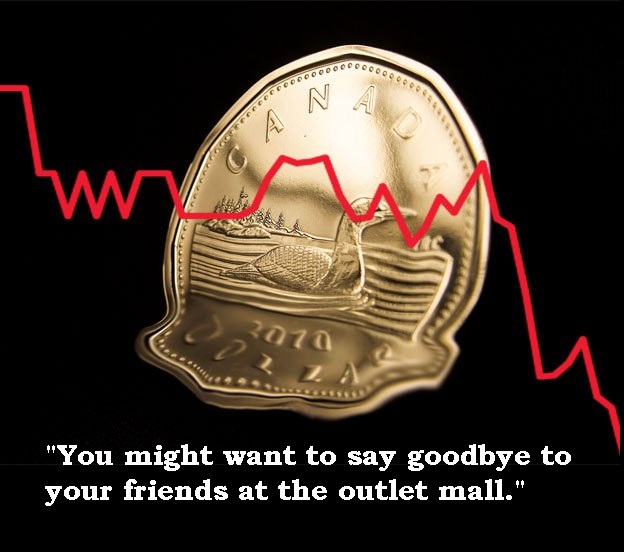

For those thinking of doing some last minute Christmas shopping south of the 49th parallel, the “deals” have become just a little less attractive. The Canadian dollar has now hit at a five year low. The Loonie is now worth 86.70 U.S. cents. Ouch! That’s not to suggest there aren’t some folks cheering.

Since 2008, the manufacturing sector in Canada has taken its fair share of lumps, especially in Ontario and Quebec. Given the value of our Lonnie today there’s less need for innovation and efficiency. Not optimal from a long view standpoint but short term it will give many the opportunity to say, “hey world, buy our stuff because it’s cheaper”. Hmm, that sounds vaguely familiar. Going forward chances are that export numbers will appear to be positive. That makes the Bank of Canada happy. Now they can say they had nothing to do with value of Loonie, as some have suggested. Now they can point to one sector and say, “it’s because of what is happening in the oil sector”. Right now oil is the new ugh! The oil sector is getting hammered and it’s an integral part of our economy. So for every yeah, there’s a yuck!

Since 2008, the manufacturing sector in Canada has taken its fair share of lumps, especially in Ontario and Quebec. Given the value of our Lonnie today there’s less need for innovation and efficiency. Not optimal from a long view standpoint but short term it will give many the opportunity to say, “hey world, buy our stuff because it’s cheaper”. Hmm, that sounds vaguely familiar. Going forward chances are that export numbers will appear to be positive. That makes the Bank of Canada happy. Now they can say they had nothing to do with value of Loonie, as some have suggested. Now they can point to one sector and say, “it’s because of what is happening in the oil sector”. Right now oil is the new ugh! The oil sector is getting hammered and it’s an integral part of our economy. So for every yeah, there’s a yuck!

The economic data suggests that the overnight lending rate is not going up, anytime soon. That’s not to suggest that consumer rates won’t be increasing. Just last week CMHC announced that the cost to securitize, CMB/NHA/MBS is going up. So who’s going to eat the cost? Spreads and margins are already compressed. So it might be difficult to rationalize further compression. The most recent bank earning, with the exception of one bank, did not meet market expectations. Bank stocks are contracting, and they may be challenged to meet net income targets in 2015. The dots are becoming a little clearer, making it easier to join them.

So if you are heading across the border this weekend to do some shopping, and the U.S. Custom Official asks you, “purpose of your trip?”. Your response might be, “just want to say goodbye to my friends working at the outlet mall”.

Until next time,

Cheers.

