Ah, but this time it’s not about casting a vote in a federal, provincial or municipal campaign. We here in Ontario will exercise our democratic right in early October, the pre-set date for the Provincial election in Ontario, the election I’m referring to is the upcoming CAAMP Board election. As someone who has campaigned twice I can assure you the process of getting elected is as political as any other election. It takes organization and a commitment of time and resources to get elected. To all the individuals that have put their names forward to run this year, I commend them for their courage and willingness to volunteer their time for the greater good. (more…)

Read More Add a CommentIs an awareness campaign necessary?

Few people really know what a mortgage broker does.- Some facts are indisputable; broker market share is trending in the wrong direction.

We must create a stable industry. This requires us to make this industry known and to attract the brightest so they can become the next generation of brokers, lenders and insurers.

Read More Add a CommentI want to share with you a retention strategy I just experienced, and I after I got off the phone I couldn’t help but wonder if we applied said companies retention strategy at Merix, would it help us to retain more customers?

Every company today has a customer retention strategy. Be it in the communication field, insurance industry, grocery stores, mail order, lending and mortgage brokering, Irrespective of the market sector…there’s a retention strategy in place. Some companies are good at it, and very aggressive. Retaining customers is critical to a company’s growth. Our industry is only now talking about this issue but the reality is it’s been a part of our work environment for many years, and the practice will become more prevalent going forward. The purpose of this blog is not to debate the “who owns the customer” question. I want to share with you a retention strategy that I just experienced, and I after I got off the phone I couldn’t help but wonder if I applied said companies retention strategy at Merix, would it help us to retain more customers?

brokering, Irrespective of the market sector…there’s a retention strategy in place. Some companies are good at it, and very aggressive. Retaining customers is critical to a company’s growth. Our industry is only now talking about this issue but the reality is it’s been a part of our work environment for many years, and the practice will become more prevalent going forward. The purpose of this blog is not to debate the “who owns the customer” question. I want to share with you a retention strategy that I just experienced, and I after I got off the phone I couldn’t help but wonder if I applied said companies retention strategy at Merix, would it help us to retain more customers?

The story goes like this. I decided to discontinue the services of an alarm company. If there’s any would-be break and enter specialists reading this blog, I didn’t say I wasn’t changing companies; I was just discontinuing to do business with a certain company. When all is said and done, I’ll have security numbers to enter, loud alarms that will go off, and a snipers nest on the second floor. What, that’s too much? Before I lose my train of thought, where was I? Oh yeah, saying goodbye to Joel. I’m not going to name the alarm company but they FORCED me to do it. The customer service rep said the following to me; “We’re sorry to see you leave Mr. Bozic, but I understand totally. Cancelling your service will not be a problem. We’re going to forward to you a list of instructions; we can send that to you by email or mail. The instructions are easy to follow, and we’ll also include a box with a courier slip from UPS. You have to send back all hardware by the 15th of the month. The hardware must in good working order, and in the same condition that you received them in. If we don’t receive hardware by the 15th of the month, you service will continue for another 30 days. Should you change your mind and wish to continue to use our services, we’ll gladly take care of that. We’ll forward another list of instructions”. Well, that’s easy, and very clever on their part. Clearly their strategy is to make it difficult for me to leave. So I couldn’t help but wonder what if Merix was to apply the same strategy?

“Hello Mr. Borrower. Yes, we did receive your discharge statement. May I ask why you have decided to take your mortgage business elsewhere? I see, the bank offered you 150 bp’s below our rate, a free chequing account, and a weekend at the banks CEO’s cottage in the Muskoka’s. I totally understand. The discharge process is very easy. We’re going to send you instructions…we can do that by email or mail. We will include a box, a plastic cup, as well as a courier slip from UPS. In the box you will include all the original documentation which was provided to you by your solicitor on closing, including the actual pen that you used to sign all the documents at the solicitor’s office. You will also include all the original documentation that the mortgage broker provided to Merix. Furthermore, a urine sample from the broker is required as well. That’s why we included the plastic cup. Please note that we have to receive the entire package by the 15th of the month. Once we’re in receipt of the complete package, your actual discharge date we’ll be set. To help you with that process, and to schedule accordingly, our discharge dates are set for next solar eclipse. Should you decide to change your mind, and stay with us, we will gladly forward a new set of instructions”.

In fairness to the alarm company, the customer service rep was very courteous and professional. He was doing his job, and he did it well. The reality is, my experience is happening every day in our industry. Lenders are investing money and resources with respect to their retention departments. Some lenders today require that they have to speak to the borrower prior to processing the discharge request. Trust me, it’s not to say “we’ll miss you Mr. Borrower, and we wish you well”. The lender will do everything possible to retain the borrower, and if reasoning fails…they’ll beg.

