I have a tremendous amount of admiration for those that can craft words in in a way to enlist emotion, and to make people say, “What the hell?” I’m not talking gibberish or some inane cliché. Real articulation and pictures being painted with words is an art. Indeed, my tired eyes have glimpsed a Picasso of statements. The artist? Outgoing Bank of Canada Governor, Mark Carney.  Today was Mr. Carney’s last monitory policy update prior to his departure this summer. It’s an art form to be able to say the same thing 32 consecutive times, and make it sound interesting.

Today was Mr. Carney’s last monitory policy update prior to his departure this summer. It’s an art form to be able to say the same thing 32 consecutive times, and make it sound interesting.

In fairness I did detect something new when reviewing the text of his speech. For example, how would you describe your business today? Challenging? Concerning? Apprehensive? I have a sneaking suspicion you didn’t think of this, “constructive evolution of imbalances in the household sector.” These were Mr. Carney’s words used to describe the current economic state of affairs. In fairness, here’s the entire statement, “With continued slack in the Canadian economy, the muted outlook for inflation, and the constructive evolution of imbalances in the household sector, the considerable monetary policy stimulus currently in place will likely remain appropriate for a period of time, after which some modest withdrawal will likely be required , consistent with achieving the 2 per cent inflation target.” See, nothing has really changed with exception of the categorization of our industry, and the real estate market in general. “Constructive evolution of imbalances in the household sector” sounds so much better than the market has slowed down significantly, the condo market is weak, job loss in the housing sector may reach 180,000 due to a real estate slowdown, many borrowers can no longer qualify for mortgages and household credit posted its slowest annual growth in 17 years in April. I’m not debating the importance of slowing down consumer debt or the Bank of Canada’s policy in general. I’m just admiring the phraseology.

So Mr. Carney bids us adieu with a message of, well, much of the same. So we wait with bated breath to hear from the new leading man, Stephen Poloz. The market will cast its eyes, and especially its ears, to the new governor of the Bank of Canada. Markets move up and down based on statements made by the governor of the Bank of Canada. So don’t expect absolute clarity from the new governor as it relates to future predictions of what the Bank of Canada may or may not do. Wiggle room is always required.

Until next time,

Cheers.

Read More Add a Comment

This is one of my favorite times of the year. I’m about to take part in what has become a marker of history for MERIX. Every year since inception we gather as group to reflect on the past twelve months but more importantly focusing on the future. It’s the one time of year where we gather to share ideas, to council, motivate and enjoy eachother’s company. We’ve taken our gathering across our country, and last year we converged on the city of San Francisco. This year? We gather in our nation’s capital. When I asked the organizers of the event why Ottawa? The answer was simple, not everyone on the team has been to Ottawa. So Ottawa it is.

This is one of my favorite times of the year. I’m about to take part in what has become a marker of history for MERIX. Every year since inception we gather as group to reflect on the past twelve months but more importantly focusing on the future. It’s the one time of year where we gather to share ideas, to council, motivate and enjoy eachother’s company. We’ve taken our gathering across our country, and last year we converged on the city of San Francisco. This year? We gather in our nation’s capital. When I asked the organizers of the event why Ottawa? The answer was simple, not everyone on the team has been to Ottawa. So Ottawa it is.

I’ll be with the MERIX team for the remainder of the week, which is code for I’ll get back to regular blog posts next week. For the next few days I get to spend time with an inspiring group of people from across our country.

Until next time,

Cheers.

Read More Add a CommentI write this blog while waiting for repairs to be made to the plane prior to take off. Which by the way I think is a damn fine idea, if there’s a problem with the plane I don’t care how much time it takes to fix the problem. It never ceases to amaze me how some people moan and grumble about the plane not being able to take off for mechanical reasons or when the plane has to be de-iced. What could possibly be that important at the end of the journey to piss and moan about flight safety? So, I have some time on my hands and I had a little extra time to devour the National Post. I came across an interesting article; it was especially interesting given the purpose of my trip…

