That famous line was attributed to Jogi Berra, Hall of Fame New York Yankee baseball player. Besides being a great ball player, Berra was also known for malapropism, mangling the English language. Normally it’s done for comedic relief but in Berra’s case it was his standard way of speaking. I thought of this quote based on what’s been happening to the markets over the last week. It’s starting to feel like 2008 all over again. Back in 2008, the world faced an economic crisis. The news was stunning. How on earth could iconic companies such as Lehman Brothers and Bear Sterns fail? Yet that’s exactly what happened. The U.S. Government forced banks to take T.A.R.P. (Troubled Asset Relief Program) money to ensure that lending would continue. The ministers of the G7 countries rushed to Washington for emergency meetings because there was fear that the markets wouldn’t open. As events unfolded in 2008 we were all left wondering what’s next? It appears the other shoe has dropped.

One of the significant differences, relative to our present day situation, is the fact that back in 2008 nobody questioned America’s credit worthiness. That all changed last Friday when S & P (Standard and Poor’s) downgraded the US from AAA to AA Plus. Not since 1917 has the US been rated lower than AAA. Not surprisingly the Obama administration has come out swinging against S & P. The administration is questioning S & P calculations and motives for the downgrade. Funny how S & P’s motives were never questioned when the US had a AAA rating. I should note that the other two rating agencies, Moody’s and Fitch, have not downgraded the US. So the question is, which rating agency has it right? In time the answer will become clearer but I’ll say this about S & P, the move they made on Friday took a lot of chutzpa. That’s a Yiddish word for tenacity and guts. I suspect shirt collars are feeling a little tight today in the corporate offices at S & P.

One of the significant differences, relative to our present day situation, is the fact that back in 2008 nobody questioned America’s credit worthiness. That all changed last Friday when S & P (Standard and Poor’s) downgraded the US from AAA to AA Plus. Not since 1917 has the US been rated lower than AAA. Not surprisingly the Obama administration has come out swinging against S & P. The administration is questioning S & P calculations and motives for the downgrade. Funny how S & P’s motives were never questioned when the US had a AAA rating. I should note that the other two rating agencies, Moody’s and Fitch, have not downgraded the US. So the question is, which rating agency has it right? In time the answer will become clearer but I’ll say this about S & P, the move they made on Friday took a lot of chutzpa. That’s a Yiddish word for tenacity and guts. I suspect shirt collars are feeling a little tight today in the corporate offices at S & P.

Based on what’s happened in the last week, what does this mean for Canada? Firstly, no one can predict with any certainty. We’re in-uncharted waters here. Besides what’s happening in the US, numerous countries are in dire straits financially in Europe. All of these factors will have an impact on us. “Canada is not an island,” Finance Minister Jim Flaherty said late Friday in a statement. “We are a trading nation, with about a third of output generated by exports and deep linkages with the U.S. economy. The global economic recovery remains fragile and this uncertainty may eventually impact Canada”. One of the ways it may impact us is that if borrowing costs increase in the US, due to S & P’s downgrading, there could be further negative impact to the US economy. This impacts us because we export so much of our goods to the US. If the Americans are not spending, we feel it. There’s also predictions that the loonie will go higher relative to the US greenback. That of course makes our goods more expensive in the US and abroad.

Firstly, no one can predict with any certainty. We’re in-uncharted waters here. Besides what’s happening in the US, numerous countries are in dire straits financially in Europe. All of these factors will have an impact on us. “Canada is not an island,” Finance Minister Jim Flaherty said late Friday in a statement. “We are a trading nation, with about a third of output generated by exports and deep linkages with the U.S. economy. The global economic recovery remains fragile and this uncertainty may eventually impact Canada”. One of the ways it may impact us is that if borrowing costs increase in the US, due to S & P’s downgrading, there could be further negative impact to the US economy. This impacts us because we export so much of our goods to the US. If the Americans are not spending, we feel it. There’s also predictions that the loonie will go higher relative to the US greenback. That of course makes our goods more expensive in the US and abroad.

Conversely there’s been some positive speculation about Canada. Investors will look for a safe haven. There’s plenty of cash on balance sheets today but given the uncertainty of the market place cash is being hoarded. Eventually corporation will want a return on their capital, and Canada is a safe bet. Based on workforce, commodities, stable financial sector and fiscally responsible government, Canada should benefit. Countries which are AAA rated today will be in demand. S & P rates Germany, Britain, Austria, Denmark, Norway, Netherlands, Australia and Canada AAA. If Europe makes investors nervous, Canada’s a solid option.