In fairness to the alarm company, the customer service rep was very courteous and professional. He was doing his job, and he did it well. The reality is, my experience is happening every day in our industry. Lenders are investing money and resources with respect to their retention departments. Some lenders today require that they have to speak to the borrower prior to processing the discharge request. Trust me, it’s not to say “we’ll miss you Mr. Borrower, and we wish you well”. The lender will do everything possible to retain the borrower, and if reasoning fails…they’ll beg.

Ah, who am I kidding? I’m not removing the security code pad, filling holes in the wall, and removing all the wires around the windows and doors. I’m staying with the same alarm company. Joel, please take me back.

Until next time,

Cheers.

Read More Add a CommentFlorida

I’m writing this blog from Florida. Hey, where else does a guy from Toronto go to escape the heat? Florida, of course. It’s steamy hot down here as well, but the heat and humidity seem tolerable when you’re in vacation mode. I have to say that the state of Florida has really grown on me. I love it down here. Why? The weather is great all year round. Secondly, they have all the amenities you can ask for – beaches, great restaurants, fantastic cigar stores, golf courses galore, professional sports franchises. Thirdly, everything is cheap. The best part about buying anything down here is that you always feel like you got a good deal. The best deal you can get today is real estate. I think it’s a good time to buy down here. Distress means great value and flexibility by the home owner, be it the vendor or the bank. A word of advice, if you decide to explore what’s available you better pick one specific location. There’s just too much product available to bounce around from one side of the state to the other to check out homes. Secondly, if you decide to buy, the day after the deal closes forget about values. It’s going to take years before Floridians see any appreciable increase in values. If you’re looking for a second home, a place where the family can go, a place where your parents can go to escape the winter, it’s a great time to buy. I was speaking to a real estate agent yesterday and he said if it wasn’t for Canadian’s buying up product in his area he wouldn’t be busy. Great value, and good exchange rates, is attracting a lot of Canadians. What I don’t like about Florida? Old farts that drive on I-75 doing 15 miles under the legal speed limit, while in the left hand lane.

I’m writing this blog from Florida. Hey, where else does a guy from Toronto go to escape the heat? Florida, of course. It’s steamy hot down here as well, but the heat and humidity seem tolerable when you’re in vacation mode. I have to say that the state of Florida has really grown on me. I love it down here. Why? The weather is great all year round. Secondly, they have all the amenities you can ask for – beaches, great restaurants, fantastic cigar stores, golf courses galore, professional sports franchises. Thirdly, everything is cheap. The best part about buying anything down here is that you always feel like you got a good deal. The best deal you can get today is real estate. I think it’s a good time to buy down here. Distress means great value and flexibility by the home owner, be it the vendor or the bank. A word of advice, if you decide to explore what’s available you better pick one specific location. There’s just too much product available to bounce around from one side of the state to the other to check out homes. Secondly, if you decide to buy, the day after the deal closes forget about values. It’s going to take years before Floridians see any appreciable increase in values. If you’re looking for a second home, a place where the family can go, a place where your parents can go to escape the winter, it’s a great time to buy. I was speaking to a real estate agent yesterday and he said if it wasn’t for Canadian’s buying up product in his area he wouldn’t be busy. Great value, and good exchange rates, is attracting a lot of Canadians. What I don’t like about Florida? Old farts that drive on I-75 doing 15 miles under the legal speed limit, while in the left hand lane.

The U.S. Avoids Default

Well that was a shock – There was little doubt that an agreement would be hammered out. The only question is what the agreement would look like. What I read and hear down here is both the Democrats and Republicans are not happy. I guess in some ways that makes me believe that it’s an okay deal. If both sides aren’t happy it means there was give and take. As details come out about the deal, and is actually passed in Congress and the Senate, we’ll get a better idea if the agreement is a band-aide solution or something that has substance. My money is on political cover rather than doing what’s best for the country. Winston Churchill said this about U.S. politicians, “they always get it right but only after failing everything else they try first“.

Well that was a shock – There was little doubt that an agreement would be hammered out. The only question is what the agreement would look like. What I read and hear down here is both the Democrats and Republicans are not happy. I guess in some ways that makes me believe that it’s an okay deal. If both sides aren’t happy it means there was give and take. As details come out about the deal, and is actually passed in Congress and the Senate, we’ll get a better idea if the agreement is a band-aide solution or something that has substance. My money is on political cover rather than doing what’s best for the country. Winston Churchill said this about U.S. politicians, “they always get it right but only after failing everything else they try first“.

