Who doesn’t like swag? Everyone likes a goodie bag full of free stuff. Personally? I won’t jump up and down like a moron to get a free t-shirt at a sporting event but if it happens to land in my lap I’m taking it. It might come in handy when I wash the car. No wait, I haven’t physically washed my car in years. Okay, I’m not sure what I’ll use it for but it’s going home with me because it’s free and now it’s mine. But what happens when you get used to getting something for free and then all of a sudden you’re asked to pay for it? That’s exactly what’s happening to the newspaper industry in Canada.

For years now I’ve been reading newspapers online. There was a time not too long ago when I would get up every Saturday and Sunday morning, head down to local café for a latte and pick up two newspapers. I head back home, crawl back into bed and read both papers while sipping on my overpriced cup of java. Then once a month I would take the stack of newspapers that had piled up out for recycling; same routine for years, winter, spring, summer and fall. Then one day it all changed, it was day I got my first iPad. Without realizing it I stopped going out for latte’s and newspapers. A cappuccino maker made its way into our home, and at my fingertips was all this information, newspapers from around the world. The experience is so much better and it’s free. It’s so easy; I no longer wait for weekends to get my fix of free news. On the train, in the car (not while driving), while watching TV or any other conceivable moment of free time. You’re hooked, and then one day when you visit one of your favorite newspapers sites a message appears, “You have now read five of twenty free articles…Click here to subscribe”. What the hell? They want money? That’s preposterous!

For years now I’ve been reading newspapers online. There was a time not too long ago when I would get up every Saturday and Sunday morning, head down to local café for a latte and pick up two newspapers. I head back home, crawl back into bed and read both papers while sipping on my overpriced cup of java. Then once a month I would take the stack of newspapers that had piled up out for recycling; same routine for years, winter, spring, summer and fall. Then one day it all changed, it was day I got my first iPad. Without realizing it I stopped going out for latte’s and newspapers. A cappuccino maker made its way into our home, and at my fingertips was all this information, newspapers from around the world. The experience is so much better and it’s free. It’s so easy; I no longer wait for weekends to get my fix of free news. On the train, in the car (not while driving), while watching TV or any other conceivable moment of free time. You’re hooked, and then one day when you visit one of your favorite newspapers sites a message appears, “You have now read five of twenty free articles…Click here to subscribe”. What the hell? They want money? That’s preposterous!

Of course it’s not preposterous. No one works for free and one has an expectation that efforts should be rewarded. Why would it be any different for the newspaper industry? The digital age has had profound impact on the newspaper industry. Advertising dollars are shrinking, which means that less people are subscribing to newspapers. How does the newspaper industry survive? What do they do? Is it simply transferring the words from paper to print and saying we want to earn the same revenues? I’m not sure. Recently a number of newspapers in Canada have introduced an online subscription fee. Will it work? I haven’t received the message on my screen from The Globe, Financial Post or Toronto Sun that says, “Sorry Bozic, the free ride is over”. But when I do, what will I do? I remember a while ago I tried to read the New York Times and Post online. They wanted money, so I moved on. I just went back to their sites, after being warned by Canadian newspapers that free wasn’t doable anymore, and much to my surprise they weren’t asking for money anymore. Did it not work for them? Did less eyeballs result in less online advertising? Don’t know and I didn’t give it a lot of thought. Maybe I should but I’m a byproduct of the new digital reality. I have different expectations today, especially when it comes to information. Most people get their news today from non-traditional news outlets, and maybe it’s hurting some industries, but it’s a fact. If a few publications shut me out because I’m not paying, there are millions of other sources that I can access simply because I want too. I can’t even imagine what it’s like to try to compete in that world.

In no shape or form am I saying that newspapers are wrong for attempting to earn revenue for their on-line efforts. A strong and vibrant press is an important staple of our society. Good journalism keeps institutions and individuals honest. Maybe I should pay the subscription fee to ensure that fifth estate remains viable. My subscription can make a small contribution in that regard. It is one thing to rationalize it and altogether different when your wallet sets your course. I can’t help but wonder if the fate of the newspaper industry will be no different than our local hardware store. Remember them? That’s right…they’re no more.

