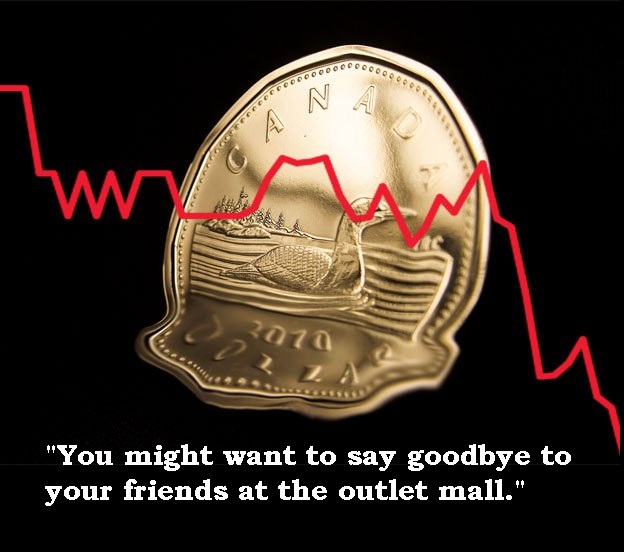

For those thinking of doing some last minute Christmas shopping south of the 49th parallel, the “deals” have become just a little less attractive. The Canadian dollar has now hit at a five year low. The Loonie is now worth 86.70 U.S. cents. Ouch! That’s not to suggest there aren’t some folks cheering.

Since 2008, the manufacturing sector in Canada has taken its fair share of lumps, especially in Ontario and Quebec. Given the value of our Lonnie today there’s less need for innovation and efficiency. Not optimal from a long view standpoint but short term it will give many the opportunity to say, “hey world, buy our stuff because it’s cheaper”. Hmm, that sounds vaguely familiar. Going forward chances are that export numbers will appear to be positive. That makes the Bank of Canada happy. Now they can say they had nothing to do with value of Loonie, as some have suggested. Now they can point to one sector and say, “it’s because of what is happening in the oil sector”. Right now oil is the new ugh! The oil sector is getting hammered and it’s an integral part of our economy. So for every yeah, there’s a yuck!

Since 2008, the manufacturing sector in Canada has taken its fair share of lumps, especially in Ontario and Quebec. Given the value of our Lonnie today there’s less need for innovation and efficiency. Not optimal from a long view standpoint but short term it will give many the opportunity to say, “hey world, buy our stuff because it’s cheaper”. Hmm, that sounds vaguely familiar. Going forward chances are that export numbers will appear to be positive. That makes the Bank of Canada happy. Now they can say they had nothing to do with value of Loonie, as some have suggested. Now they can point to one sector and say, “it’s because of what is happening in the oil sector”. Right now oil is the new ugh! The oil sector is getting hammered and it’s an integral part of our economy. So for every yeah, there’s a yuck!

The economic data suggests that the overnight lending rate is not going up, anytime soon. That’s not to suggest that consumer rates won’t be increasing. Just last week CMHC announced that the cost to securitize, CMB/NHA/MBS is going up. So who’s going to eat the cost? Spreads and margins are already compressed. So it might be difficult to rationalize further compression. The most recent bank earning, with the exception of one bank, did not meet market expectations. Bank stocks are contracting, and they may be challenged to meet net income targets in 2015. The dots are becoming a little clearer, making it easier to join them.

So if you are heading across the border this weekend to do some shopping, and the U.S. Custom Official asks you, “purpose of your trip?”. Your response might be, “just want to say goodbye to my friends working at the outlet mall”.

Until next time,

Cheers.

Leave a Comment!