And if you’re a snowbird or you planned on spending March break in the U.S., it’s going to cost you a lot more. The Canadian Dollar’s decline does not come as a surprise. The Loonie may be worth 82,81,80,79, 78 cents – it will all depend when and what time of day you read the blog. The Loonie is referred to as the petro-dollar, so when the price for a barrel of oil falls by 51%; it shouldn’t come as surprise that the Loonie moves in lockstep. What did come as surprise is the Bank of Canada’s decision to cut the overnight lending rate. Some had predicted this could happen in 2015, but no one saw this coming so soon into the New Year. It’s bit of shock to the system because the overnight lending rate has remained unchanged for over four years. Every announcement from the Bank of Canada has been the same; “move on folks, nothing to see here”. Well, there’s something to see now.

The cut to the overnight lending rate is not good news. The cut was necessitated because of the fragility of the Canadian economy. The Canadian economy grew by 2.4% in 2014. The Bank of Canada has now re-forecasted its growth for 2015 to 2.1%, and 1.5% in the first six months. Ouch! Our economies dependence on natural resources has far reaching consequences. Oil equals jobs, jobs equal consumer spending, and consumer spending equals healthy real estate values. It’s a game of dominoes that the Bank of Canada would like to avoid. So, a way to offset the some of the oil risk is to support other sectors, like manufacturing and exports. Some pundits are suggesting that the Bank of Canada is manipulating our currency to make our products more affordable to external markets. Others are suggesting that the Bank of Canada does not have the ability to manipulate our currency. For the benefit of doubt… let’s call it coincidence. The Canadian dollar decline came just in the nick of time to support other sectors of our economy, and to minimize the potential of oil becoming a contagion. Whew, we sure got lucky.

Back in early December I posted a blog entitled, “Move aside Mortgage, There’s a New Worrisome Word”. I’m paraphrasing, but the gist of the blog was that 2015 was going to be all about oil, all the time. However, I assumed that we would have some time to ease into the consequences of cheap crude. I assumed wrong. It’s here now, and we all have to deal with it. One of the first things we as consumers should do is maybe alter our way of thinking. I know this may seem counter intuitive, but lower interest rates and falling gas prices may make you feel good today, but it may end up making you much poorer in the future. If you’re looking for one stat to follow, try the unemployment rate. It’s the number that tells all.

Until next time,

Cheers.

Read More Add a Comment

A belated Happy New Year – here’s to a healthy and prosperous 2015. The beginning of a new year brings freshness and hope that “things” will be better. It would be nice if we could bundle up the previous year’s trials and tribulations and say, “abracadabra…disappear”. Don’t bother trying, it doesn’t work. Flipping the calendar over doesn’t mean there’s no carryover of issues and problems. Don’t know about you but to me the world seemed to become a nastier place in 2014. We Canadians will always remember the terrorist attack on Parliament Hill in 2014. The carryover from that incident into 2015? I think most of us believe it will happen again, it’s just a matter of when; and now we deal with the images in Paris. Innocent people were slaughtered because of political cartoon in a newspaper. I think it’s going to take a real effort in 2015 to maintain a positive outlook, and shut out the madness and evil.

The New Year is all about a positive outlook. Resolutions are made, only to be abandoned by mid-February. I don’t make any resolutions because I know February is coming. No, what I do is go into every year with a theme. That gives me a lot of wiggle room. It’s a macro approach versus micro. Example, contemplating losing 15 pounds, while elbow deep and family sized bag of Lay’s salt and vinegar potato chips, is a fool’s errand. The resolution shouldn’t be to lose 15 pounds…the theme should be “overall wellness”. See – all kinds of wiggle room.

The New Year is all about a positive outlook. Resolutions are made, only to be abandoned by mid-February. I don’t make any resolutions because I know February is coming. No, what I do is go into every year with a theme. That gives me a lot of wiggle room. It’s a macro approach versus micro. Example, contemplating losing 15 pounds, while elbow deep and family sized bag of Lay’s salt and vinegar potato chips, is a fool’s errand. The resolution shouldn’t be to lose 15 pounds…the theme should be “overall wellness”. See – all kinds of wiggle room.

