Sure signs that spring just around the corner. Firstly, March break. The airports are packed, and people working at the airports are exceptionally snarly. Second, baseball spring training is in the home stretch and soon the boys of summer will make their way home. Thirdly, the Masters Golf tournament is weeks away. And lastly, the Toronto Maple Leafs have begun their annual collapse. Sports reminds us that spring is just around the corner, at least is does for me.

Sure signs that spring just around the corner. Firstly, March break. The airports are packed, and people working at the airports are exceptionally snarly. Second, baseball spring training is in the home stretch and soon the boys of summer will make their way home. Thirdly, the Masters Golf tournament is weeks away. And lastly, the Toronto Maple Leafs have begun their annual collapse. Sports reminds us that spring is just around the corner, at least is does for me.

Another indicator that spring is just around the corner, not sports related, is the Federal Budget. I suspect tradition will continue, which means Minister Flaherty will be sporting a new pair of shoes. I wonder if the Finance Ministers actually does the shopping or is one of his flunkies responsible for picking out the perfect pair. Be that as it may, Flaherty doesn’t have much wiggle room, so grand solutions for our sputtering economy should be tempered. Government revenues are down (I really hate that term because when has the government ever earned revenue?) so spending cuts should be expected. Increasing taxes on an already over taxed population is not a solution. The question that needs to be answered is which government programs will take the hit. Provinces and municipalities will wait with bated breath to see where infrastructure spending will be directed. The government has made statements that we should not expect an equal distribution of spending on infrastructure. It appears that some children will be more special than others to the ruling Conservative.

Flaherty has his hands full trying to navigate Canada’s economy amidst all the uncertainty. Now it appears that that he will factor insanity into his global equation. That’s the only way I can explain the EU’s decision to tax bank depositors in Cyprus to offset their bailout. Will this cause a run on the banks in Cyprus, and other European countries that fear that the EU may impose the same punitive measures in their countries? Bold decision can lead to drastic mistakes, example – American government allowing Lehman Brothers to fail. The course will probably remain the same – boring; and I suspect that’s what Flaherty will give us on Thursday.

Until next time,

Cheers.

Read More Add a Comment

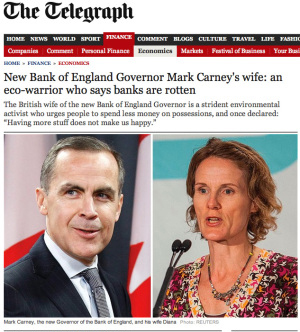

I suspect it didn’t take long for Mark Carney to conclude, after testifying before the U.K Treasury Select committee, that life might a little different for him in the U.K. Nothing to do with culture or driving on the wrong side of the road. Going from Rock Star status in Canada to please justify your salary, your yearly housing allowance, and why should we except an interloper to be the next Governor of the Bank of England, is a tad different from what Mr. Carney has been experiencing in his native homeland. In Canada it’s Careymanaia, in the U.K., it’s not what have you done for us lately but rather you’ve done nothing for us to date, therefore, we’ll treat you as such. Check out some of these British headlines about Carney. The Sun, “Heavy Metal Fan to Run Bank of England”. Why? The Sun found out that Carney would blast AC/DC’s Back in Black before he played hockey while at Harvard. The Daily Mail, “Jolly Hockey Sticks English Wife”, referring to Carney’s wife who is now open game. The Telegraph also let be known that Mrs. Carney was fair game. “Mrs. Carney, who met her husband, Mark, at Oxford, is Vice-President of Canada 2020, a left wing think tank, and reviews environmentally friendly products”. Oh my god, and they’re going to let her into the country? They also referred to her as an “eco-warrior” and that she believes “banks are rotten”. Until I started doing some research for this blog I had no idea about Mrs. Carney or Mark Carney’s musical tastes, and nor do I care. But they do in Britain, and he’s treatment by the U.K. press will be nothing like what he’s accustomed too. No gushing in the U.K.

