Is it just me, or does it appear that world has gone mad? Based on the images we are seeing from England, I asked myself that very question. The images are shocking and very troubling when you consider why it’s happening. What started as a peaceful demonstration in Tottenham, has now become a violent uprising in many cities. There’s doesn’t appear to be any visible reason for why this is happening. Cities are burning for kicks. Maybe it’s just me getting older but after the third day of watching cities burn I was wondering why the British Government had not deployed the military to quell the civil disobedience. At the very least the police should have been using stronger measures to bring this to an end. The police seem to be taking the velvet glove approach with the anarchists. So far no water cannons or rubber bullets have been used. There’s reluctance by the police, pardon the pun, to pull out the big guns. The British Prime Minister, David Cameron, questioned police methods in parliament yesterday. He’s demanding the police use a much more aggressive approach with the hooligans, anarchists, arsonists and petty thieves. Gee, hugging won’t work?

images are shocking and very troubling when you consider why it’s happening. What started as a peaceful demonstration in Tottenham, has now become a violent uprising in many cities. There’s doesn’t appear to be any visible reason for why this is happening. Cities are burning for kicks. Maybe it’s just me getting older but after the third day of watching cities burn I was wondering why the British Government had not deployed the military to quell the civil disobedience. At the very least the police should have been using stronger measures to bring this to an end. The police seem to be taking the velvet glove approach with the anarchists. So far no water cannons or rubber bullets have been used. There’s reluctance by the police, pardon the pun, to pull out the big guns. The British Prime Minister, David Cameron, questioned police methods in parliament yesterday. He’s demanding the police use a much more aggressive approach with the hooligans, anarchists, arsonists and petty thieves. Gee, hugging won’t work?

The average age of the rioters is between 18 and 21. I’m not sure how the state has wronged them to such a degree that they would be willing to burn their cities down, and shame their country in front of the world. But it’s clear that in their tinny pointed heads they’ve found some irrational justification. I get it, 18 to 21 year old are dumb or rather have a lot to learn. I remember being that age, I had all the answers, how my parents survived all those years without my council was beyond me, but even being that dumb at no time did I say to myself, “I think I’ll go burn down Toronto, just for the hell of it”. Why? Because we respected authority, we were taught right from wrong, and I was more afraid of my mother than I was of the cops. That part still true today. When the civil unrest finally ends in London, we will hear the usual verbal diarrhea. The youth of Britain feels disenfranchised, they’re poor, they have no hope, blah, blah, blah. What that really means is, “I live in a world of entitlement, I’m accustomed to getting something without earning it, the state owes me, and if I don’t get mine I’ll burn the city down”. No, that’s not just anger, that’s nuts.

I get it, 18 to 21 year old are dumb or rather have a lot to learn. I remember being that age, I had all the answers, how my parents survived all those years without my council was beyond me, but even being that dumb at no time did I say to myself, “I think I’ll go burn down Toronto, just for the hell of it”. Why? Because we respected authority, we were taught right from wrong, and I was more afraid of my mother than I was of the cops. That part still true today. When the civil unrest finally ends in London, we will hear the usual verbal diarrhea. The youth of Britain feels disenfranchised, they’re poor, they have no hope, blah, blah, blah. What that really means is, “I live in a world of entitlement, I’m accustomed to getting something without earning it, the state owes me, and if I don’t get mine I’ll burn the city down”. No, that’s not just anger, that’s nuts.

Conversely we’ve witnessed the Sprig Arab Uprising. It still continues today in Libya and Syria. These people took to the streets peacefully in the name of freedom and  self-determination. They faced jets, tanks and bullets because they wanted to overthrow oppressive totalitarian regimes. I live in the greatest country in the world, Canada. I’ve been accorded every opportunity to succeed. My parents worked themselves to the bone to provide a better life for their kids. My success or failure is my responsibility. As I compare my so called “problems” to those who took to the streets in the Arab world, I’ll take my problems any day of the week.

self-determination. They faced jets, tanks and bullets because they wanted to overthrow oppressive totalitarian regimes. I live in the greatest country in the world, Canada. I’ve been accorded every opportunity to succeed. My parents worked themselves to the bone to provide a better life for their kids. My success or failure is my responsibility. As I compare my so called “problems” to those who took to the streets in the Arab world, I’ll take my problems any day of the week.