It’s become fashionable in this country to pat ourselves on the back and say, “we’re so much smarter than the Americans”. Frankly, recent history clearly shows that we have managed our affairs far more effectively than our neighbours to the south. But things can change. In 1993, the Canadian Bond Rating Agency downgraded Canada from AAA to AA Plus. In a short period of time the other international rating agencies followed suite. How did we get our AAA rating back? The government attacked the deficit. If you recall back in the 90’s the Liberals, remember them, ran things in Ottawa. Under Finance Minister Paul Martin, programs were slashed, transfer payments reduced, and taxes were increased. This was done all in the name of deficit reduction, and it worked. Here we are in 2011, our deficit is too high and the Harper government will have to do something about it. Harper’s backed himself into a corner by campaigning that our taxes are too high, and increasing taxes is not the answer. He had me at hello. So then the only way to reduce our deficit is to cut spending. Don’t expect him to use a scalpel to cut programs. This may require a hatchet.

Until next time

Cheers

Read More Add a CommentOne thing you should never underestimate is America’s resolve. As a country, America has been on the brink on a number of occasions, and yet it has always managed to find it’s way back. From a historical standpoint, America has faced it’s share of crisis; The War of Independence, The Civil War, WW 1 and 2, The Great Depression, The Korean War, Vietnam War, The Bay of Pigs, The Cuban Missile Crisis, the Assassination of John F Kennedy, Robert Kennedy, Martin Luther King, the impeachment and resignation of Richard Nixon, the attempted Assassination of Ronald Reagan, 9/11 and the aftermath. This illustrates the U.S. isn’t squeamish about getting blood on their hands in the name of national interest, and they’re certainly willing and able to fight. Yet I can’t help but wonder where has America’s resolve gone? I’m referring to the economic plight America faces today. It’s stunning to watch the US muddle through this recession. The US has faced many deep recessions in the past, however, the present day recession has reduced this great nation to look for handouts, debt owed to China, and facing the fact that today America has zero leadership. It’s shameful that the Obama Administration, as well as the Republicans, are playing politics at this crucial moment in their history. The US is so devoid of any leadership one can’t help but be worried for our neighbours to the South.

Why does this matter to us? Canada is a branch plant economy. We export 70% of our  goods to the U.S. America is a consumer based economy, and we need a healthy and vibrant U.S. economy so we can sell our goods to them. The situation in the U.S. makes the Canadian government nervous. This is why the Conservative Government is pressing full steam ahead to negotiate free trade agreements with Europe, and South East Asia. Our reliance on the U.S. puts our economy at risk, and our government is attempting to mitigate this risk by negotiating new free trade agreements. But that will take time, maybe years. So in the short-term we’re stuck, and all we can do is keep our fingers crossed that the leaders in the US will put petty politics aside and finally lead.

goods to the U.S. America is a consumer based economy, and we need a healthy and vibrant U.S. economy so we can sell our goods to them. The situation in the U.S. makes the Canadian government nervous. This is why the Conservative Government is pressing full steam ahead to negotiate free trade agreements with Europe, and South East Asia. Our reliance on the U.S. puts our economy at risk, and our government is attempting to mitigate this risk by negotiating new free trade agreements. But that will take time, maybe years. So in the short-term we’re stuck, and all we can do is keep our fingers crossed that the leaders in the US will put petty politics aside and finally lead.

In last week’s National Post there was an article about the unemployment situation in the U.S. Statistically things don’t look good (National Post – “U. S. Job Growth in June Falls Far Short of Expectations“). Their unemployment rate is inching towards 10%, and that figure does not include those people that have stopped looking for work, and in some cases fallen through the cracks.

If their economy, and their unemployment rate doesn’t improve before the 2012 Presidential Election, Obama may well end up being a one trick pony. The voters in the US will look to punish someone.

Until next time,

Cheers.

Read More Add a CommentI think it’s safe to say that summer has finally arrived. I hear the snow melted yesterday in Calgary, and in Vancouver they’re calling for two days o f sunshine, in a row. So summer must be around the corner. But you’ll really know when summer is here when Peter Mansbridge begins the National with the following intro; “Greece is on the verge of declaring bankruptcy….the war in Afghanistan rages on … US unemployment rate hits a staggering 14%…But first our top story…Heat Wave Hits Toronto”. And this is the reason why the rest of Canada hates all things Toronto.

f sunshine, in a row. So summer must be around the corner. But you’ll really know when summer is here when Peter Mansbridge begins the National with the following intro; “Greece is on the verge of declaring bankruptcy….the war in Afghanistan rages on … US unemployment rate hits a staggering 14%…But first our top story…Heat Wave Hits Toronto”. And this is the reason why the rest of Canada hates all things Toronto.

