One of the unfortunate by-products of the “information” age is that content is required, every minute of the day. Be it 24 hour news stations, sports stations or online publications etc. There’s no time to think things through. In-depth research and analysis takes times, and nobody seems to have it today. We live in a 24 hour news cycle, and the competition is fierce. The more salacious or provocative a story is, the greater the chance that eyeballs will be directed to it. Case and point, Alberta. Our friends and colleagues in that province must feel like they’re under siege. It’s a constant bombardment of the “sky is falling” narrative. This is not an “it’s not fair” sentiment an eight year old says that when you make them go to bed by 9:30 pm. The shame is that there does not appear to be much balance in the news with respect to the price of oil, and the impact it will have in Alberta. There are contrary opinions in this regard, but you have to look for it.

I came across an article which suggests that the price for a barrel of oil has hit bottom. This is not a lone opinion, and one individual who is suggesting this has a wee bit of knowledge and credibility in this regard. (more…)

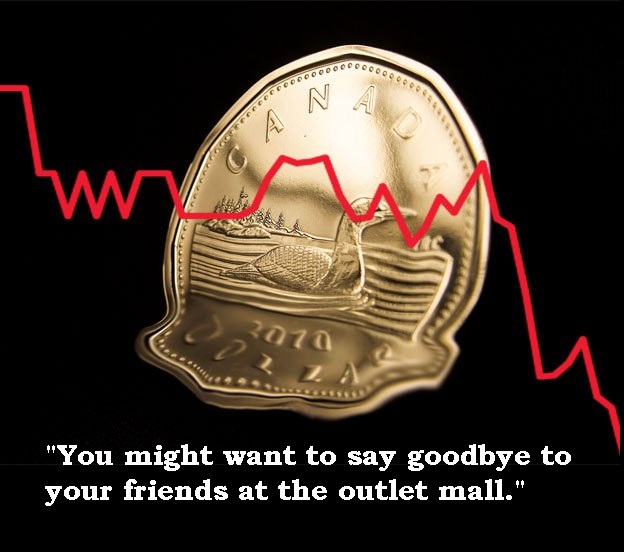

Read More Add a CommentAnd if you’re a snowbird or you planned on spending March break in the U.S., it’s going to cost you a lot more. The Canadian Dollar’s decline does not come as a surprise. The Loonie may be worth 82,81,80,79, 78 cents – it will all depend when and what time of day you read the blog. The Loonie is referred to as the petro-dollar, so when the price for a barrel of oil falls by 51%; it shouldn’t come as surprise that the Loonie moves in lockstep. What did come as surprise is the Bank of Canada’s decision to cut the overnight lending rate. Some had predicted this could happen in 2015, but no one saw this coming so soon into the New Year. It’s bit of shock to the system because the overnight lending rate has remained unchanged for over four years. Every announcement from the Bank of Canada has been the same; “move on folks, nothing to see here”. Well, there’s something to see now.

The cut to the overnight lending rate is not good news. The cut was necessitated because of the fragility of the Canadian economy. The Canadian economy grew by 2.4% in 2014. The Bank of Canada has now re-forecasted its growth for 2015 to 2.1%, and 1.5% in the first six months. Ouch! Our economies dependence on natural resources has far reaching consequences. Oil equals jobs, jobs equal consumer spending, and consumer spending equals healthy real estate values. It’s a game of dominoes that the Bank of Canada would like to avoid. So, a way to offset the some of the oil risk is to support other sectors, like manufacturing and exports. Some pundits are suggesting that the Bank of Canada is manipulating our currency to make our products more affordable to external markets. Others are suggesting that the Bank of Canada does not have the ability to manipulate our currency. For the benefit of doubt… let’s call it coincidence. The Canadian dollar decline came just in the nick of time to support other sectors of our economy, and to minimize the potential of oil becoming a contagion. Whew, we sure got lucky.

Back in early December I posted a blog entitled, “Move aside Mortgage, There’s a New Worrisome Word”. I’m paraphrasing, but the gist of the blog was that 2015 was going to be all about oil, all the time. However, I assumed that we would have some time to ease into the consequences of cheap crude. I assumed wrong. It’s here now, and we all have to deal with it. One of the first things we as consumers should do is maybe alter our way of thinking. I know this may seem counter intuitive, but lower interest rates and falling gas prices may make you feel good today, but it may end up making you much poorer in the future. If you’re looking for one stat to follow, try the unemployment rate. It’s the number that tells all.

Until next time,

Cheers.

Read More Add a Comment

A belated Happy New Year – here’s to a healthy and prosperous 2015. The beginning of a new year brings freshness and hope that “things” will be better. It would be nice if we could bundle up the previous year’s trials and tribulations and say, “abracadabra…disappear”. Don’t bother trying, it doesn’t work. Flipping the calendar over doesn’t mean there’s no carryover of issues and problems. Don’t know about you but to me the world seemed to become a nastier place in 2014. We Canadians will always remember the terrorist attack on Parliament Hill in 2014. The carryover from that incident into 2015? I think most of us believe it will happen again, it’s just a matter of when; and now we deal with the images in Paris. Innocent people were slaughtered because of political cartoon in a newspaper. I think it’s going to take a real effort in 2015 to maintain a positive outlook, and shut out the madness and evil.

The New Year is all about a positive outlook. Resolutions are made, only to be abandoned by mid-February. I don’t make any resolutions because I know February is coming. No, what I do is go into every year with a theme. That gives me a lot of wiggle room. It’s a macro approach versus micro. Example, contemplating losing 15 pounds, while elbow deep and family sized bag of Lay’s salt and vinegar potato chips, is a fool’s errand. The resolution shouldn’t be to lose 15 pounds…the theme should be “overall wellness”. See – all kinds of wiggle room.