I decided that 2013 was the year to reconnect with our customers. The previous twelve months became somewhat of black hole with respect to this practice. No excuses, but I was the Chair of CAAMP in 2012, at the same time working on a management buyout, which came to a conclusion in February of this year. Now that my responsibilities with CAAMP are becoming fainter and the Merix and Paradigm ownership issue is resolved, it’s back to basics. I’ve always believed that sitting directly across from your customers, looking at them in the eye, and asking them for feedback is the best way to gauge exactly how your organization is performing. So on tour I go. I’ve met with a number of our status originators in Toronto, Calgary, Winnipeg, and with plans to meet in Ottawa, Vancouver and either Saskatoon or Regina. One way to show a customer that their business is valued is to meet them in their backyard. The effort alone should speak volumes (pardon the pun). Back to the article in the National Post entitled, “Six skills to ensure success,” written by Rick Spence. He states that one of the six keys to success is to “snuggle up to your customer“. According to Spence, “some of your best sources of market intelligence and new ideas will come from clients.“ That is so true, and its why enjoy meeting with our loyal supporters. I talk very little about Merix Financial when I meet with our customers. I’m more interested in their business, and how we might fit within their mortgage ecosystem – the best way to find this out – talk less and ask questions. Your customer will provide a detailed road map for you and all you have to do is two things – don’t interrupt and make them THE focal point.

I decided that 2013 was the year to reconnect with our customers. The previous twelve months became somewhat of black hole with respect to this practice. No excuses, but I was the Chair of CAAMP in 2012, at the same time working on a management buyout, which came to a conclusion in February of this year. Now that my responsibilities with CAAMP are becoming fainter and the Merix and Paradigm ownership issue is resolved, it’s back to basics. I’ve always believed that sitting directly across from your customers, looking at them in the eye, and asking them for feedback is the best way to gauge exactly how your organization is performing. So on tour I go. I’ve met with a number of our status originators in Toronto, Calgary, Winnipeg, and with plans to meet in Ottawa, Vancouver and either Saskatoon or Regina. One way to show a customer that their business is valued is to meet them in their backyard. The effort alone should speak volumes (pardon the pun). Back to the article in the National Post entitled, “Six skills to ensure success,” written by Rick Spence. He states that one of the six keys to success is to “snuggle up to your customer“. According to Spence, “some of your best sources of market intelligence and new ideas will come from clients.“ That is so true, and its why enjoy meeting with our loyal supporters. I talk very little about Merix Financial when I meet with our customers. I’m more interested in their business, and how we might fit within their mortgage ecosystem – the best way to find this out – talk less and ask questions. Your customer will provide a detailed road map for you and all you have to do is two things – don’t interrupt and make them THE focal point.

If you’re executing fundamentals in customer feedback such as: requesting feedback, surveys, one-on-one meetings and user groups – that’s fantastic because it’s a key to success. However, in this day and age of text, twitter and every other medium contributing to the erosion of effective and personal communication – the one-to-one meeting is a huge advantage. There’s still customers out there who value the simplicity of an authentic conversation (and that’s becoming a skill set today). Your customers enjoy the engagement, and you learn from it; doesn’t get much better than that.

Until next time,

Cheers.

National Post: Small Business Skills for Success

Read More Add a Comment

I find it fascinating how much time, money and energy is spent looking for the next business advantage. I’m guilty of it. I’ve read countless books on business, leadership as well as hundreds of articles over the years in an effort to find the magic bullet…that one nugget that will separate me and our organization from the rest. We all know it’s never just one idea, one process, or one specific management style that separates one organization from another. Success is a result of many business layers which are refined and tweaked over the evolution of a particular business. The hope that drives me to find THE nugget is my educational driver. Over the past six weeks I’ve be reminded of something, and it may not be THE nugget, but it’s critical to the success of any business. It wasn’t anything I read. I was simply being introspective.

In my humble estimation employee engagement is one of the most critical drivers of success. Ask yourself, or think of your direct reports, how many times have you or your employees shown up for work in the last six weeks in body only? Physically present but mentally and emotionally absent. The past six weeks has made me realize that I was guilty of this in 2012. Yes, the entire year. As most of you are aware a MERIX/Paradigm management buyout was completed at the end of February. The management buyout process began well over a year ago, and if I factor in being Chair of CAAMP in 2012, I have to be brutally honest with myself and admit I that my focus and attention waned in 2012. I was not engaged in the business of running MERIX. I was there, I showed up but there were too many distractions. I only now realize the level of my disengagement in 2012.

My word, what a difference the last six weeks have been. I haven’t felt this invigorated in a long time. To arrive at work now and say, with conviction, today we get things done, and then actually get those things done, is an adrenalin rush. We’re starting to move that big concrete flywheel again at MERIX and Paradigm. To be able to speak to my partners about growth and future of our business is reminiscent of the way things were in the early years. Knowing my partners are engaged once again breeds confidence, and that’s contagious. All of this is happening because we’re simply paying attention and we have no distractions.