Firstly, as Canadian’s we’re fixated on the weather. Have you ever noticed how much time we spend talking about the weather. Yet for some reason the press elevates the weather situation in Toronto. Look, 33 degrees is hot, but when it’s about Toronto, the humidex factor is always added. It’s not enough to say it’s 33 degrees, the reporter has to say “it feels like 46 degrees”. It’s like some kind of bragging right. Here in Toronto we’re equal opportunists. In the winter it’s all about the windchill. When it’s reported that with the windchill it feels like -28 in Toronto, people in Edmonton and Winnipeg roll their eyes and say “bleeping wimps”. When it comes to the weather, Toronto measures itself by how cold or hot it is. The long range forecast for Toronto, I know this because I’m Canadian, calls for a hot and dry summer. So for everyone living outside of Toronto, don’t be surprised if you hear on The National that the Mayor of Toronto, Rob Ford, has called out the military to help us cope with the heat. The military will walk the streets of Toronto with umbrellas to shade us from the sun.

The summer is a great time of the year, but it can pose challenges for business. Firstly, don’t buy into conventional wisdom that business will slow down because it’s summer. Last time I checked bank’s weren’t boarding up branch windows, with a sign posted on the plywood that say’s…”We’ll be back in September”. It’s difficult but you have to remind your staff, and yourself, that it’s business as usual. Secondly, make a commitment to outwork the competition. Most of your competition will check out, mentally or physically. The majority of people will be lured by the distractions that summer brings. When your competition is playing, you have a great opportunity to eat their lunch. Thirdly, accept the fact that your staff wants to enjoy the summer months, but it doesn’t necessarily mean lost productivity. Flexible hours are an option, and you may decide to knock off early on Friday’s. That’s fine as long as everyone is focused throughout the week. The bills got to be paid.

The summer is a great time of the year, but it can pose challenges for business. Firstly, don’t buy into conventional wisdom that business will slow down because it’s summer. Last time I checked bank’s weren’t boarding up branch windows, with a sign posted on the plywood that say’s…”We’ll be back in September”. It’s difficult but you have to remind your staff, and yourself, that it’s business as usual. Secondly, make a commitment to outwork the competition. Most of your competition will check out, mentally or physically. The majority of people will be lured by the distractions that summer brings. When your competition is playing, you have a great opportunity to eat their lunch. Thirdly, accept the fact that your staff wants to enjoy the summer months, but it doesn’t necessarily mean lost productivity. Flexible hours are an option, and you may decide to knock off early on Friday’s. That’s fine as long as everyone is focused throughout the week. The bills got to be paid.

Until next time.

Cheers

Read More Add a Comment“…it’s all fun and games until someone loses an eye…”

-Mom

I recently had an opportunity to participate in a lender panel discussion. I would like to thank Colin Dreyer and John Kelly of VERICO for graciously inviting me to participate, (VERICO Business Forum in Las Vegas) and for providing and open forum to discuss industry issues. I was struck by the candor of all the panelist’s but I guess I shouldn’t be surprised because leadership requires facing difficult questions, and having an answer. The panel was made up of industry leaders and kudos go out to Moe Forget, Tim Mezik, Jim Smith, Paul Grewal, Hali Standlund, Ron Swift and Mark Squire. Ducking difficult questions and preparing sanitized responses is the easy way out, and no one on the panel took the safe route.

I enjoyed listening to the responses of the other panelist’s. For example, Tim Mezik, Ron Swift and Jim Smith were asked if there respective institutions would ever consider offering trailer fees as a form of compensation. Tim Mezik, and Ron Swift responded respectively by saying maybe and possibly. Jim Smith, in no uncertain terms, said “no”. His position is understandable when you consider that banks are in the customer acquisition business. Therefore, they do not see the need to perpetually pay for a customer that they have already purchased. On the other hand, we at MERIX have a different philosophical viewpoint. We try to balance the need of our enterprise, combined with the needs of our suppliers, the mortgage broker. I believe there is room for both models, and choice in the market place is critical.