There does seem to be a common thread in the in the world today. People are taking to the streets to protest. Is some cases it’s warranted, in others it’s mind boggling. So I can’t help but wonder – can it happen here? The Tea Party in the US is a populist movement. So far Tea Party demonstrations have been peaceful but partisan politics in the U.S. has become so anger based one can’t help but wonder if they will be able to keep a lid on this boiling pot. Based on the language being used by both sides in the U.S., I think there’s reason for concern. As for Canada, I think we would all like to believe that it won’t happen here. We’re far too reasonable and respectful of our community. Then I think about the G20 in Toronto, and the aftermath of game seven in Vancouver, and now I’m not so sure.

Until next time,

Cheers

That famous line was attributed to Jogi Berra, Hall of Fame New York Yankee baseball player. Besides being a great ball player, Berra was also known for malapropism, mangling the English language. Normally it’s done for comedic relief but in Berra’s case it was his standard way of speaking. I thought of this quote based on what’s been happening to the markets over the last week. It’s starting to feel like 2008 all over again. Back in 2008, the world faced an economic crisis. The news was stunning. How on earth could iconic companies such as Lehman Brothers and Bear Sterns fail? Yet that’s exactly what happened. The U.S. Government forced banks to take T.A.R.P. (Troubled Asset Relief Program) money to ensure that lending would continue. The ministers of the G7 countries rushed to Washington for emergency meetings because there was fear that the markets wouldn’t open. As events unfolded in 2008 we were all left wondering what’s next? It appears the other shoe has dropped.

One of the significant differences, relative to our present day situation, is the fact that back in 2008 nobody questioned America’s credit worthiness. That all changed last Friday when S & P (Standard and Poor’s) downgraded the US from AAA to AA Plus. Not since 1917 has the US been rated lower than AAA. Not surprisingly the Obama administration has come out swinging against S & P. The administration is questioning S & P calculations and motives for the downgrade. Funny how S & P’s motives were never questioned when the US had a AAA rating. I should note that the other two rating agencies, Moody’s and Fitch, have not downgraded the US. So the question is, which rating agency has it right? In time the answer will become clearer but I’ll say this about S & P, the move they made on Friday took a lot of chutzpa. That’s a Yiddish word for tenacity and guts. I suspect shirt collars are feeling a little tight today in the corporate offices at S & P.

One of the significant differences, relative to our present day situation, is the fact that back in 2008 nobody questioned America’s credit worthiness. That all changed last Friday when S & P (Standard and Poor’s) downgraded the US from AAA to AA Plus. Not since 1917 has the US been rated lower than AAA. Not surprisingly the Obama administration has come out swinging against S & P. The administration is questioning S & P calculations and motives for the downgrade. Funny how S & P’s motives were never questioned when the US had a AAA rating. I should note that the other two rating agencies, Moody’s and Fitch, have not downgraded the US. So the question is, which rating agency has it right? In time the answer will become clearer but I’ll say this about S & P, the move they made on Friday took a lot of chutzpa. That’s a Yiddish word for tenacity and guts. I suspect shirt collars are feeling a little tight today in the corporate offices at S & P.

Based on what’s happened in the last week, what does this mean for Canada? Firstly, no one can predict with any certainty. We’re in-uncharted waters here. Besides what’s happening in the US, numerous countries are in dire straits financially in Europe. All of these factors will have an impact on us. “Canada is not an island,” Finance Minister Jim Flaherty said late Friday in a statement. “We are a trading nation, with about a third of output generated by exports and deep linkages with the U.S. economy. The global economic recovery remains fragile and this uncertainty may eventually impact Canada”. One of the ways it may impact us is that if borrowing costs increase in the US, due to S & P’s downgrading, there could be further negative impact to the US economy. This impacts us because we export so much of our goods to the US. If the Americans are not spending, we feel it. There’s also predictions that the loonie will go higher relative to the US greenback. That of course makes our goods more expensive in the US and abroad.

