Firstly, I’ll admit that I’m totally biased when it comes to the CAAMP Mortgage Forum. The reason being is that I am the Conference Chair this year, and I’ve witnessed first-hand the effort the CAAMP staff has made to ensure that this conference surpasses all others. It’s not easy putting on an event of this size and magnitude. As a delegate I would show up to the conference, take in the experience, and give zero thought to the amount of work it takes to pull something like this off. That all changed for me when I became Conference Chair last year. I came to realize there’s a bunch of unsung heroes who work tirelessly in the background to make it all happen.

Besides the effort required to make the conference actually happen, what’s really required for improvement is a willingness to change. Based on the amount of changes taking place this year it will be clear to all – the CAAMP staff has embraced the idea of change. Changes to the conference were required because our members told us so. The survey results clearly indicated the conference needed a facelift, a shot of adrenaline, there was too much same old, same old.

I’m proud to say that change is coming, and here’s a preview of some of the changes.

One of the changes I’m most excited about is on the Sunday -

We dedicate two days to the Expo/Trade Show, Sunday and Monday. This year Sunday’s Expo will be a little different. It will be our first CAAMP Career Day. We will invite university and college students to attend the Expo on Sunday. My goal is to have between 300 to 400 students attend the Expo. I believe it is important to introduce this amazing industry to the next generation. It will be difficult for this industry to grow organically if we don’t encourage the brightest to consider becoming a mortgage broker, lender, insurer etc. Wouldn’t it benefit us all if people didn’t just bump into this industry? Imagine the talent pool available if students actually considered this industry as career path while still in school. We may not see the benefits of doing this for years to come, but we have start at some point. We’re starting this year.”

Monday will be dedicated to industry issues.

Monday will be dedicated to industry issues.

The format is changing somewhat in so much that Amanda Lang, Sr. Business Correspondent for the CBC, will act as the host and interviewer. Panelists and speakers on Monday will be interviewed on stage by Ms. Lang. My thinking is let the pro’s do what they do best. Some of the best insights come from a Q and A. Who better to ask the questions than a professional journalist? By the way, the keynote speaker on Monday is Canada’s 16th Prime Minister, the Rt Hon, Joe Clark.