The New Year is all about a positive outlook. Resolutions are made, only to be abandoned by mid-February. I don’t make any resolutions because I know February is coming. No, what I do is go into every year with a theme. That gives me a lot of wiggle room. It’s a macro approach versus micro. Example, contemplating losing 15 pounds, while elbow deep and family sized bag of Lay’s salt and vinegar potato chips, is a fool’s errand. The resolution shouldn’t be to lose 15 pounds…the theme should be “overall wellness”. See – all kinds of wiggle room.

Since there’s no way to shut out the world you’re left with no choice but to look at the issues through a dispassionate lens. Fact – China’s economy is contracting, as is Brazil’s and India’s. Not long ago the emerging markets were going to be our economic saviors; today, not so much. Fact – Europe is once again a bit of a mess. The Greeks, they’reeeeeeee back, are talking about leaving the Euro Zone. Empress Merkel of Germany said that it’s okay if the Greeks leave. That means we can all raise a glass of Ouzo, and toast the Greeks a safe avito (Greek for goodbye). If Merkel says Auf Wiedersehen, it’s time for the Greek’s to put on their Sunday best Lederhosen, and look smartly when exiting. Fact – Russia’s economy is in a mess. Putin still has popular support in Russia, but let’s see what happens when cells phone, Benz’s and Prada bags started being repossessed with greater frequency in Russia. And what happens if Putin gets really mad? We just might find out in 2015.

Closer to home, the giant is back. The U.S economy is arguably one of the most robust economies in the world today. The U.S greenback is soaring, Americans are spending, which helps Canadian exports. The price of oil impacts both the American and Canadian economy. The way it’s going now it’s just a matter of time that our credit cards will be credited 10 cents a liter at the pumps. As for interest rates? I now believe we’ll see a rate increase in the U.S. in 2015. Will Canada move in lock-step? Doubt it, the Canadian economy is still too fragile, but who can say with any certainty.

So, there are a lot of issues – hot spots – in the world that will impact us in 2015. Hopefully 2015 won’t result in us looking back on 2014 with fondness. Time will tell.

Until then, anyone want a salt and vinegar chip? Oh, sorry, all that’s left are those tiny little pieces in corner of the bag.

Until Next Time,

Cheers.

Read More Add a CommentAnother year draws to an end. I keep saying to myself that I should keep a journal to capture the events that happened throughout the year. I know it was busy, I know a lot happened, and I also know that I’ve forgotten a few things that have happened. The days, months and years sometimes become a blur. This is the time of year to take a short breath, share time with the family, forget the madness which is taking place in the world today and remember those who made the ultimate sacrifice.

And to all that have taken time to read my blog, my sincerest thank you. I wish you all a Happy Hanukkah and a very Merry Christmas. Who knows, maybe Santa will bring us all a successful and serine 2015; I certainly hope so.

We’ll chat again in the New Year.

Until next time,

Cheers.

For those thinking of doing some last minute Christmas shopping south of the 49th parallel, the “deals” have become just a little less attractive. The Canadian dollar has now hit at a five year low. The Loonie is now worth 86.70 U.S. cents. Ouch! That’s not to suggest there aren’t some folks cheering.

Since 2008, the manufacturing sector in Canada has taken its fair share of lumps, especially in Ontario and Quebec. Given the value of our Lonnie today there’s less need for innovation and efficiency. Not optimal from a long view standpoint but short term it will give many the opportunity to say, “hey world, buy our stuff because it’s cheaper”. Hmm, that sounds vaguely familiar. Going forward chances are that export numbers will appear to be positive. That makes the Bank of Canada happy. Now they can say they had nothing to do with value of Loonie, as some have suggested. Now they can point to one sector and say, “it’s because of what is happening in the oil sector”. Right now oil is the new ugh! The oil sector is getting hammered and it’s an integral part of our economy. So for every yeah, there’s a yuck!

Since 2008, the manufacturing sector in Canada has taken its fair share of lumps, especially in Ontario and Quebec. Given the value of our Lonnie today there’s less need for innovation and efficiency. Not optimal from a long view standpoint but short term it will give many the opportunity to say, “hey world, buy our stuff because it’s cheaper”. Hmm, that sounds vaguely familiar. Going forward chances are that export numbers will appear to be positive. That makes the Bank of Canada happy. Now they can say they had nothing to do with value of Loonie, as some have suggested. Now they can point to one sector and say, “it’s because of what is happening in the oil sector”. Right now oil is the new ugh! The oil sector is getting hammered and it’s an integral part of our economy. So for every yeah, there’s a yuck!

The economic data suggests that the overnight lending rate is not going up, anytime soon. That’s not to suggest that consumer rates won’t be increasing. Just last week CMHC announced that the cost to securitize, CMB/NHA/MBS is going up. So who’s going to eat the cost? Spreads and margins are already compressed. So it might be difficult to rationalize further compression. The most recent bank earning, with the exception of one bank, did not meet market expectations. Bank stocks are contracting, and they may be challenged to meet net income targets in 2015. The dots are becoming a little clearer, making it easier to join them.

So if you are heading across the border this weekend to do some shopping, and the U.S. Custom Official asks you, “purpose of your trip?”. Your response might be, “just want to say goodbye to my friends working at the outlet mall”.

Until next time,

Cheers.

Read More Add a Comment