I decided to break one of my own rules of blogging. In my humble estimation blogging should be a combination of facts and opinion. Simply cutting and pasting an article is not blogging. That’s being intellectually lazy and boring to the reader. So why am I breaking my own rule this one time? I’m a fan of Andrew Coyne, and if you’re not familiar with his work you should make a mental note to look for his articles or when he appears on TV. Andrew Coyne is a contributor to the Financial Post Magazine, and he’s a member of the “At Issue Panel” on CBC’s The National. Whenever I read one of Andrew’s columns or if I see him on TV, I always end up saying to myself, “I didn’t know that”. The man’s depth and breadth of knowledge of politics and the economy is impressive to say the last. I enjoyed his work so much that I decided to bring him in as a speaker to the Mortgage Forum in Montreal two years ago. In retrospect it probably wasn’t the right forum or audience. Speaking to an audience for fifty minutes is infinitely different than writing an article or providing forty five second sound bites on TV. That being said I wouldn’t hesitate to bring him back to a future conference, possibly as a member of a panel discussion.

I decided to break one of my own rules of blogging. In my humble estimation blogging should be a combination of facts and opinion. Simply cutting and pasting an article is not blogging. That’s being intellectually lazy and boring to the reader. So why am I breaking my own rule this one time? I’m a fan of Andrew Coyne, and if you’re not familiar with his work you should make a mental note to look for his articles or when he appears on TV. Andrew Coyne is a contributor to the Financial Post Magazine, and he’s a member of the “At Issue Panel” on CBC’s The National. Whenever I read one of Andrew’s columns or if I see him on TV, I always end up saying to myself, “I didn’t know that”. The man’s depth and breadth of knowledge of politics and the economy is impressive to say the last. I enjoyed his work so much that I decided to bring him in as a speaker to the Mortgage Forum in Montreal two years ago. In retrospect it probably wasn’t the right forum or audience. Speaking to an audience for fifty minutes is infinitely different than writing an article or providing forty five second sound bites on TV. That being said I wouldn’t hesitate to bring him back to a future conference, possibly as a member of a panel discussion.

I wanted to share Andrew’s most recent post because it speaks to the media coverage of our industry. I suspect his former employers at Maclean’s Magazine won’t be enamored with this story. It’s refreshing to read an article which is balanced, and speaks to the facts. If you’re like me there’s a good chance you’ll come across a word in one if his articles that you’re not 100% sure of its definition. The article below won’t disappoint. My new word is; “ Profligate”.

Definition of Profligate – wildly extravagant.

Until next time

Cheers,

Andrew Coyne Apr 10, 2012 – 6:00 AM ET | Last Updated: Apr 10, 2012 11:55 AM ET

Even by Maclean’s standards, the cover was alarming. “You’re about to get burned,” screamed the headline, over a picture of a house that was literally on fire. “Canada looks like the us before its devastating housing crash — maybe even worse.” And the kicker, for those still hesitating: “Why it’s officially time to panic.”

This last was doubtless something of a little in-joke. For my old colleagues at Canada’s newsweekly, it is always time to panic, especially about house prices. The magazine’s editors inhabit a world beset by all manner of hitherto undetected demons, from more expensive groceries (“sudden shortages, riots over prices, the world food crisis is about to hit home”) to insomnia (“the truth about a modern epidemic”) to, well, “The Return of Hitler.”

But nothing, nothing frightens the magazine or, it is hoped, its readers, more than real estate. For years Maclean’s has been shuddering in terror of the imminent collapse of the Canadian housing market. From the relative calm of its late 2007 cover story (“Buy? Sell? Panic?”), the magazine soon picked up signals of the coming apocalypse. “House prices start to fall,” the magazine announced the following summer. By autumn, with the world financial crisis in full swing, so was Maclean’s. “Canada’s Looming Real Estate Crisis,” the cover shouted: “Why house prices may soon fall through the floor.”

