It’s almost over! I suspect most hockey parents share same sentiment. I’m sure the kids who play organized hockey could go on and on; their parents? Not sure how much they will miss the cold arenas and scheduling three to four nights a week to be at an arena. This was really my first year as a hockey “parent/guardian”. Our 11 year shocked us by making the select team. Combine that with his house league team, well, that’s a lot of hockey. As an example he played in tournament this weekend, and as of 7:30pm last night he played 5 games over the weekend. Yes, that’s 5 trips to arenas, lacing up and taking off skates, and listening to 11 year old dressing room chatter. A wide range of topics are discussed in the dressing rooms, from the cute girl at school to boogers. And what makes the conversation even more engrossing for me is the decibel level. My ritual, and that’s what it is at his games, is to ensure he puts on his cup the right way and then lace up his skates. Once done I grab for the Advil and look for something to wash it down with.

It’s almost over! I suspect most hockey parents share same sentiment. I’m sure the kids who play organized hockey could go on and on; their parents? Not sure how much they will miss the cold arenas and scheduling three to four nights a week to be at an arena. This was really my first year as a hockey “parent/guardian”. Our 11 year shocked us by making the select team. Combine that with his house league team, well, that’s a lot of hockey. As an example he played in tournament this weekend, and as of 7:30pm last night he played 5 games over the weekend. Yes, that’s 5 trips to arenas, lacing up and taking off skates, and listening to 11 year old dressing room chatter. A wide range of topics are discussed in the dressing rooms, from the cute girl at school to boogers. And what makes the conversation even more engrossing for me is the decibel level. My ritual, and that’s what it is at his games, is to ensure he puts on his cup the right way and then lace up his skates. Once done I grab for the Advil and look for something to wash it down with.

To be clear, no one in our household is under the illusion that our 11 year old is going to earn a hockey scholarship or make it to the pros. Our desire for him to play the game is for the camaraderie, and the life lessons the sport teaches kids. The most important lesson is that there are winners and there a losers. Defeat and failure in sports prepare kids for the “real world”. Not everyone one can win, that’s life. It was tough to walk into the dressing room this weekend and see bunch of 11 year olds in tears because they lost a heartbreaker in sudden death overtime. That game effectively ended their tournament, and they knew it. As bad as I felt for the kids I was glad they were learning a lesson. There was no” poor you” by the other dads in the dressing room. My only comment to Mack was, “don’t ever forget what this feels like, and do the best you can to make sure it doesn’t happen again”. Of course it will happen again but an 11 year old can only take so much reality.

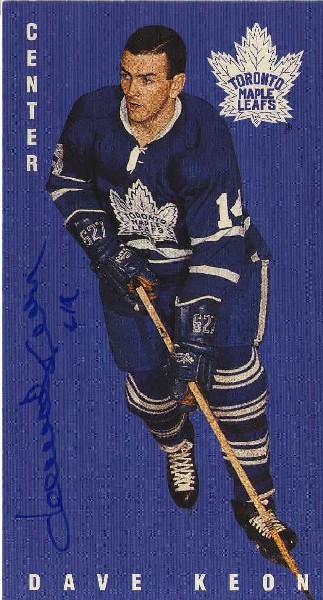

I must confess that this hockey year taught me a few things as well. It annoyed me that Ma ck, our 11 year old, doesn’t love the game. Oh, he loves to play. If there’s a practice at an outdoor rink and it happens to be minus 20 outside, no problem. But he’s not consumed by the game. There are no hockey player posters on his wall. It’s a struggle to get him to watch a period of a game with me on TV. He would rather be doing other things. I just didn’t get that. When I was his age I was sports junkie, I idolized athletes. If I close my eyes I can still remember the day when my mom called me into the house and she handed me an envelope which came by mail. I was around 10 or 11 years old, and there was an envelope for me from Maple Leaf Gardens. My hero, former Toronto Maple Leaf -Dave Keon, responded to my letter and sent me an autograph picture. I raced out of the house and showed every kid on the street the picture that Dave Keon sent me, and the kids on the street were all memorized by the photo. It was a big deal. I really wanted Mack to experience the same thing. But the lesson I’ve learned its okay if he doesn’t worship athletes. As a matter of fact by not hero worshiping he’s probably saving himself some grief. Thankfully Mack never worshiped athletes like Lance Armstrong, Tiger Woods, Marlon Jones, Alex Rodriguez, Michael Vick, Oscar Pistorious, and sadly too many other professional athletes to mention. Athletes are human beings with frailties, and that can be difficult to explain to an 11 year old. Idolizing and hero-worshiping should be dedicated to those who truly deserve it – for example, his mom. If that’s all he gets out of playing hockey then the countless hours spent in a cold arenas will be worth it.