Since there’s no way to shut out the world you’re left with no choice but to look at the issues through a dispassionate lens. Fact – China’s economy is contracting, as is Brazil’s and India’s. Not long ago the emerging markets were going to be our economic saviors; today, not so much. Fact – Europe is once again a bit of a mess. The Greeks, they’reeeeeeee back, are talking about leaving the Euro Zone. Empress Merkel of Germany said that it’s okay if the Greeks leave. That means we can all raise a glass of Ouzo, and toast the Greeks a safe avito (Greek for goodbye). If Merkel says Auf Wiedersehen, it’s time for the Greek’s to put on their Sunday best Lederhosen, and look smartly when exiting. Fact – Russia’s economy is in a mess. Putin still has popular support in Russia, but let’s see what happens when cells phone, Benz’s and Prada bags started being repossessed with greater frequency in Russia. And what happens if Putin gets really mad? We just might find out in 2015.

Closer to home, the giant is back. The U.S economy is arguably one of the most robust economies in the world today. The U.S greenback is soaring, Americans are spending, which helps Canadian exports. The price of oil impacts both the American and Canadian economy. The way it’s going now it’s just a matter of time that our credit cards will be credited 10 cents a liter at the pumps. As for interest rates? I now believe we’ll see a rate increase in the U.S. in 2015. Will Canada move in lock-step? Doubt it, the Canadian economy is still too fragile, but who can say with any certainty.

So, there are a lot of issues – hot spots – in the world that will impact us in 2015. Hopefully 2015 won’t result in us looking back on 2014 with fondness. Time will tell.

Until then, anyone want a salt and vinegar chip? Oh, sorry, all that’s left are those tiny little pieces in corner of the bag.

Until Next Time,

Cheers.

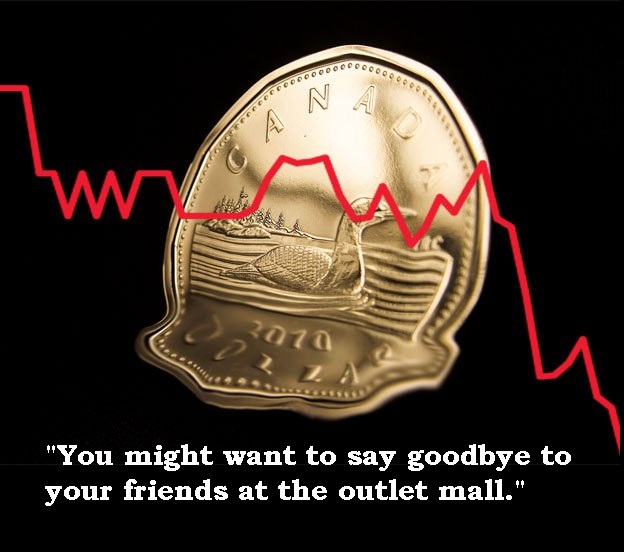

Read More Add a CommentFor those thinking of doing some last minute Christmas shopping south of the 49th parallel, the “deals” have become just a little less attractive. The Canadian dollar has now hit at a five year low. The Loonie is now worth 86.70 U.S. cents. Ouch! That’s not to suggest there aren’t some folks cheering.

Since 2008, the manufacturing sector in Canada has taken its fair share of lumps, especially in Ontario and Quebec. Given the value of our Lonnie today there’s less need for innovation and efficiency. Not optimal from a long view standpoint but short term it will give many the opportunity to say, “hey world, buy our stuff because it’s cheaper”. Hmm, that sounds vaguely familiar. Going forward chances are that export numbers will appear to be positive. That makes the Bank of Canada happy. Now they can say they had nothing to do with value of Loonie, as some have suggested. Now they can point to one sector and say, “it’s because of what is happening in the oil sector”. Right now oil is the new ugh! The oil sector is getting hammered and it’s an integral part of our economy. So for every yeah, there’s a yuck!

Since 2008, the manufacturing sector in Canada has taken its fair share of lumps, especially in Ontario and Quebec. Given the value of our Lonnie today there’s less need for innovation and efficiency. Not optimal from a long view standpoint but short term it will give many the opportunity to say, “hey world, buy our stuff because it’s cheaper”. Hmm, that sounds vaguely familiar. Going forward chances are that export numbers will appear to be positive. That makes the Bank of Canada happy. Now they can say they had nothing to do with value of Loonie, as some have suggested. Now they can point to one sector and say, “it’s because of what is happening in the oil sector”. Right now oil is the new ugh! The oil sector is getting hammered and it’s an integral part of our economy. So for every yeah, there’s a yuck!