I suspect it didn’t take long for Mark Carney to conclude, after testifying before the U.K Treasury Select committee, that life might a little different for him in the U.K. Nothing to do with culture or driving on the wrong side of the road. Going from Rock Star status in Canada to please justify your salary, your yearly housing allowance, and why should we except an interloper to be the next Governor of the Bank of England, is a tad different from what Mr. Carney has been experiencing in his native homeland. In Canada it’s Careymanaia, in the U.K., it’s not what have you done for us lately but rather you’ve done nothing for us to date, therefore, we’ll treat you as such. Check out some of these British headlines about Carney. The Sun, “Heavy Metal Fan to Run Bank of England”. Why? The Sun found out that Carney would blast AC/DC’s Back in Black before he played hockey while at Harvard. The Daily Mail, “Jolly Hockey Sticks English Wife”, referring to Carney’s wife who is now open game. The Telegraph also let be known that Mrs. Carney was fair game. “Mrs. Carney, who met her husband, Mark, at Oxford, is Vice-President of Canada 2020, a left wing think tank, and reviews environmentally friendly products”. Oh my god, and they’re going to let her into the country? They also referred to her as an “eco-warrior” and that she believes “banks are rotten”. Until I started doing some research for this blog I had no idea about Mrs. Carney or Mark Carney’s musical tastes, and nor do I care. But they do in Britain, and he’s treatment by the U.K. press will be nothing like what he’s accustomed too. No gushing in the U.K.

I must confess that I did not watch Carney’s entire performance before the U.K. Treasury Select committee. I caught little snippets of the hearing and based on what I saw I came to the following conclusion; if political stupidity and inane questions were an Olympic sport, Canada wouldn’t come close to the podium. U.S. – Gold, Britain – Silver, and any country from the Balkans – Bronze. One of the esteemed U.K. Treasury Select committee members asked Carney to explain liquidity. When the camera zoomed in on Carney for the answer, I could swear he had that “Did I just hear this moron right? I’m the Governor of the Bank of Canada, and he thinks he can stump me with this question” look on his face. There was a doozy of a follow up question from the President of the Mensa Society, “Are you familiar with QE3?” I have to hand it to Carney, from what I witnessed he was extraordinarily patient and he played the game. But I’m looking forward to the book Carney will write at some point in the future, and I hope he shares his thoughts about the first public grilling he took in the U.K. As for the committee member who asked these questions I suspect his thoughts were not unlike Homer Simpson’s, “okay brain, I don’t like you and you don’t like me… Just get me through this hearing and I’ll go back to killing you slowly with Guinness”. (Note to reader: the last line works much better if you read it out loud while impersonating Homer Simpson).

I must confess that I did not watch Carney’s entire performance before the U.K. Treasury Select committee. I caught little snippets of the hearing and based on what I saw I came to the following conclusion; if political stupidity and inane questions were an Olympic sport, Canada wouldn’t come close to the podium. U.S. – Gold, Britain – Silver, and any country from the Balkans – Bronze. One of the esteemed U.K. Treasury Select committee members asked Carney to explain liquidity. When the camera zoomed in on Carney for the answer, I could swear he had that “Did I just hear this moron right? I’m the Governor of the Bank of Canada, and he thinks he can stump me with this question” look on his face. There was a doozy of a follow up question from the President of the Mensa Society, “Are you familiar with QE3?” I have to hand it to Carney, from what I witnessed he was extraordinarily patient and he played the game. But I’m looking forward to the book Carney will write at some point in the future, and I hope he shares his thoughts about the first public grilling he took in the U.K. As for the committee member who asked these questions I suspect his thoughts were not unlike Homer Simpson’s, “okay brain, I don’t like you and you don’t like me… Just get me through this hearing and I’ll go back to killing you slowly with Guinness”. (Note to reader: the last line works much better if you read it out loud while impersonating Homer Simpson).