Read More Add a CommentJust lifted off for a quick trip to Fort McMurray, Alberta. What takes me to Fort McMurray? Well, like everyone else on this plane, opportunity. My fellow passengers are all predominately male, big lads, and there’s no doubt there off to do some heavy work. I suspect when the beverage cart comes out no one will be ordering brie with a white wine spritzer. I was just thinking the last time I was in Fort McMurray was, well, never. I may have visited some 15 years ago, but it’s all blur now for me so I’ll go with never. My knowledge of Fort McMurray is fairly limited but here’s what I know; oil and natural gas has created a boom town. Salaries are well above average, and the work is hard, and home prices would be more suited in the Vancouver market place. I was also surprised to find out that Air Canada has two direct flights from Toronto to Fort McMurray, daily. That’s not to accommodate investment bankers but rather the men and women who do the real work, and a good number of them come from Eastern Canada. It’s a long commute to work.

The natural resource sector makes a significant contribution to our economy, and not unlike the real estate industry in Canada, disruptions would adversely affect our economic growth. Bank of Canada Governor Stephen Poloz stated that plunging prices for crude oil could reduce our economic growth by a quarter percent. Anything below $90 a barrel could cause job loss in the oil sector, and ultimately impact the real estate market. So clearly the oil and gas sector is important to all of us. We will always mumble and grumble when filling up. Not unlike mortgages. Everyone hates debt, but some debt helps to create personal wealth and is a job creator.

The natural resource sector makes a significant contribution to our economy, and not unlike the real estate industry in Canada, disruptions would adversely affect our economic growth. Bank of Canada Governor Stephen Poloz stated that plunging prices for crude oil could reduce our economic growth by a quarter percent. Anything below $90 a barrel could cause job loss in the oil sector, and ultimately impact the real estate market. So clearly the oil and gas sector is important to all of us. We will always mumble and grumble when filling up. Not unlike mortgages. Everyone hates debt, but some debt helps to create personal wealth and is a job creator.

I really wish I understood what causes oil prices to fluctuate. I get why interests rates go up and down. But the price of oil seems to be a market on to its own. Setting aside the oil industries P.R. explanation of why prices are where they are, what’s the real reason? The price for a barrel of oil today has hit a two and half year low. Why? Has the insatiable urge for crude by emerging markets waned? Don’t recall reading anywhere that China and India have said, “we got enough oil…we’re good”. Have we changed our personal habits to such an extent that it would cause the price of oil to fall? Has fracking in North America dramatically affected the price of oil in such a short period of time? Everything I read is that there’s a glut of oil on the market today, supply outpaces demand, and logic would dictate that if oil industry slowed down the supply eventually the price would go up. But the supply has not slowed down, so the question is why?

Today’s Oil Supply

I came across an interesting theory, and if it’s true, today’s oil supply has nothing to do with economics but rather geopolitical reasons. In short, here’s the theory. Russia cast its wondering eye to the Ukraine, and annexed a portion of another sovereign nations land. NATO wasn’t prepared come to Ukraine’s defense but steps had to be taken to ensure Putin thinks twice about expanding his reach elsewhere. It’s been well documented that the price of oil helps to sustain Russia. Close to 50% of Russia’s budget depends on oil being priced at $100 a barrel. So how does the west punish Russia for it’s illegal occupation of the Ukraine? You glut the market with oil. Does the U.S. still have enough influence over oil producing countries to manipulate the market? Who knows for sure – but what is known is it happened once before. The fall of communism was credited to Ronald Reagan, the Pope, Lech Walesa and Gorbachev. All key players, but was not widely reported was that the U.S. convinced Saudi Arabia to glut the market with oil at that time. This played a key role in almost bankrupting Russia, and forcing them to say “we surrender, communism nyet“. What did Saudi Arabia get in return? A promise from the U.S. that they would always have their back, and they would never have reason to fear their neighbors.

What does this all mean for us? The U.S. and Canadian Central Banks continue to say exactly what they’ve been saying for what seems like forever. Overnight lending rate will not increase until data unequivocally supports full economic recovery. Key data with the price of oil, and its impact to the Canadian economy. Same old-same old. Interest rates are not going up in the foreseeable future. Oh, and one more thing…we’re all pawns in a geopolitical game of chess.

Until next time

Cheers.

