This is time of year when many Canadians start to think about their RRSP. If you’re like me you’re also giving some thought to how much money you’re prepared to lose investing in Mutual Funds. I received an email this week from a financial planner at my bank reminding me that the deadline to contribute is February 29th. That was very thoughtful of him, and I guess I shouldn’t be surprised that he didn’t remind about how much I’ve lost in the last couple years. I guess they figure I should be happy because I’m only this far away (thumb and first finger about an inch apart) from breaking even. It’s gotten to the point today where breaking even is a reason to celebrate.

This is time of year when many Canadians start to think about their RRSP. If you’re like me you’re also giving some thought to how much money you’re prepared to lose investing in Mutual Funds. I received an email this week from a financial planner at my bank reminding me that the deadline to contribute is February 29th. That was very thoughtful of him, and I guess I shouldn’t be surprised that he didn’t remind about how much I’ve lost in the last couple years. I guess they figure I should be happy because I’m only this far away (thumb and first finger about an inch apart) from breaking even. It’s gotten to the point today where breaking even is a reason to celebrate.

I came across some statistics today that I found stunning, and it should give tax payers and the Federal Government pause for concern. According to Statistics Canada, 93% of Canadians have the ability to make RRSP contributions. Yet only 26% of those eligible made a contribution in 2010. In real dollars a total of $34 billion was contributed by those who made a contribution in 2010. Yet there was room for $665 billion in total contributions. Ouch, that’s a wee bit of a gap. The reason this could be painful for all is that our society is aging. There is no way that Fed’s will be able to meet the financial burden required to provide retirees a pension which could translate into a decent standard of living. Therefore, if the issue isn’t addressed today the Canadian tax payer will have to make even greater contributions then they do today.

The reason given for the unused contributions is that low income Canadians cannot afford to make contributions. According to a report in the Financial Post, “Someone earning under $40,000 or so annually would generally be better off saving through Tax Free Savings Accounts than RRSP’s to avoid losing various income-tested government benefits such as Guarantees Income Supplement, which is clawed back based on net income, including RSSP or RIFF withdrawals. TFSA withdrawals are not considered income and thus do not effect income tested benefits”. Well that makes perfect sense…if I’m a freakin’ accountant. How on earth can lower income Canadians possibly understand what’s available to them when the tax code is written in a way that only graduates from M.I.T can understand? For those in the middle or upper income class, they hire an accountant to figure it out. Yet those who need the council the most have no place to turn.

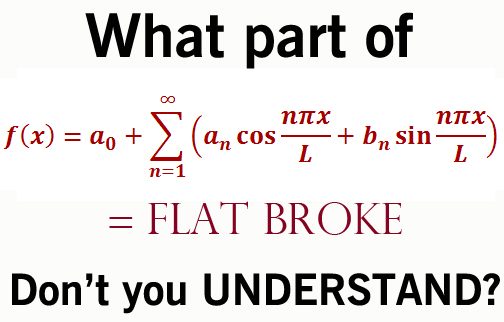

There’s really a bigger issue here – it’s financial literacy. I’m of the opinion that our education system has failed in this regard. Learning trigonometry is important but if kids don’t know what it means to balance a cheque book f(x) = aò + Σ [(n=1) aÕ cos=n∏χ / μ] +Œ = FLAT BROKE. Financial literacy has to become a part of the curriculum.  If we don’t want future generation to become a financial burden on society, we have to teach them to take care of themselves financially. As for my own RRSP contribution, if the financial planner at my bank can figure out a way to make the money I’m about to put under my mattress an RRSP contribution, he’ll get my business. If not, I like my chances of getting a better return under my mattress. At least I’ll break even, well, not when I factor in cost of living and inflation. But at least I’ll feel a little better.

If we don’t want future generation to become a financial burden on society, we have to teach them to take care of themselves financially. As for my own RRSP contribution, if the financial planner at my bank can figure out a way to make the money I’m about to put under my mattress an RRSP contribution, he’ll get my business. If not, I like my chances of getting a better return under my mattress. At least I’ll break even, well, not when I factor in cost of living and inflation. But at least I’ll feel a little better.

Until next time,

Cheers.

Leave a Comment!