Firstly, no one can predict with any certainty. We’re in-uncharted waters here. Besides what’s happening in the US, numerous countries are in dire straits financially in Europe. All of these factors will have an impact on us. “Canada is not an island,” Finance Minister Jim Flaherty said late Friday in a statement. “We are a trading nation, with about a third of output generated by exports and deep linkages with the U.S. economy. The global economic recovery remains fragile and this uncertainty may eventually impact Canada”. One of the ways it may impact us is that if borrowing costs increase in the US, due to S & P’s downgrading, there could be further negative impact to the US economy. This impacts us because we export so much of our goods to the US. If the Americans are not spending, we feel it. There’s also predictions that the loonie will go higher relative to the US greenback. That of course makes our goods more expensive in the US and abroad.

Conversely there’s been some positive speculation about Canada. Investors will look for a safe haven. There’s plenty of cash on balance sheets today but given the uncertainty of the market place cash is being hoarded. Eventually corporation will want a return on their capital, and Canada is a safe bet. Based on workforce, commodities, stable financial sector and fiscally responsible government, Canada should benefit. Countries which are AAA rated today will be in demand. S & P rates Germany, Britain, Austria, Denmark, Norway, Netherlands, Australia and Canada AAA. If Europe makes investors nervous, Canada’s a solid option.

It’s become fashionable in this country to pat ourselves on the back and say, “we’re so much smarter than the Americans”. Frankly, recent history clearly shows that we have managed our affairs far more effectively than our neighbours to the south. But things can change. In 1993, the Canadian Bond Rating Agency downgraded Canada from AAA to AA Plus. In a short period of time the other international rating agencies followed suite. How did we get our AAA rating back? The government attacked the deficit. If you recall back in the 90’s the Liberals, remember them, ran things in Ottawa. Under Finance Minister Paul Martin, programs were slashed, transfer payments reduced, and taxes were increased. This was done all in the name of deficit reduction, and it worked. Here we are in 2011, our deficit is too high and the Harper government will have to do something about it. Harper’s backed himself into a corner by campaigning that our taxes are too high, and increasing taxes is not the answer. He had me at hello. So then the only way to reduce our deficit is to cut spending. Don’t expect him to use a scalpel to cut programs. This may require a hatchet.

Until next time

Cheers

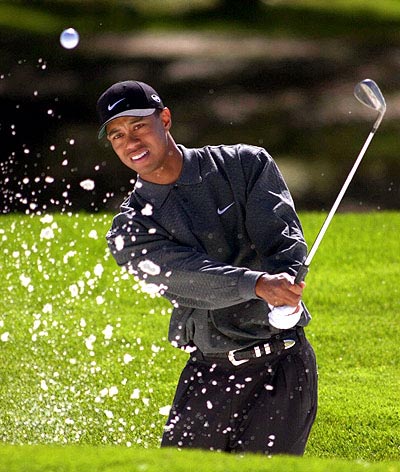

Read More Add a CommentThe sports pages are making a fuss about Tiger Wood’s return to the links this weekend after an absence of three months. The Messiah returns and if truth be told he did  bring golf to the promise land. Thanks to Wood’s, prize money on the tour has increased dramatically over the last ten years. It’s his star power that attracts sponsors, the paying public, and the rest of players on the tour went along for the ride. What I find interesting is the deafening silence from players on the tour as it relates to Tiger’s indiscretions. Not many are saying, “he’s paid a price and now it’s time to forgive and forget”. The odd player will say “he’s good for the tour and it will be good to have him compete again”. The few that say anything about Tiger usually reference the good of the game, and not that it’s good to have Tiger back, the person. Now why is that? Could it be that every player on tour is angry at him because they now get grilled by their wives as to their whereabouts at every tour event? “Baby, pinky swear…it was only Tiger that was doing it”. Oh what a tangled web we weave when we practice to conceive. Or could the lack of enthusiasm being shown by other players towards Tiger because he’s an, you know, an A-hole? It’s been widely reported the if you weren’t in Tiger’s inner sanctum, you were no better than the goose poo on the bottom of his golf shoe. Like the saying goes, karma’s a b*#$h.