ck, our 11 year old, doesn’t love the game. Oh, he loves to play. If there’s a practice at an outdoor rink and it happens to be minus 20 outside, no problem. But he’s not consumed by the game. There are no hockey player posters on his wall. It’s a struggle to get him to watch a period of a game with me on TV. He would rather be doing other things. I just didn’t get that. When I was his age I was sports junkie, I idolized athletes. If I close my eyes I can still remember the day when my mom called me into the house and she handed me an envelope which came by mail. I was around 10 or 11 years old, and there was an envelope for me from Maple Leaf Gardens. My hero, former Toronto Maple Leaf -Dave Keon, responded to my letter and sent me an autograph picture. I raced out of the house and showed every kid on the street the picture that Dave Keon sent me, and the kids on the street were all memorized by the photo. It was a big deal. I really wanted Mack to experience the same thing. But the lesson I’ve learned its okay if he doesn’t worship athletes. As a matter of fact by not hero worshiping he’s probably saving himself some grief. Thankfully Mack never worshiped athletes like Lance Armstrong, Tiger Woods, Marlon Jones, Alex Rodriguez, Michael Vick, Oscar Pistorious, and sadly too many other professional athletes to mention. Athletes are human beings with frailties, and that can be difficult to explain to an 11 year old. Idolizing and hero-worshiping should be dedicated to those who truly deserve it – for example, his mom. If that’s all he gets out of playing hockey then the countless hours spent in a cold arenas will be worth it.

Until next time,

Cheers.

Read More Add a Comment

Any Plans For March Break?

This is the time of year when Canadian families look to escape the winter blues by heading to warmer climates. Arizona and Florida are popular destinations, especially for snow birds. The state of Florida provides a lot of things for families to do. There’s Disney, Bush Gardens, the Cape, and going to open houses. What, you don’t think dragging your kids to open houses when you’re on vacation is normal? Hmm, must just be our family. We’re dragged our 11 year old to so many open houses over the years that he actually now provides feedback on the home we’ve just looked at. Kid you not the last time we were in Florida we took him to an open house, and on the way home I asked him what he thought of the house? His answer? “I really liked the footprint”; nearly brought a tear to my eye.

This is the time of year when Canadian families look to escape the winter blues by heading to warmer climates. Arizona and Florida are popular destinations, especially for snow birds. The state of Florida provides a lot of things for families to do. There’s Disney, Bush Gardens, the Cape, and going to open houses. What, you don’t think dragging your kids to open houses when you’re on vacation is normal? Hmm, must just be our family. We’re dragged our 11 year old to so many open houses over the years that he actually now provides feedback on the home we’ve just looked at. Kid you not the last time we were in Florida we took him to an open house, and on the way home I asked him what he thought of the house? His answer? “I really liked the footprint”; nearly brought a tear to my eye.

For past six months I’ve suggested that if you’re thinking of buying a second home in the Sunbelt you may want to do so sooner rather than later. Many Canadian’s are doing just that because there’s deals to be had however there’s no doubt that Florida market is showing signs of recovery, which means the insanely good deals will be a thing of the past. In the last six months I know of two families who have purchased properties in Florida. One family purchased a condo, a foreclosure, and another family purchased a single family detached home, a short-sale. In both cases the price they paid would make you shake your head. In both cases the two families could have purchased their homes on their credit cards, and still have room on their limit. Through sheer luck or astute analysis they purchased their home at the bottom of the market. According to the Florida Real Estate Association, one third of all home being purchased by foreign nationals in Florida are Canadians. The net result of all this activity? The average home price increased by 17.8% in 2012, and the time on the market has dropped to 63 days from 78. Credit is still fairly tight for American buyers so foreign nationals purchasing a home in Florida are making a significant contribution to the Florida real estate market. It’s estimated that 90% of Canadians buying homes in Florida are doing so with cash. No need for mortgages, dollar parity makes it a little more affordable for Canadians.