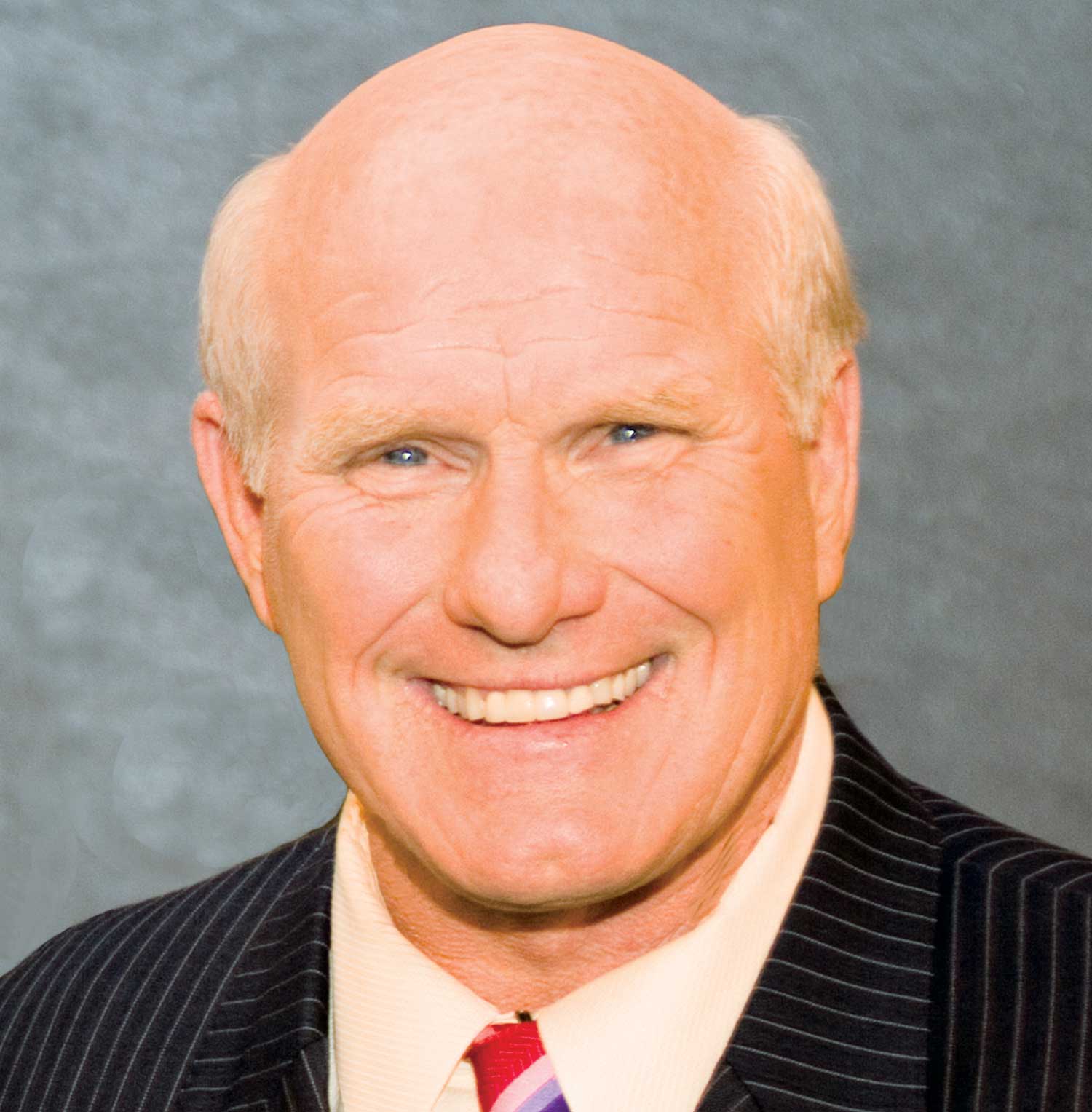

Monday lunch will feature sports industry legend, Terry Bradshaw. NFL studio personality and a multi-Emmy and award-winning broadcaster on Fox’s NFL Sunday. Named Sports Illustrated’s Man of the Year award, the list goes on.

Monday lunch will feature sports industry legend, Terry Bradshaw. NFL studio personality and a multi-Emmy and award-winning broadcaster on Fox’s NFL Sunday. Named Sports Illustrated’s Man of the Year award, the list goes on.

Monday night is also changing significantly.

Monday night is also changing significantly.

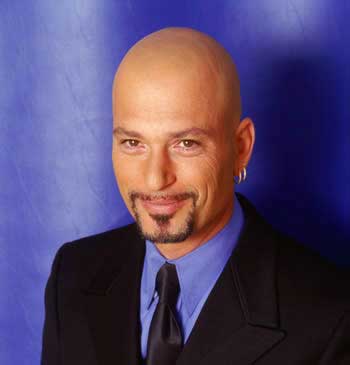

For the past decade Monday night was known for LenderFest. As a point of reference, over a decade ago a decision was made to organize a grand party, which would encourage the attendees to socialize under one roof. A number of lenders sponsored the event, and it was cost-effective way of throwing a bash. Thus Lender Fest was born. For a number of years it worked but recently LenderFest has lost some of its luster. So it was decided that we do something different, but at the same time ensure a great night of entertainment. Ladies and gentlemen I invite you to join us at the first ever CAAMP Comedy Fest. The headliner?…Howie Mandel!…Now that’s cool.

Tuesday will also bring big changes.

Tuesday will also bring big changes.