Read More Add a Comment Just coming back from New York, and I’ll spare you the cliché. New York – bright lights, the city that never sleeps, blah, blah. All true, but the bright lights I’m referring to is a select group of loyal supporters of Merix Financial. We had the pleasure of hosting a number of mortgage brokers in New York to attend the World Business Forum. The event is held over two days and attendees at the conference are leaders and executives from around the world. The lineup of speakers have diverse backgrounds and experiences. It’s the diversity of the speakers which provoke thought and critical thinking. The two day event allowed all of us to exit the echo chamber that we all find ourselves occupying. That is a critical element of professional development. Thought provocation forces you out of your comfort zone.

Just coming back from New York, and I’ll spare you the cliché. New York – bright lights, the city that never sleeps, blah, blah. All true, but the bright lights I’m referring to is a select group of loyal supporters of Merix Financial. We had the pleasure of hosting a number of mortgage brokers in New York to attend the World Business Forum. The event is held over two days and attendees at the conference are leaders and executives from around the world. The lineup of speakers have diverse backgrounds and experiences. It’s the diversity of the speakers which provoke thought and critical thinking. The two day event allowed all of us to exit the echo chamber that we all find ourselves occupying. That is a critical element of professional development. Thought provocation forces you out of your comfort zone.

Our invited guests embraced the opportunity to listen and learn from speakers whose subject matter expertise may have appeared to have only a subtle correlation to their daily actives. But, they came open minded and prepared to see where the experience takes them. I got a big kick watching our guests as the event evolved. Here was a small group of people who for the most part were strangers to each other or know by name only. However, in a short period of time small micro groups were formed to talk about issues that each individual faces each and every day at work. It’s remarkable how quickly trust was built among the group, and it was a safe environment to say “I got a work problem, and I don’t have an answer”. Assistance and suggestions from peers was immediate, and no one held back for competitive reasons. I can’t tell you how cool it is to watch a team come together. Make no mistake, this is a team. As of today they know they can pick up the phone and reach out to one of their peers from across the country to help them solve a problem. Sometimes business can be overwhelming, but it doesn’t have to be lonely.

In my humble estimation, the event was a success, and here’s why. First and foremost, our guests wanted to be there. That was demonstrated by their support of Merix to ensure they were invited. Also, our guests are all focused on building a business, and not just a job. That’s an important distinction. Secondly, Merix set the right expectations. It was learning first, party second. Don’t get me wrong, there was time to have fun. Like the night we all went to Madison Square Gardens for a Fleetwood Mac concert. Our seats we on the floors and we were swept up by the music and the New York audience. Even though there was bit of a “generational” gap for some of our guests, all danced, had a few libations, and allowed themselves to be swept up by the event and the masses. But come 8:30 am the next morning, all were ready to begin a new day.

An extraordinary amount of time and effort is put into planning one of these events. I can never really be sure if our guests will find a benefit in attending, while leaving their business for a few days. After the wrap up dinner we hosted on the final night, one of our guests sat next to me and gave me a book. She wanted me to have the book because she thought I would enjoy the read. She mentioned that she wrote a note on the inside of the cover but asked me not to read it at the table. She said she didn’t want to become emotional. I smiled and said I would respect her wishes. After three hours of the book being by my side, I finally made it back to my hotel and I read her note on the inside of the cover. It was heartfelt, genuine and so sincere. It was right then that I knew the effort in putting this event together was worth it.

So to Gerry, Tim, Scott, Shawn, Karen, Richard, Brenda, Tracey, Sandy, Paul, Sarah, and Elisseos, if you don’t mind…let’s do it again.

Until next time.

Cheers,

Read More Add a CommentIs the glass half full or half empty? Are the measures that we’re taken to modify the real estate market balanced or have policy makers over reached? Numbers are supposed to be black and white. Shades of grey come into play depending on the side of the argument you’re on.