bring golf to the promise land. Thanks to Wood’s, prize money on the tour has increased dramatically over the last ten years. It’s his star power that attracts sponsors, the paying public, and the rest of players on the tour went along for the ride. What I find interesting is the deafening silence from players on the tour as it relates to Tiger’s indiscretions. Not many are saying, “he’s paid a price and now it’s time to forgive and forget”. The odd player will say “he’s good for the tour and it will be good to have him compete again”. The few that say anything about Tiger usually reference the good of the game, and not that it’s good to have Tiger back, the person. Now why is that? Could it be that every player on tour is angry at him because they now get grilled by their wives as to their whereabouts at every tour event? “Baby, pinky swear…it was only Tiger that was doing it”. Oh what a tangled web we weave when we practice to conceive. Or could the lack of enthusiasm being shown by other players towards Tiger because he’s an, you know, an A-hole? It’s been widely reported the if you weren’t in Tiger’s inner sanctum, you were no better than the goose poo on the bottom of his golf shoe. Like the saying goes, karma’s a b*#$h.

As for Tigers indiscretions, I could care less what the man does in his private life It’s his life, his family, his conscious to deal with. Who am I to judge? But ever since that day over two years ago, when his 105 pound Barbie-Doll ex-wife chased him out of the house with a nine iron, his life has become a train wreck. To watch the hookers, porn stars and hostesses from Denny’s to Perkins come out and tell their story is mind numbing. I don’t understand how a man who is worth that much money didn’t pay to have the right people around him to protect him. For god sakes, anyone who has watched one episode of the Sopranos knows that if you’re going to engage in questionable activities you need a disposable phone. I guess Tiger was too busy to watch TV.

As for Tigers indiscretions, I could care less what the man does in his private life It’s his life, his family, his conscious to deal with. Who am I to judge? But ever since that day over two years ago, when his 105 pound Barbie-Doll ex-wife chased him out of the house with a nine iron, his life has become a train wreck. To watch the hookers, porn stars and hostesses from Denny’s to Perkins come out and tell their story is mind numbing. I don’t understand how a man who is worth that much money didn’t pay to have the right people around him to protect him. For god sakes, anyone who has watched one episode of the Sopranos knows that if you’re going to engage in questionable activities you need a disposable phone. I guess Tiger was too busy to watch TV.

From an economic standpoint this has cost Tiger untold millions of dollars. Sponsors have pulled out, no pun intended. The prize money hasn’t been much, and now he’s ranked 28th in the world. Not exactly a ranking that has sponsors running towards you with a blank cheque. He’s replaced his management team, his caddie and pretty well everything else that was connected to his previous life. He’s looking for a clean slate. Will sponsors give him a second chance? They will if he wins. His sponsors might be different, Viagra versus Buick, but the cash will be there. Every one loves a winner, especially if the winner has been savaged and torn down.

I hope Tiger Woods makes a successful return to the game he changed and dominated. If for no other reason than to silence all the sanctimonious, pious and the morally superior critics who cloak themselves in righteous indignation. The man changed the sport of golf, he was about to set new records for winning majors – and yet may still do so – then human frailty got in way. It’s not easy being perfect.