I’ll share with you how the Tuesday came about. Some six months ago I received an electronic conference brochure from a company called The Art Of. They specialize in sales, marketing and leadership conferences. I was intrigued by their brochure and I invited them to a meeting in my office. They gladly accepted because they thought I was interested in being a sponsor at their conference. I must confess I didn’t say or do anything to dispel them of that notion. When the meeting finally took place I dropped this on them, would they consider doing a joint conference with CAAMP? To say the least they were surprised by my offer, but in short order they saw the possibilities. In a short period of time an agreement was negotiated with CAAMP. The Art Of is bringing in some of the best speakers we’ve ever had on the Tuesday. All of them are renowned speakers and New York Times best-selling authors.

For a list of confirmed speakers visit our website at: http://www.mortgageconference.ca

You’ll be impressed with the line-up. Oh, one of the biggest differences for Tuesday, it’s a full day.

As the conference chair it’s my responsibility to provide vision and direction. But I want to be very clear, the real work is being done by Michael Ellenzweig, and all the staff at CAAMP. And they’re about to get a whole lot busier.

Until next time

Cheers

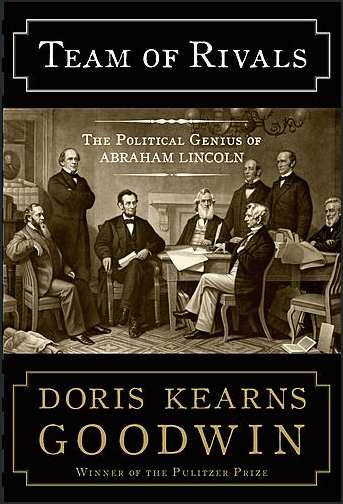

For more information and to register for the conference, please visit: http://www.mortgageconference.ca/ Read More Add a Comment This is the best way I know how to describe the book Team of Rivals: The Political Genius of Abraham Lincoln. It’s a labour of love because you have to be committed to reading a book that’s 754 pages long. This is no weekend read or a book that you will devour while on vacation, unless you plan on taking a couple of months off. That being said, making the commitment to read the entire book is worth the effort. Team of Rivals provided many business lessons for me, yet the book has nothing to do with business. Team of Rivals is a biography of Abraham Lincoln, written by an extraordinary author, Doris Kerns Goodwin.

This is the best way I know how to describe the book Team of Rivals: The Political Genius of Abraham Lincoln. It’s a labour of love because you have to be committed to reading a book that’s 754 pages long. This is no weekend read or a book that you will devour while on vacation, unless you plan on taking a couple of months off. That being said, making the commitment to read the entire book is worth the effort. Team of Rivals provided many business lessons for me, yet the book has nothing to do with business. Team of Rivals is a biography of Abraham Lincoln, written by an extraordinary author, Doris Kerns Goodwin.

Ms. Goodwin won the Pulitzer Prize in history for No Ordinary Time: Franklin and Eleanor Roosevelt. She also authored other best sellers, Wait Till Next Year:A Memoir (the Fitzgerald’s and the Kennedy’s), and Lyndon Johnson and the American Dream. Besides being a gifted writer, Ms Goodwin is a very effective public speaker. I had the good fortune of hearing Ms. Goodwin speak at an MBA conference in Boston a few years ago, and she was talking about her newly published book, which happened to be Team of Rivals. I must confess that I’m somewhat of a political junkie, therefore, the subject matter had instant appeal for me. But at that time I wasn’t really into biographies, yet after hearing Ms. Goodwin speak I decided it was a must read. What makes Ms. Goodwin such an extraordinary author is even though I know how the book ends (first President to die of assassination by being shot in the back of the head) her writing style makes you forget about the ending of the book because of her story telling abilities. She weaves historical facts in a way that you have to remind yourself this isn’t fiction. The events actually occurred and yet the facts are written in an entertaining way.