Until next time,

Cheers.

Read More Add a CommentFor some time now, finding positive news about the mortgage industry and the real estate market in general required a Sherpa Guide and a donkey. “I think I just heard something positive about mortgages… OOPS, my bad, it’s just Big Foot.”

It hasn’t been easy but over the past couple of weeks there’s been news which leads me to believe the Four Horsemen of the Apocalypse may not be on the way.

CAAMP’s Annual State of the Residential Mortgage Market in Canada (love those short titles) was released just prior to Mortgage Forum 2012 in Vancouver. It’s a must read for everyone in the industry. All the major media outlets have picked up the report and there’s been a significant amount of coverage based on the report. One aspect of the report that bodes well for the industry, and should give regulators some degree of comfort, is how responsible Canadian borrowers are. I found it striking that 32% of borrowers either increased their monthly payments or made principal reductions over the past 12 months. It is estimated that $3.5 billion in additional monthly payments were made, and a further $20 billion in lump sum payments. Yes, consumers are taking on more debt but they’re looking at paying off their debt sooner. When stories are written about consumer debt levels, a word or two should be dedicated to how responsible Canadians are in attempting to eliminate their debt.

CAAMP’s Annual State of the Residential Mortgage Market in Canada (love those short titles) was released just prior to Mortgage Forum 2012 in Vancouver. It’s a must read for everyone in the industry. All the major media outlets have picked up the report and there’s been a significant amount of coverage based on the report. One aspect of the report that bodes well for the industry, and should give regulators some degree of comfort, is how responsible Canadian borrowers are. I found it striking that 32% of borrowers either increased their monthly payments or made principal reductions over the past 12 months. It is estimated that $3.5 billion in additional monthly payments were made, and a further $20 billion in lump sum payments. Yes, consumers are taking on more debt but they’re looking at paying off their debt sooner. When stories are written about consumer debt levels, a word or two should be dedicated to how responsible Canadians are in attempting to eliminate their debt.

Here’s another indication that consumers maybe be smarter than the press give them credit for. Over the past 12 months there’s been a high level of ARM conversions to 5 year fixed terms, and the product of choice today is 5 year fixed. Maybe, just maybe consumers are smart enough to know that now is not the time to gamble. They’re looking at five year terms and saying the rate is competitive and it’s worth the peace of mind for the next five years.

As far as I’m concerned, the only stat that matters to our industry is the unemployment rate. Everything else, where prime is going etc., is secondary. Our industry, our entire economy will rise and fall with employment numbers. It’s simple, if borrowers are working and they have access to cheap money, like they do now and will have for the next few years, there’s less reason to dump a property. A home owner may not get the price they’re looking for but because the home is affordable there is less reason to discount the price.

If a home owner loses their job a completely different set of circumstances arise. That’s why there’s reason for optimism over the most recent employment numbers. According to Stat’s Canada, 59 thousand new jobs were created in November. On a year over year basis 294 thousand new jobs have been created, and hours worked have also increased. These numbers are critical, not only to our industry but to our economy. Anytime we see a reduction in the employment rate it’s a reason for a high five or fist bump. So turn around and give your work mate a fist bump because our unemployment rate has been reduced to 7.2%.

There’s more good news that will be readily available when the full Maritz survey becomes public in January, another must read. But even if we only take into account the data available today there’s reason for optimism, and lessons to be learned. For instance, consumers do not require regulators to legislate responsibility. Consumers are miles ahead on that one.

Until next time,

Cheers.

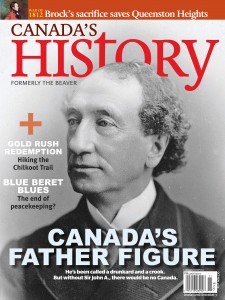

Read More Add a Comment“And we think Obama’s oratory skills are good? Sir John A. had depth and great vision.”

As I mentioned in my last blog my goal is to write about positive stories for the remainder of the year. Positive stories about mortgages may be a bit of a stretch or at the very least a search for silver linings. There’s some data that just came out which suggests there may be some silver linings for our industry, and I’ll attempt to piece some of the data together for a future blog; for now the search continues.