The Canadian Real Estate Association, (CREA) released data this week which will make all sides of the Canadian real estate market argument happy. Example, according to the MLS Home Price Index, home prices have increased by 7.6% from a year ago. Now if you take Vancouver and Toronto out of the equation, the increase was 4.6% on a year over year basis. So are we on the cusp of a potential real estate bubble or is it simple supply side economics? The number of homes sold came in slightly lower than a year ago. So is demand outpacing supply, causing prices to increase? And oh my god, condo sales increased in Toronto as well. Red Rover, Red Rover, Doom Sayers come on over. There’s a little something for everyone. The teeth nashers and those predicting Armageddon are fist bumping each other. Others, justifiably so, are saying it’s a balanced market. Should the price of a real estate never rise? If that we’re the case we would all be squatters, living in tents. The commentators I love are the ones that sit firmly on the fence. An economist for one major bank said their analysis suggests that we all experience a 10% decrease in home values, and there could be further risk if sales activity was to increase. They were so concerned with the “risk” that they matched the 2.99% five year rate that one of their competitors came out with. That fence post must really be uncomfortable to sit on.

Sifting through all the commentary can be confusing, and let’s be honest, depending on the amount of skin you have in the game will influence the argument and opinion you support. To combat human nature it’s important to seek contrary opinions, and I force myself do that, almost daily. It takes some effort to find commentary which is not self-serving, like those selling newspapers, hedge funds that are shorting the Canadian economy or politicians playing politics. Here’s a couple names to look out for when you want broader viewpoint, economists Nouriel Roubini and David Rosenberg. What’s their bona fide? They predicted the financial collapse of 2008. So what are they saying today? According to Rosenberg, “Nattering nabobs of negativity – stop knocking yourself out. First, there are a host of reasons why I see inflation rising moderately, and the wage process is but one of them. There is a very interesting development taking place that is not garnering a lot of attention. The U.S. commercial banks are loosening their purse strings. As for the U.S. economy, it is looking as though Q2 real GDP growth will come in close to a 4% annual rate. Why I turned bullish on the U.S. consumer.” Clearly he’s refereeing to the U.S. Economy, but like it or not, when America sneezes we look for a tissue. In good times and bad.

Until next time!

Cheers,

Read More Add a CommentWell, it certainly feels that way. The deadline to file with Ottawa is Monday, and if it slipped your mind, go directly to the sin bin and hold your head down in shame. Oh yeah, you should prepared to pay more in penalties if you’re late. If you’re hoping the CRA (Canada Revenue Agency) won’t notice if you’ve filed or not, trust me, they’ll notice. May 5th is the day for you to make good with the government. If you feel this strange sensation of a number in hands in your pocket, it’s real. Here in Toronto, we all feel like we’ve been groped this week.

A report was released this week about the impact to the Toronto economy due to implementation of the municipal land transfer tax. For those of you not aware, real estate purchases in Toronto are subjected to a Provincial Land Transfer Tax, as well as a municipal land transfer tax. The net result is that anyone buying a home in Toronto, will pay the highest land transfer tax in the country. A study was commissioned by the Ontario Real Estate Association, and the findings are interesting. According to the report, if the municipal land transfer tax was eliminated, Toronto could see a $2 billion boost to the local economy, and possibly create 12,000 new jobs. The municipal land transfer tax came into effect in 2008, remember what happened to the global economy 2008?, and our elected officials at that time thought it would be wise to implement further financial burden on home buyers. The new study suggests that the city of Toronto has experienced a decline of 38,000 home sales due to the implementation of the municipal land transfer tax, and a $1.2 billion reduction in GDP. Of course critics of the study say that the report is self-serving because it was commissioned by the Ontario Real Estate Association. Okay, let’s assume there was some embellishment, and we cut the number in half. A $1 billion dollar boost to the economy, and 6,000 new jobs created is not trivial or throw away numbers. The focus should be on the message, and not the messenger. If you’re of the mind that this is just a Toronto problem, and too bad for them, you may want to rethink that. Do you think your municipal politicians will be able to resist the urge to go to the real estate trough and impose their own municipal land transfer tax? If there’s no real backlash by voters in Toronto, and the municipal land transfer tax just slowly becomes the cost of doing business, why shouldn’t your municipal council get some? If you think it could never happen, I admire your blind faith. Speaking of faith, I have zero in our current mayor. It’s not because of the crack smoking, drunken stupors and all round buffoonery. Who amongst us hasn’t sinned? I can forgive, but what I can’t forgive is that our rehabbing mayor promised to do away with the municipal land transfer tax, and he lied. Hey, it’s one thing to lie about smoking crack, but when you promised that we could keep more of hard earned money, and you lie, now you’ve gone too far. Unlike the mayor, the vast majority of Torontonians would invest the extra money in our children’s education, home renovations, vacations and maybe something really outrageous, like increasing their down payment on a home purchase.