The devil is in the detail. To write an extraordinary book like this requires extensive research, and commitment to getting the facts right. I later learned that Ms. Goodwin employs a number of researchers, and they are mechanically focused on getting the facts right. A historian cannot afford to have their facts questioned by critics. The reasons are obvious, reputation risk and poor book sales. The same applies to business. A product launch, a compensation model, new hires etc, will fail unless you sweat the details. An idea is just that. What makes it work is execution.

The devil is in the detail. To write an extraordinary book like this requires extensive research, and commitment to getting the facts right. I later learned that Ms. Goodwin employs a number of researchers, and they are mechanically focused on getting the facts right. A historian cannot afford to have their facts questioned by critics. The reasons are obvious, reputation risk and poor book sales. The same applies to business. A product launch, a compensation model, new hires etc, will fail unless you sweat the details. An idea is just that. What makes it work is execution.

It’s not about geography, it’s about the people. Lincoln was from Kentucky, not exactly a breeding ground for future presidents. Yet he accomplished his goal because he was committed to bettering himself, and he preserved after failing so many times to get elected. From a business standpoint the best don’t necessarily reside in Toronto, Vancouver or other major urban Centers. In this day and age of technology, and the ability to communicate irrespective of geography, home address is secondary. First and foremost it’s about finding the right people.

It’s not about geography, it’s about the people. Lincoln was from Kentucky, not exactly a breeding ground for future presidents. Yet he accomplished his goal because he was committed to bettering himself, and he preserved after failing so many times to get elected. From a business standpoint the best don’t necessarily reside in Toronto, Vancouver or other major urban Centers. In this day and age of technology, and the ability to communicate irrespective of geography, home address is secondary. First and foremost it’s about finding the right people.

It doesn’t matter if I like you or not. During Lincoln’s primary campaign, his opponents (members of his own party) were at the very least condescending, and at the very worst, cruel. They tried to humiliate him because he wasn’t a blue blood, and he had no pedigree. They ridiculed him because of his birth place, the backwaters of Kentucky. They questioned his intellectual capacity. They even ridiculed him for his physical appearance. Yet after winning the presidency, he asked these individuals to join his cabinet. He put aside the humiliation, and degradation, he faced because he believed these individuals were the best qualified to serve their nation. From a business standpoint there are many lessons to be learned. The ability to put slights (real or perceived) and differences aside, should come first for the greater good.

It doesn’t matter if I like you or not. During Lincoln’s primary campaign, his opponents (members of his own party) were at the very least condescending, and at the very worst, cruel. They tried to humiliate him because he wasn’t a blue blood, and he had no pedigree. They ridiculed him because of his birth place, the backwaters of Kentucky. They questioned his intellectual capacity. They even ridiculed him for his physical appearance. Yet after winning the presidency, he asked these individuals to join his cabinet. He put aside the humiliation, and degradation, he faced because he believed these individuals were the best qualified to serve their nation. From a business standpoint there are many lessons to be learned. The ability to put slights (real or perceived) and differences aside, should come first for the greater good.

As you can see I’m a huge fan of this book. I enjoyed the story but I also learned a great deal. Did you know that Lincoln was a Republican, and it was the Democrats who wanted no part of freeing the slaves? Interesting given today’s political discourse and so-called ideological differences. If you buy the book but don’t end up reading it, there’s still some benefits. Carry it around with you or have it displayed on your bookshelf. People will think you’re really smart.

Until next time

Cheers

Read More Add a CommentDiversification has been a topic of interest in the broker space. Yesterday Mortgage Broker News was in my office to record, on video, my thoughts on this matter. If CMP (Canadian Mortgage Professionals) is covering this story, there must be a lot of chatter on this issue. Here’s my two cents.

It’s prudent for every business to consider diversification. The reasons are obvious, increased revenues, new market opportunities, risk mitigation etc. What has to be carefully thought out is that potential new revenue streams may take your focus away from your core competency. In our world it’s mortgages. We do not have the luxury of treating mortgages as a loss leader. This is what we do, this is who we are. Therefore, ancillary revenues are secondary, and the amount of resources allocated to such endeavors should not come at the expense of your core business.