The Justin Bieber, Lady Gaga and economic messiah status Carney experienced in Canada will soon be a thing of the past. It’s time to put the big boy pants on and get ready to play in a much different school yard. Besides setting monetary policy for the third largest economy in Europe, Carney will have to deal with a press who can’t wait for him to stumble. They’ll poke an prod into his personal life, and the paparazzi rule in the U.K. His new salary is three times greater than what he earned as Governor of the Bank of Canada. That’s more than fair because his grief is going to increase tenfold.

Until next time

Cheers

Read More Add a CommentPayment Shock – It’s a term we’re familiar with in the mortgage industry, and it’s in the news again. But hallelujah, this time it has nothing to do with the mortgage industry. Nope, payment or bill shock making the news today is about the billing practices of the duopoly which controls all things wireless in Canada. Here’s the definition of a Duopoly – “situation in which two companies own all or nearly all of the market for a given product or service. A duopoly is the most basic form of oligopoly, a market dominated by a small number of companies. A duopoly can have the same impact on the market as a monopoly if the two players collude on prices or output. Collusion results in consumers paying higher prices than they would in a truly competitive market”.

You can decide if the definition fits as it relates to the wireless providers in Canada. As you’re mulling it over keep this in mind, the OECD (Organization for Economic Co-operation and Development) conducted a survey which concluded that the average Canadian cellphone user is paying among the highest bills in the developed world. To be exact, the OECD determined that Canada has the third highest wireless rates in the developed world.

Not surprising neither Rogers nor TELUS agree with the OECD findings; but regulators are causing both companies some indigestion. Both Rogers and TELUS are regulated by the CRTC (Canadian Radio-Television and Telecommunication Commission) and a new wireless code is being drafted by the CRTC. The CRTC would like the service providers to automatically suspend certain services once a customer is charged an additional $50 above and beyond their normal monthly plan. At first blush you may agree with the CRTC position, but keep mind for most of us in the mortgage industry we would exceed the $50 overage by the first Tuesday of every month. Imagine if you had to call your service providers every time the meter went past $50? If you think wait times for service is less than satisfactory today, imagine what it would be like if this was implemented? Rogers and TELUS were summoned to the hill to provide their thoughts and views on the proposed draft. Suffice to say that neither Rogers nor TELUS said, “we agree with you CRTC, and it’s about damn time you did something about the high cost of wireless fees in Canada.” They said what you would expect them to say, and why wouldn’t they? They’re protecting their own turf. Setting aside the self-interest of the wireless providers in Canada, the real issue is when regulators want to do right by consumers but the practical application of said efforts may result in even more consumer dissatisfaction. Regulatory changes or new “codes” being enacted and implemented has a domino effect. Everyone in the mortgage industry already knows that.

On one hand you can applaud the CRTC for trying to do right by consumers. Who wouldn’t want to pay less to their wireless provider? On the other the CRTC’s position is a little bit of a head scratcher as it relates to practicality. As for the CRTC this might be a case of not seeing the forest from trees. Instead of expending all this time, energy, money and brain cells on way to protect consumers from price shock, maybe the CRTC is missing the obvious. Maybe the CRTC should make it easier for new entrants into the Canadian wireless market. Competition serves consumers well. Why shouldn’t that apply to the wireless industry in Canada?

Until next time,

Cheers.

Read More Add a CommentMuch has been written and said about mortgage debt and affordability recently. No point in belaboring what has and has not been done to address this issue. I’m sure there will be plenty of that in the future, as well ample hang ringing about the so-called condo bubble, specifically in Vancouver and Toronto.

The so-called “condo crisis” (oh, how the mere thought of it makes the press salivate) in Vancouver and Toronto came to mind after I read an article in the Wall Street Journal. The article focused on the cost of condos in Manhattan. The current median price of a condo in Manhattan is the lowest it’s has been since 2004. Could Manhattan’s experience be a harbinger of what’s to come for Vancouver and Toronto? If it is then maybe the 36 people in Toronto who don’t own a condo already should go and get one.

