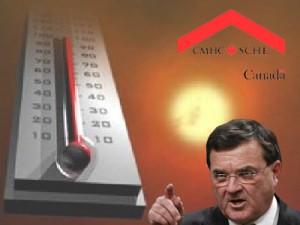

Media coverage of “consumer debt” and “inflated home values” in Canada has been relentless. The national newspapers have used up plenty of ink to cover these stories. There’s been no shortage of so called experts willing to quote on these issue. Opinions range from mild concern to abject hypocrisy. Given that the temperature gauge has risen significantly over these issues, I have to assume that the federal government will be forced to respond. This is not a story with 24 hour life cycle, and the government will want political shelter if the so called experts are right.

Media coverage of “consumer debt” and “inflated home values” in Canada has been relentless. The national newspapers have used up plenty of ink to cover these stories. There’s been no shortage of so called experts willing to quote on these issue. Opinions range from mild concern to abject hypocrisy. Given that the temperature gauge has risen significantly over these issues, I have to assume that the federal government will be forced to respond. This is not a story with 24 hour life cycle, and the government will want political shelter if the so called experts are right.

I have a great deal of empathy for the good folks at CMHC. For some time now they’ve been in cross-hairs. The press, economists and some within the financial sector have taken liberties as it relates to CMHC’s credibility. Does anyone really believe that CMHC does not know what it is doing? That they do not have the required expertise to manage their business? That they would act recklessly or in some way irresponsibly? The answer clearly is no. Yet, there’s been coverage recently about CMHC’S solvency. Their financial statements clearly show that they have enough capital on hand to withstand market variances. They continually run stress tests to ensure their financial viability, which equates to being responsible to the tax payer. Their most recent stress test indicated that insolvency was not an issue, with the following caveat. Our economy would have to go into multi-year recessionary period, and unemployment would have to reach 13%. Who among the so called experts are willing to put their reputations on the line by guaranteeing that dooms day scenario? I suspect not many. As for 13% unemployment, could it happen? Certainly, it reached 13.2% in December of 1982. Anything can happen but the question is what’s the probability? That’s what CMHC manages day in and day out, and from where I sit they’re pretty damn effective.

As for the other favorite target, the Ministry of Finance, I find it fascinating that some within the financial sector are publicly stating that the government must act now and tighten mortgage rules. They suggest that we’ve reached a critical stage, consumer debt it too high, home values are inflated. Really? If that’s the case why don’t they do the responsible thing and act independently. They could change their credit policies tomorrow. If they believe that the government should change the mortgage rules to reflect a maximum 25 year amortization, a minimum down-payment of 10%, and that borrowers should be qualified at the 5 year posted rate, then they should be prepared to lead by example. If they’re not prepared to lead, and do it on their own, we have to assume that present day circumstances poses no risk to their share holders. For if it did, they would do the right thing. Just like the folks at CMHC have been doing.

Until next time.

Cheers.

Bob Salisbury @Twitter ID Website