So if you’re heading down South for the March break you may want to set aside a day to have look at some real estate. After two or three days at Disney the little darlings owe you. But if you have to bribe them you can tell them you’re going to visit some friends, and if they’re not at home it’s okay if they jump on all the beds.

Until next time,

Cheers.

Read More Add a Comment

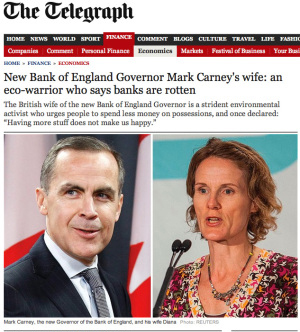

I suspect it didn’t take long for Mark Carney to conclude, after testifying before the U.K Treasury Select committee, that life might a little different for him in the U.K. Nothing to do with culture or driving on the wrong side of the road. Going from Rock Star status in Canada to please justify your salary, your yearly housing allowance, and why should we except an interloper to be the next Governor of the Bank of England, is a tad different from what Mr. Carney has been experiencing in his native homeland. In Canada it’s Careymanaia, in the U.K., it’s not what have you done for us lately but rather you’ve done nothing for us to date, therefore, we’ll treat you as such. Check out some of these British headlines about Carney. The Sun, “Heavy Metal Fan to Run Bank of England”. Why? The Sun found out that Carney would blast AC/DC’s Back in Black before he played hockey while at Harvard. The Daily Mail, “Jolly Hockey Sticks English Wife”, referring to Carney’s wife who is now open game. The Telegraph also let be known that Mrs. Carney was fair game. “Mrs. Carney, who met her husband, Mark, at Oxford, is Vice-President of Canada 2020, a left wing think tank, and reviews environmentally friendly products”. Oh my god, and they’re going to let her into the country? They also referred to her as an “eco-warrior” and that she believes “banks are rotten”. Until I started doing some research for this blog I had no idea about Mrs. Carney or Mark Carney’s musical tastes, and nor do I care. But they do in Britain, and he’s treatment by the U.K. press will be nothing like what he’s accustomed too. No gushing in the U.K.

I suspect it didn’t take long for Mark Carney to conclude, after testifying before the U.K Treasury Select committee, that life might a little different for him in the U.K. Nothing to do with culture or driving on the wrong side of the road. Going from Rock Star status in Canada to please justify your salary, your yearly housing allowance, and why should we except an interloper to be the next Governor of the Bank of England, is a tad different from what Mr. Carney has been experiencing in his native homeland. In Canada it’s Careymanaia, in the U.K., it’s not what have you done for us lately but rather you’ve done nothing for us to date, therefore, we’ll treat you as such. Check out some of these British headlines about Carney. The Sun, “Heavy Metal Fan to Run Bank of England”. Why? The Sun found out that Carney would blast AC/DC’s Back in Black before he played hockey while at Harvard. The Daily Mail, “Jolly Hockey Sticks English Wife”, referring to Carney’s wife who is now open game. The Telegraph also let be known that Mrs. Carney was fair game. “Mrs. Carney, who met her husband, Mark, at Oxford, is Vice-President of Canada 2020, a left wing think tank, and reviews environmentally friendly products”. Oh my god, and they’re going to let her into the country? They also referred to her as an “eco-warrior” and that she believes “banks are rotten”. Until I started doing some research for this blog I had no idea about Mrs. Carney or Mark Carney’s musical tastes, and nor do I care. But they do in Britain, and he’s treatment by the U.K. press will be nothing like what he’s accustomed too. No gushing in the U.K.