The economic data suggests that the overnight lending rate is not going up, anytime soon. That’s not to suggest that consumer rates won’t be increasing. Just last week CMHC announced that the cost to securitize, CMB/NHA/MBS is going up. So who’s going to eat the cost? Spreads and margins are already compressed. So it might be difficult to rationalize further compression. The most recent bank earning, with the exception of one bank, did not meet market expectations. Bank stocks are contracting, and they may be challenged to meet net income targets in 2015. The dots are becoming a little clearer, making it easier to join them.

So if you are heading across the border this weekend to do some shopping, and the U.S. Custom Official asks you, “purpose of your trip?”. Your response might be, “just want to say goodbye to my friends working at the outlet mall”.

Until next time,

Cheers.

Read More Add a CommentIt’s OIL! Let’s be nostalgic for a moment and think back to the days when every headline screamed “Mortgages are responsible for all things that could go wrong”. Words such as Bust, Household Debt, Hard Landing, and a multitude of other adjectives that would lead you believe that the four horseman of the apocalypse were on the way . If I’m not mistaken, I think I read somewhere that the former mayor of Toronto was driven to smoke crack cocaine because he had a mortgage. Okay, I’m making that up, but I suspect former mayor may be annoyed because that excuse didn’t dawn on him. In no way am I suggesting that today the word “mortgage” is out of the woods, it’s just that “mortgage” has company now while traipsing through the evil forest.

Get ready; it’s going to be all oil, all the time. Oil, like mortgages, has tentacles that reach far beyond our borders. Mortgages nearly brought down the global economy, see sub-prime crisis of 2008, but the new partner in crime can have devastating consequences as well. OPEC, meaning Saudi Arabia, decided not to cut oil productions. The net result is that there’s a glut of oil today. Ah, simple economics – supply and demand. Too much supply means a drop in prices. We’ve all seen it at the pumps, and given that Saudi’s said they’re comfortable at $60 a barrel, don’t be surprised to see a liter of oil sell for less than a dollar. I don’t remember the last time I saw a liter of gas for less than a buck. Gosh, it must be 15 or 20 pounds ago.

Get ready; it’s going to be all oil, all the time. Oil, like mortgages, has tentacles that reach far beyond our borders. Mortgages nearly brought down the global economy, see sub-prime crisis of 2008, but the new partner in crime can have devastating consequences as well. OPEC, meaning Saudi Arabia, decided not to cut oil productions. The net result is that there’s a glut of oil today. Ah, simple economics – supply and demand. Too much supply means a drop in prices. We’ve all seen it at the pumps, and given that Saudi’s said they’re comfortable at $60 a barrel, don’t be surprised to see a liter of oil sell for less than a dollar. I don’t remember the last time I saw a liter of gas for less than a buck. Gosh, it must be 15 or 20 pounds ago.

The plight of oil today is so juicy, and would make for a good Robert Ludlum novel. There’s speculation that the Saudi’s are targeting the booming U.S. oil market. It’s like they’re saying, “you wanna play?…frack this”. Then there’s the other geopolitical conspiracy theory that the Saudi’s and the U.S. are in cahoots, and they’ve aimed their laser at Russia, in particular Russia’s lovable teddy bear, Putin. Hmm, how are things going in Russia today? Let’s see, the Ruble has plummeted, their foreign cash reserves are being depleted, inflation is on the rise, and they’re on the verge of deep recession. Putin’s wondering eye, neighboring countries to annex, may have cost Russia dearly.

The political gamesmanship aside, we’re going to feel this at home. The obvious being that projects in the oil sands may be delayed or halted altogether. That impacts jobs. Federal Tories will have their hands full with problems, due to the timing of the oil prices plummeting. We’re not far away from an election, which means the Tories were banking on revenues from oil to build as bigger surplus when they drop their next budget. Wonder if the B.C. Government is regretting not cutting a deal to run pipeline through its province. They weren’t morally opposed to the idea; they just wanted more money by way of fees. I’m reminded of what a very successful entrepreneur once said to me, “pigs get fat…hogs get slaughtered”. A lesson for all.

Interesting times ahead of us. The Bank of Canada Governor, Poloz, used stronger than normal language regarding his concern at the amount of household debt this week. So mortgages will continue to get its fair share of air time. But for those of us in the mortgage industry, we should whisper a thank you to the gas pump the next time will fill up. It’s nice not to be alone. Just thought of something, If you’re looking for a stocking stuffer this Christmas, why not a barrel of oil? Nah, wait till Boxing Day, it will be a lot cheaper.