My advice to you is to be completely honest with yourself about your level of engagement at work. Ask yourself if you’re just showing up to work, mailing it in, and really is work a comfortable place to kill time? If you answer yes to any of these you need to eliminate the distractions and reengage. It’s better you deal with it yourself than your employer. I came across a saying recently, once again looking for that nugget, that speaks to a level of engagement at work, and at home. “Treat everyday day at work like it’s your fist day on the job, and treat every day at home like it’s your last day on earth”.

Until next time,

Cheers.

Read More Add a Comment

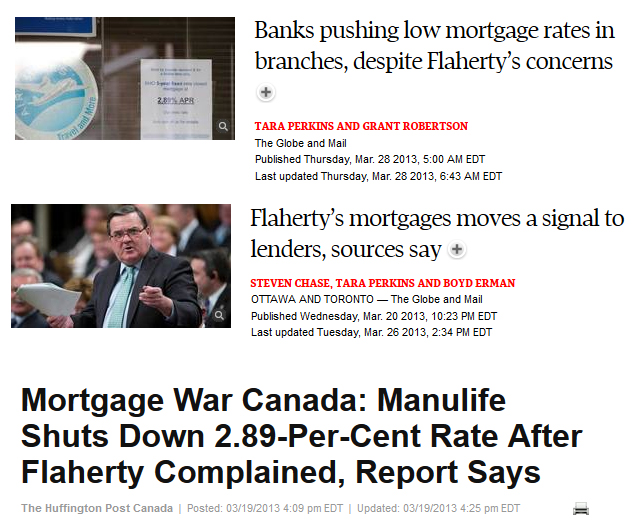

“I wonder how you would feel if you received a call from the government saying we would rather you not buy down interest rates.”

Ever run across something that doesn’t sit right. That nagging doubt that you can’t put your finger on, and it just hangs out there. I experienced that a few days ago after reading an article in the Globe. I decided to take few days and give the article one more glance to see if my original reaction would still be the same. Yup, nothing changed. The article in question appeared in the Globe on Wednesday, March, 20th. The headline read, “Flaherty Pushes up Lending Rates – Finance Minister called lenders to express displeasure at mortgage competition, raising bankers’ hackles“.

Few will or should care about a bankers disposition, but I think we should all care when big brother over reaches. I do not how else I can categorize the direct influence over pricing by the government in the private sector. As reported in the Globe, Minister Flaherty contacted Bank of Montreal to chastise them for lowering rates in an attempt to buy market share. A call also went out to Manulife, but the scolding was delivered by one of the Minister’s underlings. It’s easy to say who cares if faceless corporations get their wrists slapped. But any government encroachment of pricing in the private sector should give us all pause. Imagine you are a mortgage broker who has embarked on a strategy of rate buy-downs. The merit of such a strategy is irrelevant, what is relevant is that you have the right to earn or lose money based on your competency or incompetency. We live and work in a free market economy, and the state plays an important role; pricing of products should never be one of them. I wonder how you would feel if you received a call from the government saying we would rather you not buy down interest rates. I get it – that would never happen based on the actions of a handful of brokers. But entrepreneurs of all sizes share a common principals, and for it to be different based on the size of the enterprise alone undermines the fundamentals of competition.

Few will or should care about a bankers disposition, but I think we should all care when big brother over reaches. I do not how else I can categorize the direct influence over pricing by the government in the private sector. As reported in the Globe, Minister Flaherty contacted Bank of Montreal to chastise them for lowering rates in an attempt to buy market share. A call also went out to Manulife, but the scolding was delivered by one of the Minister’s underlings. It’s easy to say who cares if faceless corporations get their wrists slapped. But any government encroachment of pricing in the private sector should give us all pause. Imagine you are a mortgage broker who has embarked on a strategy of rate buy-downs. The merit of such a strategy is irrelevant, what is relevant is that you have the right to earn or lose money based on your competency or incompetency. We live and work in a free market economy, and the state plays an important role; pricing of products should never be one of them. I wonder how you would feel if you received a call from the government saying we would rather you not buy down interest rates. I get it – that would never happen based on the actions of a handful of brokers. But entrepreneurs of all sizes share a common principals, and for it to be different based on the size of the enterprise alone undermines the fundamentals of competition.

Another part of the story I find troublesome is why did this become public? I suspect the Minister of Finance would be put directly through to the CEO of both Bank of Montreal and Manulife. For appearance sake alone this arm twisting should have been done in private, and not worn like a badge of honour in public. The general public already believes that the working relationship between the government and banks is too cozy; these stories don’t help to dispel that notion.

Until next time,

Cheers.

Read More Add a Comment