According to the Canadian Real Estate Association, the average home price for the month of December in Toronto was $501,361, and in Vancouver it was $730, 912. Remember this includes dirt to go along with the walls. In Manhattan the average condo price in 2012 was $835,000. However, adjusted for inflation it was the lowest since 2004. Can you imagine the headlines if Toronto was similar to Manhattan’s reality? The median price in Manhattan for a 2 bedroom condo was $1.26 million, 3 bedroom was $2.37 million and a 4 bedroom was $4.75 million. Adjusted for inflation these are the lowest prices since 2004. According to the Wall Street Journal article there’s a disconnect between buyers and investment indicators. Buyers are saying there’s not enough affordable housing and yet when you take inflation into account prices have actually declined. So is it a good time to buy a condo in Manhattan? I’m not familiar with the Manhattan’s housing cycle so I’m not sure, but what I can say is this: at an average price of $2.37 million for a 3 bedroom condo in Manhattan, I think Toronto is a good buy.

Some might be aghast that I would compare Manhattan to Toronto. Well, Toronto is the 4th largest market between the US and Canada. Therefore, I think it’s valid to look at values on a comparative basis. That’s exactly what foreign investors did when buying property in Vancouver and Toronto. As absurd as we think our prices may be, the investor from Hong Kong looks at our market and thinks of great value. As we all know value is driven in large part by consumer perception. The perception of Vancouver and Toronto is that consumers buying condos are doing so at their own peril. Yet in Manhattan, home buyers lament the high cost and scarcity, all the while being told now is a good time to buy. It’s interesting how some things never change. Here’s a headline that helped shape New Yorkers perception of their condo market, “Great Scarcity in Apartments…Never before has there been such scarcity of apartments on Manhattan Island.” That headline came from the New York Times, in 1916!

Until Next Time

Cheers

Read More Add a Comment On Monday, February 4, a little piece of Canadiana is no more. Yesterday was the official date where banks and businesses would no longer receive pennies. Yes, that useless little copper coloured currency has gone the way of the Canadian one a two dollar bills – out of circulation. The difference being that the one and two dollar bills were replaced by coins. Why? Because they were actually worth something. The penny? Not so much.

On Monday, February 4, a little piece of Canadiana is no more. Yesterday was the official date where banks and businesses would no longer receive pennies. Yes, that useless little copper coloured currency has gone the way of the Canadian one a two dollar bills – out of circulation. The difference being that the one and two dollar bills were replaced by coins. Why? Because they were actually worth something. The penny? Not so much.

I like money, who doesn’t? But for most people the penny has become a nuisance. For most people it’s been like this for a long time. How many times have you reached into your pocket to retrieve change and penny drops on the ground. You look down at and say to yourself, “it’s not worth the effort of bending over and picking it up”. So you just leave it and walk away. You do this not because you think you’re a baller. You leave it be because it’s not worth the effort of bending all the way down to get it. What would total strangers think of you if you we’re to ? Not going to allow anyone to think poorly of you over a penny. Nope, that useless, bacteria infested coin just isn’t worth a simple knee bend.

I suspect right now you’re thinking, “Soon the penny will be history, and I wish someone would provide me with some useless information about the penny which might come handy if I ever play Trivial Pursuit again”. Lucky you! The penny was put into circulation in 1858. The high cost of copper back in 1920 forced the government to make the penny smaller in size. The Queens likeness first appeared on the penny in 1965. Shall I go on? No, eh? What if I was to say, “A penny for your thoughts?” Just dawned on me that “a penny for your thoughts” really means that you don’t put any kind of value to what the other person is thinking. Finally! There’s some value in a penny.

Until next time,

Cheers.

Read More Add a Comment