Until next time

Cheers

Read More Add a CommentFlorida

I’m writing this blog from Florida. Hey, where else does a guy from Toronto go to escape the heat? Florida, of course. It’s steamy hot down here as well, but the heat and humidity seem tolerable when you’re in vacation mode. I have to say that the state of Florida has really grown on me. I love it down here. Why? The weather is great all year round. Secondly, they have all the amenities you can ask for – beaches, great restaurants, fantastic cigar stores, golf courses galore, professional sports franchises. Thirdly, everything is cheap. The best part about buying anything down here is that you always feel like you got a good deal. The best deal you can get today is real estate. I think it’s a good time to buy down here. Distress means great value and flexibility by the home owner, be it the vendor or the bank. A word of advice, if you decide to explore what’s available you better pick one specific location. There’s just too much product available to bounce around from one side of the state to the other to check out homes. Secondly, if you decide to buy, the day after the deal closes forget about values. It’s going to take years before Floridians see any appreciable increase in values. If you’re looking for a second home, a place where the family can go, a place where your parents can go to escape the winter, it’s a great time to buy. I was speaking to a real estate agent yesterday and he said if it wasn’t for Canadian’s buying up product in his area he wouldn’t be busy. Great value, and good exchange rates, is attracting a lot of Canadians. What I don’t like about Florida? Old farts that drive on I-75 doing 15 miles under the legal speed limit, while in the left hand lane.

I’m writing this blog from Florida. Hey, where else does a guy from Toronto go to escape the heat? Florida, of course. It’s steamy hot down here as well, but the heat and humidity seem tolerable when you’re in vacation mode. I have to say that the state of Florida has really grown on me. I love it down here. Why? The weather is great all year round. Secondly, they have all the amenities you can ask for – beaches, great restaurants, fantastic cigar stores, golf courses galore, professional sports franchises. Thirdly, everything is cheap. The best part about buying anything down here is that you always feel like you got a good deal. The best deal you can get today is real estate. I think it’s a good time to buy down here. Distress means great value and flexibility by the home owner, be it the vendor or the bank. A word of advice, if you decide to explore what’s available you better pick one specific location. There’s just too much product available to bounce around from one side of the state to the other to check out homes. Secondly, if you decide to buy, the day after the deal closes forget about values. It’s going to take years before Floridians see any appreciable increase in values. If you’re looking for a second home, a place where the family can go, a place where your parents can go to escape the winter, it’s a great time to buy. I was speaking to a real estate agent yesterday and he said if it wasn’t for Canadian’s buying up product in his area he wouldn’t be busy. Great value, and good exchange rates, is attracting a lot of Canadians. What I don’t like about Florida? Old farts that drive on I-75 doing 15 miles under the legal speed limit, while in the left hand lane.

The U.S. Avoids Default

Well that was a shock – There was little doubt that an agreement would be hammered out. The only question is what the agreement would look like. What I read and hear down here is both the Democrats and Republicans are not happy. I guess in some ways that makes me believe that it’s an okay deal. If both sides aren’t happy it means there was give and take. As details come out about the deal, and is actually passed in Congress and the Senate, we’ll get a better idea if the agreement is a band-aide solution or something that has substance. My money is on political cover rather than doing what’s best for the country. Winston Churchill said this about U.S. politicians, “they always get it right but only after failing everything else they try first“.

Well that was a shock – There was little doubt that an agreement would be hammered out. The only question is what the agreement would look like. What I read and hear down here is both the Democrats and Republicans are not happy. I guess in some ways that makes me believe that it’s an okay deal. If both sides aren’t happy it means there was give and take. As details come out about the deal, and is actually passed in Congress and the Senate, we’ll get a better idea if the agreement is a band-aide solution or something that has substance. My money is on political cover rather than doing what’s best for the country. Winston Churchill said this about U.S. politicians, “they always get it right but only after failing everything else they try first“.