I was asked two specific questions about our industry. Firstly, do I believe there’s a level playing field today. Secondly, what is one thing that a lender can do today to ensure long term sustainability, and what can mortgage brokers do in kind.

With respect to a level playing field, do I believe that it actually exists? Today I can state unequivocally the answer is “no”. Anyone who would suggest otherwise would at the very least be disingenuous. At the very worst they would be insulting everyone’s intelligence. Here are some examples of why a level playing field does not exist today:

All this being I said, I say the following: boohoo…

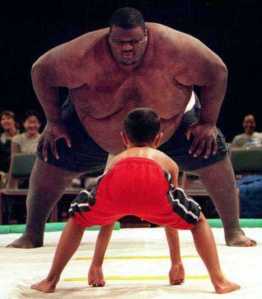

I don’t expect anyone to shed any  crocodile tears for the mono-lines. That’s life, that’s business. As matter of fact many of the challenges we face today are no different than what we at MERIX faced when we launched our business close to seven years ago. We are the guppies swimming amongst the whales, and that hasn’t changed since day one. Frankly, I don’t mind that one bit. All it means is that we have to work harder, be smarter and fight tooth and nail for every market share percentage point. This is the classic story of David and Goliath. It’s not easy going to a gun fight with slingshot and a rock, but it’s the terms of battle we embrace. As my mother would want to say, “it’s all fun and games until someone loses an eye”. We at MERIX plan on having 20/20 vision for a long time to come.

crocodile tears for the mono-lines. That’s life, that’s business. As matter of fact many of the challenges we face today are no different than what we at MERIX faced when we launched our business close to seven years ago. We are the guppies swimming amongst the whales, and that hasn’t changed since day one. Frankly, I don’t mind that one bit. All it means is that we have to work harder, be smarter and fight tooth and nail for every market share percentage point. This is the classic story of David and Goliath. It’s not easy going to a gun fight with slingshot and a rock, but it’s the terms of battle we embrace. As my mother would want to say, “it’s all fun and games until someone loses an eye”. We at MERIX plan on having 20/20 vision for a long time to come.

I’ll address the second question in Thursday’s blog.

Until next time.

Cheers

Read More Add a CommentI say that with tongue firmly planted in cheek. The month of June has been one long road trip for me. I’ve spent a grand total of 6 days at home this month. It was one of those months where my work obligations and responsibilities to CAAMP converged at the same time. Mission accomplished, and I’m going to be grounded for a while. For those of you that don’t have to travel for occupational reasons, I can honestly say professional travel isn’t very glamourous. Being away from family, living out of a suitcase, and eating way too much crappy food catches up with you. The worst part of traveling today is the air travel. Most people are less than thrilled about air travel today. The destination you’re going to is great, but it’s the getting there that’s a pain. Air travel changed after 9/11.

The need for security is real, but some of the security practices at airports seem to be an exercise in optics. Really, A woman’s lipgloss was confiscated going through security! I know, many a plane has been taken down by lipgloss. Admit it, I think we all believe that whatever is confiscated at security is later divvied up amongst the security staff. Protestations to the contrary by the airport, well, I don’t buy it. But on a positive note, at least when you’re going through that security shakedown the security staff makes the experience pleasurable. It must be due to all that extensive training they received. I believe the classroom training consisted of the following; “Everyone’s a threat, treat them accordingly. Congratulations, you’ve just completed your training”. I get it, nothing about that job seems enjoyable. But no one forced these people to take the job.

I would be remiss not to mention the role that the airline staff could play in making air travel a little more tolerable.

I primarily fly Air Canada because, well, brokers aren’t the only one’s who want to earn status.

I’m sure we will all remember the AC strike of 2011. No, you don’t remember it? That might be because the strike only lasted 3 days. I flew twice with AC during the strike and can honestly say that I didn’t notice any difference in service levels. I’m thinking that if employees withhold their services, and no one notices, they have a problem. I have a suggestion for AC employees when they negotiate their next contract with management. Create a new bonus structure. For example, the employees would receive a 50 cent bonus for every time they say the following to a passenger; “good morning, good afternoon, good evening, thank you, you’re welcome, hello, goodbye, please let me know if I can be of any further assistance, it’s wonderful to have you back with us”. Oh, and maybe there could be an additional 25 cent bonus if an airline attendant didn’t treat you like you were a member of a sleeper cell because your seat wasn’t in the full upright position prior to landing.

Until next time

Cheers

Read More Add a Comment