I must confess that I did not watch Carney’s entire performance before the U.K. Treasury Select committee. I caught little snippets of the hearing and based on what I saw I came to the following conclusion; if political stupidity and inane questions were an Olympic sport, Canada wouldn’t come close to the podium. U.S. – Gold, Britain – Silver, and any country from the Balkans – Bronze. One of the esteemed U.K. Treasury Select committee members asked Carney to explain liquidity. When the camera zoomed in on Carney for the answer, I could swear he had that “Did I just hear this moron right? I’m the Governor of the Bank of Canada, and he thinks he can stump me with this question” look on his face. There was a doozy of a follow up question from the President of the Mensa Society, “Are you familiar with QE3?” I have to hand it to Carney, from what I witnessed he was extraordinarily patient and he played the game. But I’m looking forward to the book Carney will write at some point in the future, and I hope he shares his thoughts about the first public grilling he took in the U.K. As for the committee member who asked these questions I suspect his thoughts were not unlike Homer Simpson’s, “okay brain, I don’t like you and you don’t like me… Just get me through this hearing and I’ll go back to killing you slowly with Guinness”. (Note to reader: the last line works much better if you read it out loud while impersonating Homer Simpson).

I must confess that I did not watch Carney’s entire performance before the U.K. Treasury Select committee. I caught little snippets of the hearing and based on what I saw I came to the following conclusion; if political stupidity and inane questions were an Olympic sport, Canada wouldn’t come close to the podium. U.S. – Gold, Britain – Silver, and any country from the Balkans – Bronze. One of the esteemed U.K. Treasury Select committee members asked Carney to explain liquidity. When the camera zoomed in on Carney for the answer, I could swear he had that “Did I just hear this moron right? I’m the Governor of the Bank of Canada, and he thinks he can stump me with this question” look on his face. There was a doozy of a follow up question from the President of the Mensa Society, “Are you familiar with QE3?” I have to hand it to Carney, from what I witnessed he was extraordinarily patient and he played the game. But I’m looking forward to the book Carney will write at some point in the future, and I hope he shares his thoughts about the first public grilling he took in the U.K. As for the committee member who asked these questions I suspect his thoughts were not unlike Homer Simpson’s, “okay brain, I don’t like you and you don’t like me… Just get me through this hearing and I’ll go back to killing you slowly with Guinness”. (Note to reader: the last line works much better if you read it out loud while impersonating Homer Simpson).

The Justin Bieber, Lady Gaga and economic messiah status Carney experienced in Canada will soon be a thing of the past. It’s time to put the big boy pants on and get ready to play in a much different school yard. Besides setting monetary policy for the third largest economy in Europe, Carney will have to deal with a press who can’t wait for him to stumble. They’ll poke an prod into his personal life, and the paparazzi rule in the U.K. His new salary is three times greater than what he earned as Governor of the Bank of Canada. That’s more than fair because his grief is going to increase tenfold.

Until next time

Cheers

Read More Add a CommentPayment Shock – It’s a term we’re familiar with in the mortgage industry, and it’s in the news again. But hallelujah, this time it has nothing to do with the mortgage industry. Nope, payment or bill shock making the news today is about the billing practices of the duopoly which controls all things wireless in Canada. Here’s the definition of a Duopoly – “situation in which two companies own all or nearly all of the market for a given product or service. A duopoly is the most basic form of oligopoly, a market dominated by a small number of companies. A duopoly can have the same impact on the market as a monopoly if the two players collude on prices or output. Collusion results in consumers paying higher prices than they would in a truly competitive market”.

You can decide if the definition fits as it relates to the wireless providers in Canada. As you’re mulling it over keep this in mind, the OECD (Organization for Economic Co-operation and Development) conducted a survey which concluded that the average Canadian cellphone user is paying among the highest bills in the developed world. To be exact, the OECD determined that Canada has the third highest wireless rates in the developed world.