Volumes Decrease

Over the last few weeks we’ve been hearing that volumes for Q2 are down year over year in the broker world. We know for a fact that submissions are down as of the end  of June. How that translates to actual volumes will become clearer when D + H publishes their market share report for Q2 in the second week of August. The market share report will probably validate what I’ve been hearing from brokers in the last 90 days, it’s slower and banks are still very aggressive. If the Ministry of Finance wanted to cool things down from a borrowing perspective, with the changes they made in April, mission accomplished. The only question is did the broker world take a bigger hit than the direct to bank world? We’ll find out soon enough.

of June. How that translates to actual volumes will become clearer when D + H publishes their market share report for Q2 in the second week of August. The market share report will probably validate what I’ve been hearing from brokers in the last 90 days, it’s slower and banks are still very aggressive. If the Ministry of Finance wanted to cool things down from a borrowing perspective, with the changes they made in April, mission accomplished. The only question is did the broker world take a bigger hit than the direct to bank world? We’ll find out soon enough.

Until next time,

Cheers.

We’ve all seen or heard the media reports about the possibility of countries defaulting on their loans. Most recently the U.S. has come under fire about their obli gations and ability to pay. Rating agencies are threatening to downgrade the U.S., which would have dire consequences for the US economy. Frankly, I don’t believe that will ever happen. The threat of a downgrade was intended to be exactly that, a threat. In other words, this was a public shot at the U.S. government, an attempt to exert public pressure for the U.S. to get their act together.

gations and ability to pay. Rating agencies are threatening to downgrade the U.S., which would have dire consequences for the US economy. Frankly, I don’t believe that will ever happen. The threat of a downgrade was intended to be exactly that, a threat. In other words, this was a public shot at the U.S. government, an attempt to exert public pressure for the U.S. to get their act together.

Where this is real and happening today is in Greece. So what happens if Greece doesn’t pay? Do they file for bankruptcy? Does that mean their bankruptcy will appear on their countries credit bureau report for the next 7 years? Does it mean that no one in Greece will be able to get a mortgage until their country has been discharged for 2 years? I ask these questions with tongue firmly planted in cheek. The answer is that the countries debt doesn’t go away. It means that Greece has not met its financial obligation for that particular month. The creditors will demand payment, but unlike consumer debt there’s nothing to repossess. It’s not as if the lenders can foreclose on Athens.

The reality is that the Greek currency will go into the toilet because they’ll be printing money like mad. They may opt out of the Euro currency for some period, possibly two years, and go back to the Drachma, Greece’s currency prior to entering the EU. This will lead to hyperinflation, and there will be zero demand for their currency or more importantly trust in their currency. This reminds me of the 80′s when I visited countries in the Balkans. I would go into the bank, exchange $100 Canadian for the local currency, and I would need a wheelbarrow to carry my cash around. A devalued currency will mean that all imports will be extremely expensive, and this will have a direct effect on the standard of living in Greece. Then there’s the obvious, borrowing in the future may become next to impossible for Greece. To be clear this isn’t just Greece’s problem, there’s concern for Spain, Ireland and Portugal as well. They may be next.

The reality is that the Greek currency will go into the toilet because they’ll be printing money like mad. They may opt out of the Euro currency for some period, possibly two years, and go back to the Drachma, Greece’s currency prior to entering the EU. This will lead to hyperinflation, and there will be zero demand for their currency or more importantly trust in their currency. This reminds me of the 80′s when I visited countries in the Balkans. I would go into the bank, exchange $100 Canadian for the local currency, and I would need a wheelbarrow to carry my cash around. A devalued currency will mean that all imports will be extremely expensive, and this will have a direct effect on the standard of living in Greece. Then there’s the obvious, borrowing in the future may become next to impossible for Greece. To be clear this isn’t just Greece’s problem, there’s concern for Spain, Ireland and Portugal as well. They may be next.

Back to the U.S. – One of the funniest solutions I have heard recently about their debt came from comedian Dennis Miller. On his most recent HBO special he talked about the US debt. He said, and I’m paraphrasing, “I don’t understand this debt issue. The numbers are way above my head. But if I was in the White House I would say bleep’em, we’re not paying. We got nukes”.

Until next time,

Cheers

Read More Add a Comment