Volumes Decrease

Over the last few weeks we’ve been hearing that volumes for Q2 are down year over year in the broker world. We know for a fact that submissions are down as of the end  of June. How that translates to actual volumes will become clearer when D + H publishes their market share report for Q2 in the second week of August. The market share report will probably validate what I’ve been hearing from brokers in the last 90 days, it’s slower and banks are still very aggressive. If the Ministry of Finance wanted to cool things down from a borrowing perspective, with the changes they made in April, mission accomplished. The only question is did the broker world take a bigger hit than the direct to bank world? We’ll find out soon enough.

of June. How that translates to actual volumes will become clearer when D + H publishes their market share report for Q2 in the second week of August. The market share report will probably validate what I’ve been hearing from brokers in the last 90 days, it’s slower and banks are still very aggressive. If the Ministry of Finance wanted to cool things down from a borrowing perspective, with the changes they made in April, mission accomplished. The only question is did the broker world take a bigger hit than the direct to bank world? We’ll find out soon enough.

Until next time,

Cheers.

Firstly, I’ll admit that I’m totally biased when it comes to the CAAMP Mortgage Forum. The reason being is that I am the Conference Chair this year, and I’ve witnessed first-hand the effort the CAAMP staff has made to ensure that this conference surpasses all others. It’s not easy putting on an event of this size and magnitude. As a delegate I would show up to the conference, take in the experience, and give zero thought to the amount of work it takes to pull something like this off. That all changed for me when I became Conference Chair last year. I came to realize there’s a bunch of unsung heroes who work tirelessly in the background to make it all happen.

Besides the effort required to make the conference actually happen, what’s really required for improvement is a willingness to change. Based on the amount of changes taking place this year it will be clear to all – the CAAMP staff has embraced the idea of change. Changes to the conference were required because our members told us so. The survey results clearly indicated the conference needed a facelift, a shot of adrenaline, there was too much same old, same old.

I’m proud to say that change is coming, and here’s a preview of some of the changes.

One of the changes I’m most excited about is on the Sunday -

We dedicate two days to the Expo/Trade Show, Sunday and Monday. This year Sunday’s Expo will be a little different. It will be our first CAAMP Career Day. We will invite university and college students to attend the Expo on Sunday. My goal is to have between 300 to 400 students attend the Expo. I believe it is important to introduce this amazing industry to the next generation. It will be difficult for this industry to grow organically if we don’t encourage the brightest to consider becoming a mortgage broker, lender, insurer etc. Wouldn’t it benefit us all if people didn’t just bump into this industry? Imagine the talent pool available if students actually considered this industry as career path while still in school. We may not see the benefits of doing this for years to come, but we have start at some point. We’re starting this year.”

Monday will be dedicated to industry issues.

Monday will be dedicated to industry issues.

The format is changing somewhat in so much that Amanda Lang, Sr. Business Correspondent for the CBC, will act as the host and interviewer. Panelists and speakers on Monday will be interviewed on stage by Ms. Lang. My thinking is let the pro’s do what they do best. Some of the best insights come from a Q and A. Who better to ask the questions than a professional journalist? By the way, the keynote speaker on Monday is Canada’s 16th Prime Minister, the Rt Hon, Joe Clark.