A report was released this week about the impact to the Toronto economy due to implementation of the municipal land transfer tax. For those of you not aware, real estate purchases in Toronto are subjected to a Provincial Land Transfer Tax, as well as a municipal land transfer tax. The net result is that anyone buying a home in Toronto, will pay the highest land transfer tax in the country. A study was commissioned by the Ontario Real Estate Association, and the findings are interesting. According to the report, if the municipal land transfer tax was eliminated, Toronto could see a $2 billion boost to the local economy, and possibly create 12,000 new jobs. The municipal land transfer tax came into effect in 2008, remember what happened to the global economy 2008?, and our elected officials at that time thought it would be wise to implement further financial burden on home buyers. The new study suggests that the city of Toronto has experienced a decline of 38,000 home sales due to the implementation of the municipal land transfer tax, and a $1.2 billion reduction in GDP. Of course critics of the study say that the report is self-serving because it was commissioned by the Ontario Real Estate Association. Okay, let’s assume there was some embellishment, and we cut the number in half. A $1 billion dollar boost to the economy, and 6,000 new jobs created is not trivial or throw away numbers. The focus should be on the message, and not the messenger. If you’re of the mind that this is just a Toronto problem, and too bad for them, you may want to rethink that. Do you think your municipal politicians will be able to resist the urge to go to the real estate trough and impose their own municipal land transfer tax? If there’s no real backlash by voters in Toronto, and the municipal land transfer tax just slowly becomes the cost of doing business, why shouldn’t your municipal council get some? If you think it could never happen, I admire your blind faith. Speaking of faith, I have zero in our current mayor. It’s not because of the crack smoking, drunken stupors and all round buffoonery. Who amongst us hasn’t sinned? I can forgive, but what I can’t forgive is that our rehabbing mayor promised to do away with the municipal land transfer tax, and he lied. Hey, it’s one thing to lie about smoking crack, but when you promised that we could keep more of hard earned money, and you lie, now you’ve gone too far. Unlike the mayor, the vast majority of Torontonians would invest the extra money in our children’s education, home renovations, vacations and maybe something really outrageous, like increasing their down payment on a home purchase.

In fairness to our esteemed municipal politicians, the ability to impose the municipal land transfer tax was granted by the Provincial Liberal’s magic wand. Granting permission is in keeping with their modus operandi. Like the new Provincial budget they tabled this week. The numbers are mind-boggling, and there’s no point getting into the details because it will probably never pass, and the voters in Ontario will be heading to the polls again. However, the budget does give us a glimpse of the Liberal’s campaign platform. If they’re looking for a campaign slogan, I can simplify it for them. “Vote Liberal, we’ll spend and tax more”. It’s kind of catchy. If you’re bored this weekend, and you feel like doing a slow burn, click on the link to the Fraser Institute Personal Tax Freedom Day Calculator. It calculates when you stop working for the government, and you start keeping your hard earned dollars. For all of in Canada, it’s sometime in June, your personal income and the province you reside in determines the actual day. Wait, there’s one exception, Alberta. Albertan’s personal tax freedom day falls in May. I love Alberta, and I have thou$ands of reasons why.

Until Next Time,

Cheers.

Read More Add a Comment