With the respect to the why, beyond the reasons I stated above, I believe uncertainty in the market is driving some of the interest. The competition has become fierce, and the broker market is realizing this is the new norm. Furthermore, mortgage brokers are learning (from the banks) that selling a customer multiple products increases customer retention. When the market was buoyant very little planning or commitment is accorded to this issue. Over the last ten years there were plenty of philosophical discussions about this issue but there was little will. Today, the market is different, and brokers are looking for ways to cannibalize the customer’s application. Brokers know that some entity is going to sell their customer other financial products, and they’re contributing to someone else’s success by handing over the data/mortgage application.

As to how successful brokers have been to date offering ancillary products, we need to look no further than creditor life insurance. This product has been available in the broker space for well over a decade. To date the success rate or penetration ratio is somewhat underwhelming. Most recent statistics suggest that brokers have a penetration rate of approximately 22%. Yet the banks have penetration rate in the high 60’s to low 70’s in terms of percentages. Why is that? Is it because brokers view the selling of creditor life as a nuisance? Does the broker not believe the compensation is worth it? Is there no structure or discipline around selling creditor life insurance? Do brokers have a moral issue around selling this product? It appears that bank employees have figured out the answers, and I believe the answer is simple. Bank employees are mandated to sell creditor life. It’s not voluntary, and that’s why they’re successful at selling creditor life and other ancillary products. What gets measured gets done.

The idea of being able to offer multiple products to your customer is very appealing. However, we need to ask ourselves the following; “is being able to offer multiple products a must have or a nice to have?”. Creditor life penetration ratios suggests that ancillary products may reside in the “nice to have” bucket.

Until next time

Cheers

Read More Add a CommentWe’ve all seen or heard the media reports about the possibility of countries defaulting on their loans. Most recently the U.S. has come under fire about their obli gations and ability to pay. Rating agencies are threatening to downgrade the U.S., which would have dire consequences for the US economy. Frankly, I don’t believe that will ever happen. The threat of a downgrade was intended to be exactly that, a threat. In other words, this was a public shot at the U.S. government, an attempt to exert public pressure for the U.S. to get their act together.

gations and ability to pay. Rating agencies are threatening to downgrade the U.S., which would have dire consequences for the US economy. Frankly, I don’t believe that will ever happen. The threat of a downgrade was intended to be exactly that, a threat. In other words, this was a public shot at the U.S. government, an attempt to exert public pressure for the U.S. to get their act together.

Where this is real and happening today is in Greece. So what happens if Greece doesn’t pay? Do they file for bankruptcy? Does that mean their bankruptcy will appear on their countries credit bureau report for the next 7 years? Does it mean that no one in Greece will be able to get a mortgage until their country has been discharged for 2 years? I ask these questions with tongue firmly planted in cheek. The answer is that the countries debt doesn’t go away. It means that Greece has not met its financial obligation for that particular month. The creditors will demand payment, but unlike consumer debt there’s nothing to repossess. It’s not as if the lenders can foreclose on Athens.

The reality is that the Greek currency will go into the toilet because they’ll be printing money like mad. They may opt out of the Euro currency for some period, possibly two years, and go back to the Drachma, Greece’s currency prior to entering the EU. This will lead to hyperinflation, and there will be zero demand for their currency or more importantly trust in their currency. This reminds me of the 80′s when I visited countries in the Balkans. I would go into the bank, exchange $100 Canadian for the local currency, and I would need a wheelbarrow to carry my cash around. A devalued currency will mean that all imports will be extremely expensive, and this will have a direct effect on the standard of living in Greece. Then there’s the obvious, borrowing in the future may become next to impossible for Greece. To be clear this isn’t just Greece’s problem, there’s concern for Spain, Ireland and Portugal as well. They may be next.

