“I wonder how you would feel if you received a call from the government saying we would rather you not buy down interest rates.”

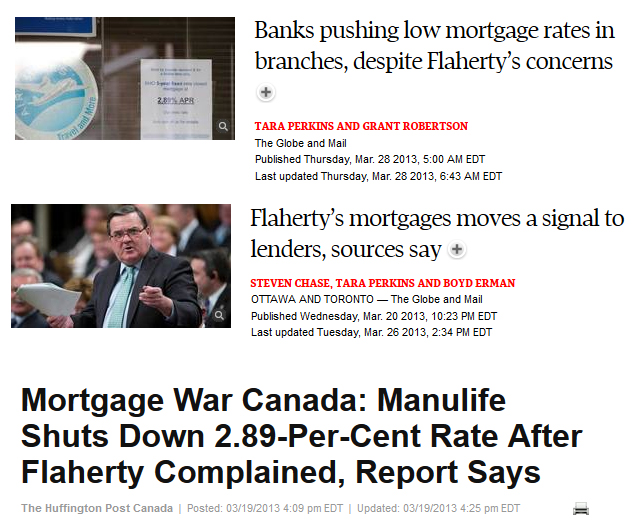

Ever run across something that doesn’t sit right. That nagging doubt that you can’t put your finger on, and it just hangs out there. I experienced that a few days ago after reading an article in the Globe. I decided to take few days and give the article one more glance to see if my original reaction would still be the same. Yup, nothing changed. The article in question appeared in the Globe on Wednesday, March, 20th. The headline read, “Flaherty Pushes up Lending Rates – Finance Minister called lenders to express displeasure at mortgage competition, raising bankers’ hackles“.

Few will or should care about a bankers disposition, but I think we should all care when big brother over reaches. I do not how else I can categorize the direct influence over pricing by the government in the private sector. As reported in the Globe, Minister Flaherty contacted Bank of Montreal to chastise them for lowering rates in an attempt to buy market share. A call also went out to Manulife, but the scolding was delivered by one of the Minister’s underlings. It’s easy to say who cares if faceless corporations get their wrists slapped. But any government encroachment of pricing in the private sector should give us all pause. Imagine you are a mortgage broker who has embarked on a strategy of rate buy-downs. The merit of such a strategy is irrelevant, what is relevant is that you have the right to earn or lose money based on your competency or incompetency. We live and work in a free market economy, and the state plays an important role; pricing of products should never be one of them. I wonder how you would feel if you received a call from the government saying we would rather you not buy down interest rates. I get it – that would never happen based on the actions of a handful of brokers. But entrepreneurs of all sizes share a common principals, and for it to be different based on the size of the enterprise alone undermines the fundamentals of competition.

Few will or should care about a bankers disposition, but I think we should all care when big brother over reaches. I do not how else I can categorize the direct influence over pricing by the government in the private sector. As reported in the Globe, Minister Flaherty contacted Bank of Montreal to chastise them for lowering rates in an attempt to buy market share. A call also went out to Manulife, but the scolding was delivered by one of the Minister’s underlings. It’s easy to say who cares if faceless corporations get their wrists slapped. But any government encroachment of pricing in the private sector should give us all pause. Imagine you are a mortgage broker who has embarked on a strategy of rate buy-downs. The merit of such a strategy is irrelevant, what is relevant is that you have the right to earn or lose money based on your competency or incompetency. We live and work in a free market economy, and the state plays an important role; pricing of products should never be one of them. I wonder how you would feel if you received a call from the government saying we would rather you not buy down interest rates. I get it – that would never happen based on the actions of a handful of brokers. But entrepreneurs of all sizes share a common principals, and for it to be different based on the size of the enterprise alone undermines the fundamentals of competition.

Another part of the story I find troublesome is why did this become public? I suspect the Minister of Finance would be put directly through to the CEO of both Bank of Montreal and Manulife. For appearance sake alone this arm twisting should have been done in private, and not worn like a badge of honour in public. The general public already believes that the working relationship between the government and banks is too cozy; these stories don’t help to dispel that notion.

Until next time,

Cheers.

Len Lane @Twitter ID Website