As the months wore on, and the cataclysm failed to arrive, Maclean’s remained ever hopeful of a real collapse. But durned if prices, after a brief dip, resumed rising. By June 2008, a grumpy Maclean’s was warning readers “Don’t believe the housing hype,” insisting there are “plenty of signs that the Canadian housing market is still on some very shaky ground,” even if “average home prices are up more than 16 per cent this year.”

Fast forward through several more stories in the same vein and by this year the magazine and others were in even less doubt: Canada was in a housing bubble. Why, just look at the numbers. For starters, there’s the oft-repeated fact that Canadians are carrying debts worth 153% of their annual income. That’s true: but other countries’ citizens manage much heavier debt loads, from the spendthrift Swiss (200%) to the feckless Dutch (260%) to the profligate Danes (320%). We may be carrying almost as much debt as the Americans before the crash, but with nothing like the same risk factors, from subprime mortgages to small regional banks, that made their economy such a firetrap. And if we’re mentioning how Canadians’ debts have grown, we should surely also mention that their assets have as well: still five times as large as their debts.

Mortgage costs, interests and principal combined, are currently running at about 30% of disposable income — again, higher than a few years ago, but barely half what they were in the early 1990s. Yes, house prices were still rising as of year-end, but more slowly than before, as even the Maclean’s piece acknowledges — though somehow it cites this as evidence for its doomsday thesis. But then, what doesn’t? If prices were rising quickly, that would be proof of housing “mania.” If they fell a little, that would be the bubble starting to burst. And if they fell a lot? Look out below!

The truth is the real estate market is cooling slightly, helped by a modest tightening of lending regulations. It’s true that a rise in interest rates from current, historically low levels would put some homeowners in distress, but they’d have to spike a long way before the damage grew widespread — a concern, sure, but nowhere near as frightening as, say, the return of Hitler.

Posted in: Financial Post Magazine Tags: Canadian housing bubble, Maclean’s, real estate

Read More Add a Comment My ritual every morning is to load up on some high octane coffee and surf the web for economic news. I’ve conditioned myself to expect some negative articles about the mortgage industry, and thanks to Canada’s major newspaper I’m rarely disappointed. Our industry has taken so many body blows that we’re qualified to perform for the WWE. Go ahead, suplex me off the top ropes. It can’t be any worse than the predictions of doom and gloom and specifically that the housing industry is the greatest threat to Canada since confederation. Well, imagine my shock when I read the Globe and Mail’s Report on Business last Friday. The headline bellowed, “Labour market shakes off winter blues. Economy creates 82,300 jobs in March, its best month since recession, as unemployment rate falls to 7.2 per cent”. I double checked, it really was The Globe.

My ritual every morning is to load up on some high octane coffee and surf the web for economic news. I’ve conditioned myself to expect some negative articles about the mortgage industry, and thanks to Canada’s major newspaper I’m rarely disappointed. Our industry has taken so many body blows that we’re qualified to perform for the WWE. Go ahead, suplex me off the top ropes. It can’t be any worse than the predictions of doom and gloom and specifically that the housing industry is the greatest threat to Canada since confederation. Well, imagine my shock when I read the Globe and Mail’s Report on Business last Friday. The headline bellowed, “Labour market shakes off winter blues. Economy creates 82,300 jobs in March, its best month since recession, as unemployment rate falls to 7.2 per cent”. I double checked, it really was The Globe.

To be clear there wasn’t a single sentence in the article about the importance of the housing and mortgage sector, and the millions of direct and indirect jobs the housing and mortgage sector creates. Let’s not let facts get in the way of a good story. At least we’re not being blamed for something. Maybe I’m becoming cynical but one day I expect to read that global warming, Iran’s nuclear capabilities and the Leafs failure to make the play-off is a result of consumer debt levels in Canada, as well as over inflated home values. So it’s big news when we can get through a day without being held accountable for… well… just about anything that goes wrong with the economy.