As I mentioned in my last blog my goal is to write about positive stories for the remainder of the year. Positive stories about mortgages may be a bit of a stretch or at the very least a search for silver linings. There’s some data that just came out which suggests there may be some silver linings for our industry, and I’ll attempt to piece some of the data together for a future blog; for now the search continues.

I came across a really good magazine that I never knew existed. The magazine is called “Canada’s History”, formerly “The Beaver”; nope, never heard of the Beaver either. The only Beaver I’m aware of had a brother named Wally, a father and mother named Ward and June. I picked up the magazine while in the Maple Leaf Lounge at the airport. I always have to pick up reading materials prior to take off because apparently my Kindle can bring a plane down during takeoff and landings; seems perfectly plausible to me. So, I pick up this magazine which had a picture of Sir John A. MacDonald on the cover. I rack my brain to come up with things I know about Sir John Eh, get it? Never mind. The only thing I could come up with was that he was Canada’s first Prime Minister, and Conservative. Beyond that I really didn’t know much about our first Prime Minister. That’s a little embarrassing, and I was determined to change that.

What a fascinating man, with such a rich story. Oh sure, he liked to drink a little but what politician doesn’t? Even today’s politicians that are stone cold sober usually sound like they’re inebriated. There was that issue with Pacific Railway where Sir John was caught with his hand in the cookie jar. The lesson there? Political corruption has a long and distinguished history in this country. Character flaws aside, there was a lot substance to Sir John. The magazine story provides some detail on how concerned our first Prime Minister was with the possibility that the U.S. would attempt to swallow us up. He was determined not to let this happen and fought with all his will and intellect to keep Canada out America’s clutches. He was the first national leader in the world, who suggested that woman should have the right to vote. Oh how the opposition Liberals howled in protest over that. Truth be told, not many in his own party supported him on this initiative but that didn’t stop him from fighting the good fight. Here’s an expert of a speech he gave in the house in 1885, “I had hoped that Canada would have the honour of first placing woman in the position she is certain, eventually after centuries of oppression, to obtain of completely establishing her equality as a human being and as a member of society with men”. And we think Obama’s oratory skills are good? Sir John A. had depth and great vision.

I learned a lot reading this story, and I would encourage you to pick up the magazine if for no other reason to remind yourself that this country’s history may be short but it possess great substance. And if your kid is spending too much time playing video games or making friends on Facebook, tell them to read this magazine and share with you what they’ve learned.

Knowledge is a great gift, and this country is a gift to us all.

Until next time,

Cheers.

Read More Add a Comment December is upon us. It’s the time of year when all men head to the mall to get an early start on Christmas shopping (usually around December 23rd). Ah, the joys of going to Sherway Mall or Yorkadale Plaza in Toronto. Looking for a parking space, fighting the crowds in the mall and not knowing what to buy just screams peace on earth to all. It’s the time of year when stress levels rise and you say to yourself, “$%@! %$”. But I’ve decided that this year is going to be a little different.

December is upon us. It’s the time of year when all men head to the mall to get an early start on Christmas shopping (usually around December 23rd). Ah, the joys of going to Sherway Mall or Yorkadale Plaza in Toronto. Looking for a parking space, fighting the crowds in the mall and not knowing what to buy just screams peace on earth to all. It’s the time of year when stress levels rise and you say to yourself, “$%@! %$”. But I’ve decided that this year is going to be a little different.

It’s been a hell of a year for all of us. Changes to the mortgage rules and the economy contributed to a stressful year. Every time we turned around our industry was taking it on the chin from the media. But ultimately we’re responsible for our own state of mind. I’ve decided to try to something different for the rest of the year and search high and low  for positive things to blog about. It may mean there will be very few blogs about the mortgage industry but so be it.

for positive things to blog about. It may mean there will be very few blogs about the mortgage industry but so be it.

