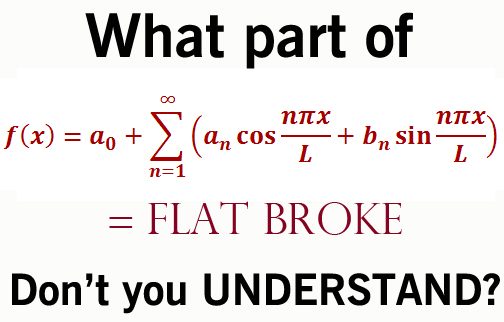

This is time of year when many Canadians start to think about their RRSP. If you’re like me you’re also giving some thought to how much money you’re prepared to lose investing in Mutual Funds. I received an email this week from a financial planner at my bank reminding me that the deadline to contribute is February 29th. That was very thoughtful of him, and I guess I shouldn’t be surprised that he didn’t remind about how much I’ve lost in the last couple years. I guess they figure I should be happy because I’m only this far away (thumb and first finger about an inch apart) from breaking even. It’s gotten to the point today where breaking even is a reason to celebrate. (more…)

This is time of year when many Canadians start to think about their RRSP. If you’re like me you’re also giving some thought to how much money you’re prepared to lose investing in Mutual Funds. I received an email this week from a financial planner at my bank reminding me that the deadline to contribute is February 29th. That was very thoughtful of him, and I guess I shouldn’t be surprised that he didn’t remind about how much I’ve lost in the last couple years. I guess they figure I should be happy because I’m only this far away (thumb and first finger about an inch apart) from breaking even. It’s gotten to the point today where breaking even is a reason to celebrate. (more…)

I always find it fascinating that highly trained people can look at the same raw data and come up with different interpretations. Some time ago CAAMP’s Chief Economists, Will Dunning, characterized economists this way to me, “if the economist is an optimists his forecasts will reflect that. Conversely, if the economist is a pessimist his finding will have a glass is half empty slant”. Your DNA, your personality, and getting up on the wrong side of the bed will influence the finding of those who join the dots and make predictions. Based on headlines recently many economic prognosticators should be going to bed earlier to avoid  crankiness. (more…)

crankiness. (more…)

The story I’m about to share with you is true. The events occurred on Monday, February 06, 2012. The names have not been changed to protect the innocent or guilty. Now that I have the disclaimer out of the way I can get on with the story. The story revolves around a man who is kind, understanding and always has a sunny disposition. That man would be me. Hey! What the hell are laughing for? It’s my story and that’s how I see it. Moving on, t he story is about moi and the ATM machine where I bank. I won’t mention the banks name but their initials are TD. I’ve done my banking there for years but they don’t have my mortgage. My mortgage is with this wonderful little company named Merix Financial. This company is brilliantly led, with unbelievable staff and access to more mortgage products than most. The blatant plug aside, the story goes like this… (more…)

he story is about moi and the ATM machine where I bank. I won’t mention the banks name but their initials are TD. I’ve done my banking there for years but they don’t have my mortgage. My mortgage is with this wonderful little company named Merix Financial. This company is brilliantly led, with unbelievable staff and access to more mortgage products than most. The blatant plug aside, the story goes like this… (more…)

Many in our industry were taken by surprise by the news that CMHC was cutting back on portfolio insurance, i.e. Bulk Insurance, as well as announcements made by lenders to discontinue offering NIQ/Stated Income Programs within conventional mortgage guidelines. The surprise created a stir and a great deal of speculations in our industry. What does it mean? How will we be impacted? Are the changes going to be fair and equitable, and will all stake holders be mandated to play by the same rules? The answer to these questions is simple, we just don’t know. (more…)

Many in our industry were taken by surprise by the news that CMHC was cutting back on portfolio insurance, i.e. Bulk Insurance, as well as announcements made by lenders to discontinue offering NIQ/Stated Income Programs within conventional mortgage guidelines. The surprise created a stir and a great deal of speculations in our industry. What does it mean? How will we be impacted? Are the changes going to be fair and equitable, and will all stake holders be mandated to play by the same rules? The answer to these questions is simple, we just don’t know. (more…)

Why is that telemarketers always seem to call at the wrong time? Some of you may be asking when is the right time? That’s a good question but I always try to remind myself that the person on the other end of the line is doing their job. These people have mortgages to pay, a family to feed and the other daily expenses we all have to deal with. The right side of my brain gets that but the left side of my brain screams “expletive”, I’m having dinner, watching the game or some other important activity. Who am I kidding, a telemarketer would annoy me if I was watching re-runs of Degrassi High, while biting on tinfoil. There’s just something about an unsolicited phone call with the sole purpose to sell me something. (more…)

Read More Add a Comment