government encroachment of pricing in the private sector should give us all pause. Imagine you are a mortgage broker who has embarked on a strategy of rate buy-downs. The merit of such a strategy is irrelevant, what is relevant is that you have the right to earn or lose money based on your competency or incompetency. We live and work in a free market economy, and the state plays an important role; pricing of products should never be one of them. I wonder how you would feel if you received a call from the government saying we would rather you not buy down interest rates. I get it – that would never happen based on the actions of a handful of brokers. But entrepreneurs of all sizes share a common principals, and for it to be different based on the size of the enterprise alone undermines the fundamentals of competition.

Another part of the story I find troublesome is why did this become public? I suspect the Minister of Finance would be put directly through to the CEO of both Bank of Montreal and Manulife. For appearance sake alone this arm twisting should have been done in private, and not worn like a badge of honour in public. The general public already believes that the working relationship between the government and banks is too cozy; these stories don’t help to dispel that notion.

Until next time,

Cheers.

Read More Add a Comment