With the positive things in mind, the Paradigm/Merix Children’s Christmas party was held this past weekend. The staff who organized the party wondered if my “friend” would be willing to play the part of Santa. I said I would have to think…I mean…I would ask my “friend” if he would be interested in doing it. My “friend” has never done something like this before and I think he was a little concerned that some of the kids might have to go for therapy after the event. “Santa, why are you drinking Grey Goose vodka, and does Santa always wear Hugo Boss cologne, and Santa do you think you’re setting a bad example having an unlit cigar in your mouth”? Out of the mouth of babes.

My “friend” decided to do it and he sent me some photographs. Mrs. Clause has a striking resemblance to Kathy Gregory, and the elf looks eerily like her son Mackenzie. Sheer coincidence? My “friend’ said he had an amazing time, and the smiles on the children’s faces were worth sweating like a pig in that costume. This time of year is truly what we make of it.

My “friend” decided to do it and he sent me some photographs. Mrs. Clause has a striking resemblance to Kathy Gregory, and the elf looks eerily like her son Mackenzie. Sheer coincidence? My “friend’ said he had an amazing time, and the smiles on the children’s faces were worth sweating like a pig in that costume. This time of year is truly what we make of it.

Until next time,

Cheers.

Read More Add a Comment

Customer Complaints play a critical role in any organization because they are the rawest form of interaction between a customer and a business. Complaints, by their very nature, are an emotional reaction to an experience. It’s visceral so it’s more about emotion than fact. Customers who are angry, frustrated or “feel” like they have been disrespected in some fashion are more inclined to let their feelings be known. A company should never, ever, dismiss a customer’s complaint, even if it’s proven that the complaint has no factual foundation. An angry customer today has a multitude of communication platforms at their disposal to share their outrage. A company who ignores customer complaints does so at their own peril. Companies can learn a great deal from complaints and in some cases customer complaints can help an organization identify flaws in their DNA.

Customer Complaints play a critical role in any organization because they are the rawest form of interaction between a customer and a business. Complaints, by their very nature, are an emotional reaction to an experience. It’s visceral so it’s more about emotion than fact. Customers who are angry, frustrated or “feel” like they have been disrespected in some fashion are more inclined to let their feelings be known. A company should never, ever, dismiss a customer’s complaint, even if it’s proven that the complaint has no factual foundation. An angry customer today has a multitude of communication platforms at their disposal to share their outrage. A company who ignores customer complaints does so at their own peril. Companies can learn a great deal from complaints and in some cases customer complaints can help an organization identify flaws in their DNA.

As the Chair of the CAAMP Mortgage Forum, I think about customer complaints and feedback, and how best to interpret the complaints/feedback. Unlike organizations that produce a product, the Mortgage Forum is an experience. An experience is emotional and therefore when I review the CAAMP survey I do so through a filter. All the feedback we receive about the conference is carefully analyzed but I also remind myself that it is nearly impossible to satisfy everyone. Some people are predisposed to having a less than positive experience.

For example, some complaints are made by those who fall into the “bitter bucket”. These are individuals who really dislike a different approach. Let me rephrase that, they hate everything. They long for the old ways. The simple things in life provide them comfort, and they miss that. If the messiah himself was to appear on stage these people would say, “great…just what we need…another motivational speaker”. The other group is the “phantom bucket”. These are the people who go to the conference and don’t attend any sessions. However, they still share their opinions about the quality of the sessions and speakers. I’m impressed that their telepathic prowess is not impacted by sleep deprivation and libation intake.

Irrespective of the categories of complaints they all serve a purpose. The Mortgage Forum is a two and half day experience and the likelihood of being completely satisfied over the course of the entire conference is pretty low. The attention to detail, by those responsible for putting this event together, is the reason why the majority of delegates are satisfied with their experience at the Mortgage Forum. For the people who arrange the Mortgage Forum, it’s the little things. Like addressing the complaint we received one year that “the bagel’s we served at breakfast were too small”. So now when you have breakfast at the Mortgage Forum you’ll notice there are bagel instructions on the back of all the napkins: “If you believe the bagels are too small, please feel free to eat two of them“. Just kidding, we went with bigger bagels.

Until next time,

Cheers.

Read More Add a CommentYour request has been sent.