There was plenty of good news of Friday. On the employment front some 82,300 jobs were created last month. The overall unemployment rate fell to 7.2 per cent. The pace of hiring is clearly picking up and corporate Canada is far more optimistic about our recovery, as well for our neighbours South of the boarder and in Europe. You know the news is good when the manufacturing sector in Ontario is showing signs of growth. And you we’re skeptical about the Easter Bunny. What’s really refreshing about our economic growth is who’s leading the way. Not the usual suspects. All hail the new king, Saskatchewan! You want to live and experience an economic boom…move to Regina. The unemployment rate there is 3.9 per cent. Last year Regina’s GDP growth was 6.1 per cent. The average price of a bungalow is $315,000. For prosperity go west young man, just not all the way west. This is a great success story. Good people deserve good fortune.

So we should all bask in the glow of this good news for as long as it lasts. I see the markets have gone into the tank since Friday because of poor job growth numbers in the US. It seems that economists were expecting much better job numbers in the U.S.; economists have been having a tough go of it recently. Our actual job growth numbers came in eight times greater than what economists were calling for. I wonder if this is the same group of economists who called on the Finance Department to change the mortgage rules because the sky was falling. Here’s a suggestion for them; they should set aside their data and cognitive skills and use something a little more reliable, like tarot cards.

Until next time.

Cheers.

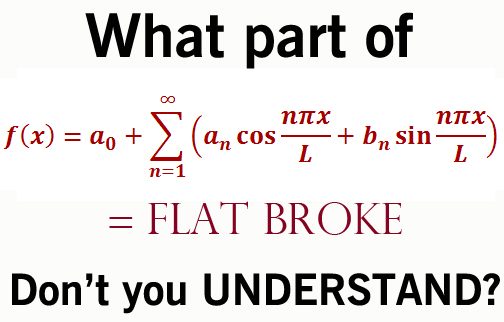

Read More Add a Comment This is time of year when many Canadians start to think about their RRSP. If you’re like me you’re also giving some thought to how much money you’re prepared to lose investing in Mutual Funds. I received an email this week from a financial planner at my bank reminding me that the deadline to contribute is February 29th. That was very thoughtful of him, and I guess I shouldn’t be surprised that he didn’t remind about how much I’ve lost in the last couple years. I guess they figure I should be happy because I’m only this far away (thumb and first finger about an inch apart) from breaking even. It’s gotten to the point today where breaking even is a reason to celebrate. (more…)

This is time of year when many Canadians start to think about their RRSP. If you’re like me you’re also giving some thought to how much money you’re prepared to lose investing in Mutual Funds. I received an email this week from a financial planner at my bank reminding me that the deadline to contribute is February 29th. That was very thoughtful of him, and I guess I shouldn’t be surprised that he didn’t remind about how much I’ve lost in the last couple years. I guess they figure I should be happy because I’m only this far away (thumb and first finger about an inch apart) from breaking even. It’s gotten to the point today where breaking even is a reason to celebrate. (more…)

I always find it fascinating that highly trained people can look at the same raw data and come up with different interpretations. Some time ago CAAMP’s Chief Economists, Will Dunning, characterized economists this way to me, “if the economist is an optimists his forecasts will reflect that. Conversely, if the economist is a pessimist his finding will have a glass is half empty slant”. Your DNA, your personality, and getting up on the wrong side of the bed will influence the finding of those who join the dots and make predictions. Based on headlines recently many economic prognosticators should be going to bed earlier to avoid  crankiness. (more…)

crankiness. (more…)

The Fed’s still have concerns about Europe and the impact it may have for the global economy, and Canada specifically. Well they should, and it’s the Fed’s responsibility to worry about such issues.

I t’s not sophisticated or scientific but it can’t hurt to keep our fingers crossed when it comes to the economy. Markets rallied in a big way yesterday, due in part to a number of central banks around the world making moves to ensure liquidity, and it will be interesting to see if this is just another crest of a roller coaster ride the market has been on for some time now. There was also encouraging news about the Canadian economy. (more…)

t’s not sophisticated or scientific but it can’t hurt to keep our fingers crossed when it comes to the economy. Markets rallied in a big way yesterday, due in part to a number of central banks around the world making moves to ensure liquidity, and it will be interesting to see if this is just another crest of a roller coaster ride the market has been on for some time now. There was also encouraging news about the Canadian economy. (more…)