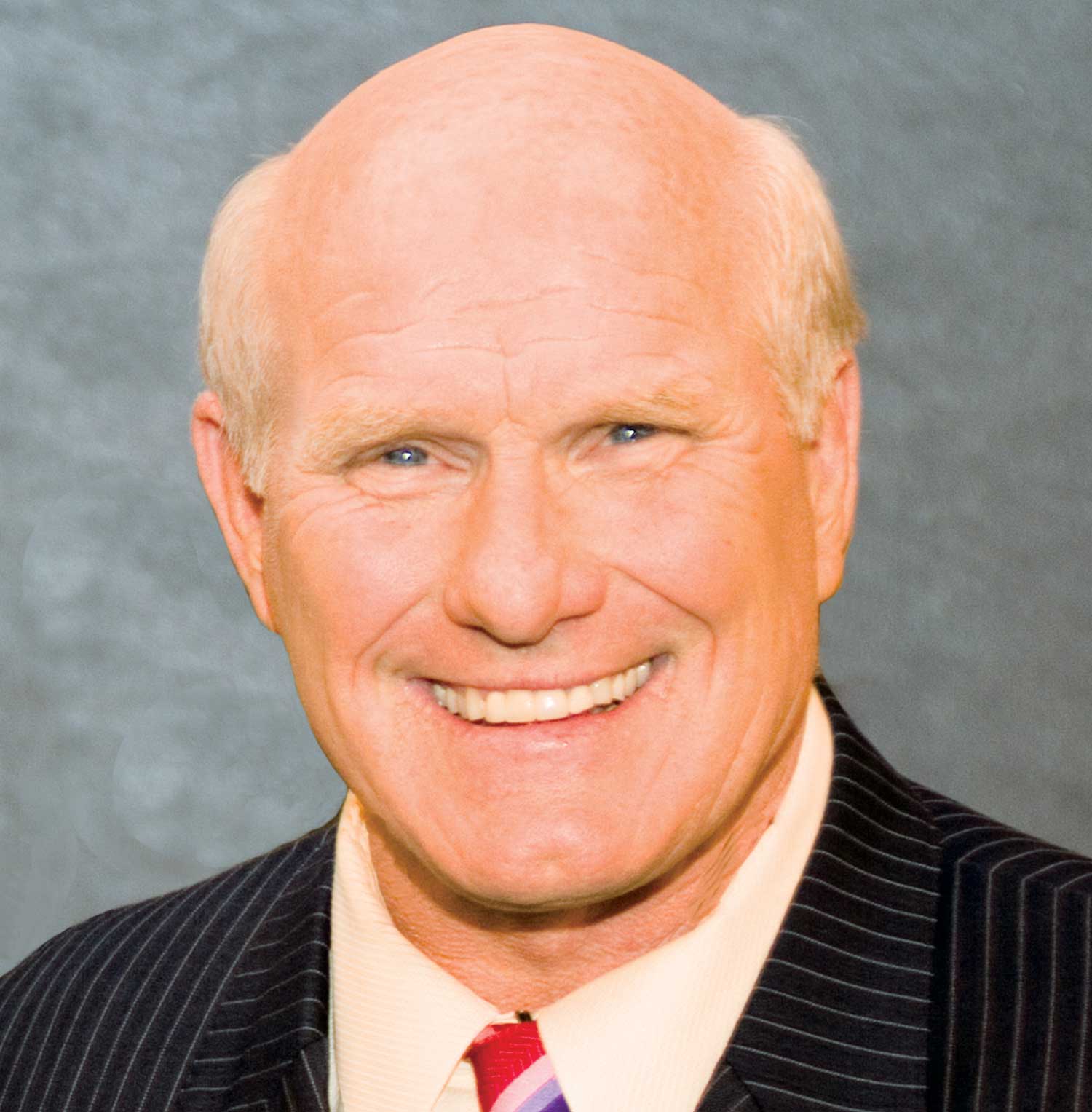

Monday lunch will feature sports industry legend, Terry Bradshaw. NFL studio personality and a multi-Emmy and award-winning broadcaster on Fox’s NFL Sunday. Named Sports Illustrated’s Man of the Year award, the list goes on.

Monday lunch will feature sports industry legend, Terry Bradshaw. NFL studio personality and a multi-Emmy and award-winning broadcaster on Fox’s NFL Sunday. Named Sports Illustrated’s Man of the Year award, the list goes on.

Monday night is also changing significantly.

Monday night is also changing significantly.

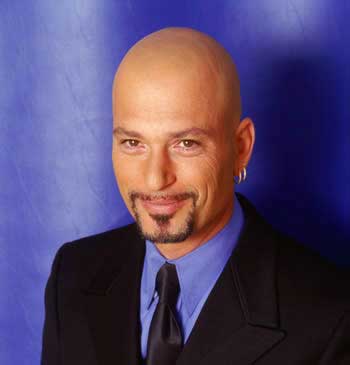

For the past decade Monday night was known for LenderFest. As a point of reference, over a decade ago a decision was made to organize a grand party, which would encourage the attendees to socialize under one roof. A number of lenders sponsored the event, and it was cost-effective way of throwing a bash. Thus Lender Fest was born. For a number of years it worked but recently LenderFest has lost some of its luster. So it was decided that we do something different, but at the same time ensure a great night of entertainment. Ladies and gentlemen I invite you to join us at the first ever CAAMP Comedy Fest. The headliner?…Howie Mandel!…Now that’s cool.

Tuesday will also bring big changes.

Tuesday will also bring big changes.

I’ll share with you how the Tuesday came about. Some six months ago I received an electronic conference brochure from a company called The Art Of. They specialize in sales, marketing and leadership conferences. I was intrigued by their brochure and I invited them to a meeting in my office. They gladly accepted because they thought I was interested in being a sponsor at their conference. I must confess I didn’t say or do anything to dispel them of that notion. When the meeting finally took place I dropped this on them, would they consider doing a joint conference with CAAMP? To say the least they were surprised by my offer, but in short order they saw the possibilities. In a short period of time an agreement was negotiated with CAAMP. The Art Of is bringing in some of the best speakers we’ve ever had on the Tuesday. All of them are renowned speakers and New York Times best-selling authors.

For a list of confirmed speakers visit our website at: http://www.mortgageconference.ca

You’ll be impressed with the line-up. Oh, one of the biggest differences for Tuesday, it’s a full day.

As the conference chair it’s my responsibility to provide vision and direction. But I want to be very clear, the real work is being done by Michael Ellenzweig, and all the staff at CAAMP. And they’re about to get a whole lot busier.

Until next time

Cheers

For more information and to register for the conference, please visit: http://www.mortgageconference.ca/ Read More Add a Comment