The reality is that the Greek currency will go into the toilet because they’ll be printing money like mad. They may opt out of the Euro currency for some period, possibly two years, and go back to the Drachma, Greece’s currency prior to entering the EU. This will lead to hyperinflation, and there will be zero demand for their currency or more importantly trust in their currency. This reminds me of the 80′s when I visited countries in the Balkans. I would go into the bank, exchange $100 Canadian for the local currency, and I would need a wheelbarrow to carry my cash around. A devalued currency will mean that all imports will be extremely expensive, and this will have a direct effect on the standard of living in Greece. Then there’s the obvious, borrowing in the future may become next to impossible for Greece. To be clear this isn’t just Greece’s problem, there’s concern for Spain, Ireland and Portugal as well. They may be next.

Back to the U.S. – One of the funniest solutions I have heard recently about their debt came from comedian Dennis Miller. On his most recent HBO special he talked about the US debt. He said, and I’m paraphrasing, “I don’t understand this debt issue. The numbers are way above my head. But if I was in the White House I would say bleep’em, we’re not paying. We got nukes”.

Until next time,

Cheers

Read More Add a CommentOne thing you should never underestimate is America’s resolve. As a country, America has been on the brink on a number of occasions, and yet it has always managed to find it’s way back. From a historical standpoint, America has faced it’s share of crisis; The War of Independence, The Civil War, WW 1 and 2, The Great Depression, The Korean War, Vietnam War, The Bay of Pigs, The Cuban Missile Crisis, the Assassination of John F Kennedy, Robert Kennedy, Martin Luther King, the impeachment and resignation of Richard Nixon, the attempted Assassination of Ronald Reagan, 9/11 and the aftermath. This illustrates the U.S. isn’t squeamish about getting blood on their hands in the name of national interest, and they’re certainly willing and able to fight. Yet I can’t help but wonder where has America’s resolve gone? I’m referring to the economic plight America faces today. It’s stunning to watch the US muddle through this recession. The US has faced many deep recessions in the past, however, the present day recession has reduced this great nation to look for handouts, debt owed to China, and facing the fact that today America has zero leadership. It’s shameful that the Obama Administration, as well as the Republicans, are playing politics at this crucial moment in their history. The US is so devoid of any leadership one can’t help but be worried for our neighbours to the South.

Why does this matter to us? Canada is a branch plant economy. We export 70% of our  goods to the U.S. America is a consumer based economy, and we need a healthy and vibrant U.S. economy so we can sell our goods to them. The situation in the U.S. makes the Canadian government nervous. This is why the Conservative Government is pressing full steam ahead to negotiate free trade agreements with Europe, and South East Asia. Our reliance on the U.S. puts our economy at risk, and our government is attempting to mitigate this risk by negotiating new free trade agreements. But that will take time, maybe years. So in the short-term we’re stuck, and all we can do is keep our fingers crossed that the leaders in the US will put petty politics aside and finally lead.

goods to the U.S. America is a consumer based economy, and we need a healthy and vibrant U.S. economy so we can sell our goods to them. The situation in the U.S. makes the Canadian government nervous. This is why the Conservative Government is pressing full steam ahead to negotiate free trade agreements with Europe, and South East Asia. Our reliance on the U.S. puts our economy at risk, and our government is attempting to mitigate this risk by negotiating new free trade agreements. But that will take time, maybe years. So in the short-term we’re stuck, and all we can do is keep our fingers crossed that the leaders in the US will put petty politics aside and finally lead.

In last week’s National Post there was an article about the unemployment situation in the U.S. Statistically things don’t look good (National Post – “U. S. Job Growth in June Falls Far Short of Expectations“). Their unemployment rate is inching towards 10%, and that figure does not include those people that have stopped looking for work, and in some cases fallen through the cracks.

If their economy, and their unemployment rate doesn’t improve before the 2012 Presidential Election, Obama may well end up being a one trick pony. The voters in the US will look to punish someone.

Until next time,

Cheers.

Read More Add a Comment