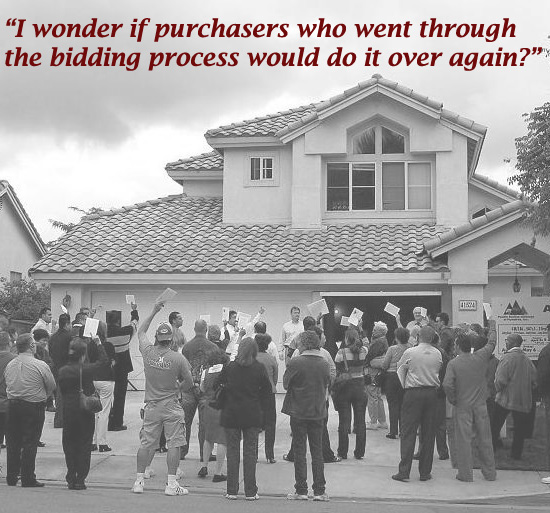

I wonder if purchasers who went through the bidding process would do it over again? We’ve all made bad business decisions, it happens.

But if the purchaser feels like they were played, well, that’s not good for any of us. The integrity of the real estate sales process is sacrosanct.

I assumed that real estate bidding wars was specific to pockets in the Vancouver and Toronto market place. You know? Big home values, big incomes – the bigger-better syndrome. Alas, my assumptions were incorrect. I made a stop in Winnipeg a few weeks ago to meet with some of our broker supporters, and I was surprised to hear how prevalent bidding wars are in the Winnipeg market place. I guess I shouldn’t be surprised, given the Globe ran article recently about what to do if you find yourself in a bidding war. People on the front lines are talking about it, and Canada’s self-proclaimed National newspaper is providing advice on what to do if you find yourself in real estate auction. I’ll assume that real estate bidding wars are no longer a one off or the exclusive domain of larger urban centers.

Should we care? I think we should.

Some would describe real estate bidding wars as the free market economy at work- a willing seller and a willing buyer. The flip side of the definition is; the manipulation of the real estate process, predicated on an unsuspecting and uniformed buyer. An argument can be made for both definitions. Here’s where I stand -

I think it’s an unseemly practice, and should be stopped or at the very least an attempt should be made to curtail it. Here’s how it works, the real estate agent convinces the vendor to list their property for slightly less than market value. The listing states that no offers will be entertained for a period of time, somewhere between five to seven days. Enough time is given to view the property, and hope that perspective purchasers, especially those who are frustrated and disillusioned because they’ve done this a number of times and have no home to show for it, will submit an offer on the prescribed date. The hope is the offer will be based on emotion, excuse me…market reality, and over pay. And that’s what’s happening with greater frequency today. I often wonder if purchasers who went through this process could do it over again, would they? We’ve all made bad business decisions, it happens. But if the purchaser feels like they were played, well, that’s not good for any of us. The integrity of the real estate sales process is sacrosanct.

I think it’s an unseemly practice, and should be stopped or at the very least an attempt should be made to curtail it. Here’s how it works, the real estate agent convinces the vendor to list their property for slightly less than market value. The listing states that no offers will be entertained for a period of time, somewhere between five to seven days. Enough time is given to view the property, and hope that perspective purchasers, especially those who are frustrated and disillusioned because they’ve done this a number of times and have no home to show for it, will submit an offer on the prescribed date. The hope is the offer will be based on emotion, excuse me…market reality, and over pay. And that’s what’s happening with greater frequency today. I often wonder if purchasers who went through this process could do it over again, would they? We’ve all made bad business decisions, it happens. But if the purchaser feels like they were played, well, that’s not good for any of us. The integrity of the real estate sales process is sacrosanct.

The best way to ensure that the integrity of the real estate sales process is not questioned is by way of transparency. The Competition Bureau’s attempt to have CREA (Canadian Real Estate Association) publish the historical sale price for the listed property, is a step in the right direction. CREA is fighting this because of “privacy” legislation. I find that interesting given that the information is already public, and one can find it if they have the time, and know where to look. Finding historical sales data shouldn’t be laborious or treated as tradecraft. We live in an age of instant information, and there’s no conceivable reason not provide this information to purchasers, and existing home owners. If you want an example of how this can work, go to Zillow.com. On this website is the listing of every property there is for sale in the U.S. It also provides estimated property evaluation, and historical sales activity for all properties. It would be a valuable tool for anyone finding themselves in a bidding war. If a realtor councils perspective purchasers to go in at “x” dollars, the council can be judged and validated as quickly as the purchaser can tap his/her tablet. Transparency and information assists the purchaser to make a better decision. A home is shelter, it’s also the biggest single investment decision that most people will make in their lifetime.

There’s a self-serving reason why I would like to see theses bidding wars come to an end. If the purchase price of the home is over market value, the appraisal is not going to come in. That’s the point when everyone who was party to the over inflated purchase price runs for the hills, and start blaming those who are left to try and fix it, the mortgage broker and lender. Rather unjust.

Oh yeah, my quick-fix solution is this, the mortgage amount is based on the purchase price or appraised value, whichever is lower. We should add the listing to that as well. That would pretty much end the gaming of perspective purchasers.

Until next time,

Cheers.

KarenB @Twitter ID Website