Not surprising neither Rogers nor TELUS agree with the OECD findings; but regulators are causing both companies some indigestion. Both Rogers and TELUS are regulated by the CRTC (Canadian Radio-Television and Telecommunication Commission) and a new wireless code is being drafted by the CRTC. The CRTC would like the service providers to automatically suspend certain services once a customer is charged an additional $50 above and beyond their normal monthly plan. At first blush you may agree with the CRTC position, but keep mind for most of us in the mortgage industry we would exceed the $50 overage by the first Tuesday of every month. Imagine if you had to call your service providers every time the meter went past $50? If you think wait times for service is less than satisfactory today, imagine what it would be like if this was implemented? Rogers and TELUS were summoned to the hill to provide their thoughts and views on the proposed draft. Suffice to say that neither Rogers nor TELUS said, “we agree with you CRTC, and it’s about damn time you did something about the high cost of wireless fees in Canada.” They said what you would expect them to say, and why wouldn’t they? They’re protecting their own turf. Setting aside the self-interest of the wireless providers in Canada, the real issue is when regulators want to do right by consumers but the practical application of said efforts may result in even more consumer dissatisfaction. Regulatory changes or new “codes” being enacted and implemented has a domino effect. Everyone in the mortgage industry already knows that.

On one hand you can applaud the CRTC for trying to do right by consumers. Who wouldn’t want to pay less to their wireless provider? On the other the CRTC’s position is a little bit of a head scratcher as it relates to practicality. As for the CRTC this might be a case of not seeing the forest from trees. Instead of expending all this time, energy, money and brain cells on way to protect consumers from price shock, maybe the CRTC is missing the obvious. Maybe the CRTC should make it easier for new entrants into the Canadian wireless market. Competition serves consumers well. Why shouldn’t that apply to the wireless industry in Canada?

Until next time,

Cheers.

Read More Add a CommentMuch has been written and said about mortgage debt and affordability recently. No point in belaboring what has and has not been done to address this issue. I’m sure there will be plenty of that in the future, as well ample hang ringing about the so-called condo bubble, specifically in Vancouver and Toronto.

The so-called “condo crisis” (oh, how the mere thought of it makes the press salivate) in Vancouver and Toronto came to mind after I read an article in the Wall Street Journal. The article focused on the cost of condos in Manhattan. The current median price of a condo in Manhattan is the lowest it’s has been since 2004. Could Manhattan’s experience be a harbinger of what’s to come for Vancouver and Toronto? If it is then maybe the 36 people in Toronto who don’t own a condo already should go and get one.

According to the Canadian Real Estate Association, the average home price for the month of December in Toronto was $501,361, and in Vancouver it was $730, 912. Remember this includes dirt to go along with the walls. In Manhattan the average condo price in 2012 was $835,000. However, adjusted for inflation it was the lowest since 2004. Can you imagine the headlines if Toronto was similar to Manhattan’s reality? The median price in Manhattan for a 2 bedroom condo was $1.26 million, 3 bedroom was $2.37 million and a 4 bedroom was $4.75 million. Adjusted for inflation these are the lowest prices since 2004. According to the Wall Street Journal article there’s a disconnect between buyers and investment indicators. Buyers are saying there’s not enough affordable housing and yet when you take inflation into account prices have actually declined. So is it a good time to buy a condo in Manhattan? I’m not familiar with the Manhattan’s housing cycle so I’m not sure, but what I can say is this: at an average price of $2.37 million for a 3 bedroom condo in Manhattan, I think Toronto is a good buy.

Some might be aghast that I would compare Manhattan to Toronto. Well, Toronto is the 4th largest market between the US and Canada. Therefore, I think it’s valid to look at values on a comparative basis. That’s exactly what foreign investors did when buying property in Vancouver and Toronto. As absurd as we think our prices may be, the investor from Hong Kong looks at our market and thinks of great value. As we all know value is driven in large part by consumer perception. The perception of Vancouver and Toronto is that consumers buying condos are doing so at their own peril. Yet in Manhattan, home buyers lament the high cost and scarcity, all the while being told now is a good time to buy. It’s interesting how some things never change. Here’s a headline that helped shape New Yorkers perception of their condo market, “Great Scarcity in Apartments…Never before has there been such scarcity of apartments on Manhattan Island.” That headline came from the New York Times, in 1916!

Until Next Time

Cheers

Read More Add a Comment