Until next time

Cheers

Read More Add a Comment

Just lifted off for a quick trip to Fort McMurray, Alberta. What takes me to Fort McMurray? Well, like everyone else on this plane, opportunity. My fellow passengers are all predominately male, big lads, and there’s no doubt there off to do some heavy work. I suspect when the beverage cart comes out no one will be ordering brie with a white wine spritzer. I was just thinking the last time I was in Fort McMurray was, well, never. I may have visited some 15 years ago, but it’s all blur now for me so I’ll go with never. My knowledge of Fort McMurray is fairly limited but here’s what I know; oil and natural gas has created a boom town. Salaries are well above average, and the work is hard, and home prices would be more suited in the Vancouver market place. I was also surprised to find out that Air Canada has two direct flights from Toronto to Fort McMurray, daily. That’s not to accommodate investment bankers but rather the men and women who do the real work, and a good number of them come from Eastern Canada. It’s a long commute to work.

The natural resource sector makes a significant contribution to our economy, and not unlike the real estate industry in Canada, disruptions would adversely affect our economic growth. Bank of Canada Governor Stephen Poloz stated that plunging prices for crude oil could reduce our economic growth by a quarter percent. Anything below $90 a barrel could cause job loss in the oil sector, and ultimately impact the real estate market. So clearly the oil and gas sector is important to all of us. We will always mumble and grumble when filling up. Not unlike mortgages. Everyone hates debt, but some debt helps to create personal wealth and is a job creator.

The natural resource sector makes a significant contribution to our economy, and not unlike the real estate industry in Canada, disruptions would adversely affect our economic growth. Bank of Canada Governor Stephen Poloz stated that plunging prices for crude oil could reduce our economic growth by a quarter percent. Anything below $90 a barrel could cause job loss in the oil sector, and ultimately impact the real estate market. So clearly the oil and gas sector is important to all of us. We will always mumble and grumble when filling up. Not unlike mortgages. Everyone hates debt, but some debt helps to create personal wealth and is a job creator.

I really wish I understood what causes oil prices to fluctuate. I get why interests rates go up and down. But the price of oil seems to be a market on to its own. Setting aside the oil industries P.R. explanation of why prices are where they are, what’s the real reason? The price for a barrel of oil today has hit a two and half year low. Why? Has the insatiable urge for crude by emerging markets waned? Don’t recall reading anywhere that China and India have said, “we got enough oil…we’re good”. Have we changed our personal habits to such an extent that it would cause the price of oil to fall? Has fracking in North America dramatically affected the price of oil in such a short period of time? Everything I read is that there’s a glut of oil on the market today, supply outpaces demand, and logic would dictate that if oil industry slowed down the supply eventually the price would go up. But the supply has not slowed down, so the question is why?

Today’s Oil Supply

I came across an interesting theory, and if it’s true, today’s oil supply has nothing to do with economics but rather geopolitical reasons. In short, here’s the theory. Russia cast its wondering eye to the Ukraine, and annexed a portion of another sovereign nations land. NATO wasn’t prepared come to Ukraine’s defense but steps had to be taken to ensure Putin thinks twice about expanding his reach elsewhere. It’s been well documented that the price of oil helps to sustain Russia. Close to 50% of Russia’s budget depends on oil being priced at $100 a barrel. So how does the west punish Russia for it’s illegal occupation of the Ukraine? You glut the market with oil. Does the U.S. still have enough influence over oil producing countries to manipulate the market? Who knows for sure – but what is known is it happened once before. The fall of communism was credited to Ronald Reagan, the Pope, Lech Walesa and Gorbachev. All key players, but was not widely reported was that the U.S. convinced Saudi Arabia to glut the market with oil at that time. This played a key role in almost bankrupting Russia, and forcing them to say “we surrender, communism nyet“. What did Saudi Arabia get in return? A promise from the U.S. that they would always have their back, and they would never have reason to fear their neighbors.

What does this all mean for us? The U.S. and Canadian Central Banks continue to say exactly what they’ve been saying for what seems like forever. Overnight lending rate will not increase until data unequivocally supports full economic recovery. Key data with the price of oil, and its impact to the Canadian economy. Same old-same old. Interest rates are not going up in the foreseeable future. Oh, and one more thing…we’re all pawns in a geopolitical game of chess.

Until next time

Cheers.

Read More Add a Comment