I decided to break one of my own rules of blogging. In my humble estimation blogging should be a combination of facts and opinion. Simply cutting and pasting an article is not blogging. That’s being intellectually lazy and boring to the reader. So why am I breaking my own rule this one time? I’m a fan of Andrew Coyne, and if you’re not familiar with his work you should make a mental note to look for his articles or when he appears on TV. Andrew Coyne is a contributor to the Financial Post Magazine, and he’s a member of the “At Issue Panel” on CBC’s The National. Whenever I read one of Andrew’s columns or if I see him on TV, I always end up saying to myself, “I didn’t know that”. The man’s depth and breadth of knowledge of politics and the economy is impressive to say the last. I enjoyed his work so much that I decided to bring him in as a speaker to the Mortgage Forum in Montreal two years ago. In retrospect it probably wasn’t the right forum or audience. Speaking to an audience for fifty minutes is infinitely different than writing an article or providing forty five second sound bites on TV. That being said I wouldn’t hesitate to bring him back to a future conference, possibly as a member of a panel discussion.

I decided to break one of my own rules of blogging. In my humble estimation blogging should be a combination of facts and opinion. Simply cutting and pasting an article is not blogging. That’s being intellectually lazy and boring to the reader. So why am I breaking my own rule this one time? I’m a fan of Andrew Coyne, and if you’re not familiar with his work you should make a mental note to look for his articles or when he appears on TV. Andrew Coyne is a contributor to the Financial Post Magazine, and he’s a member of the “At Issue Panel” on CBC’s The National. Whenever I read one of Andrew’s columns or if I see him on TV, I always end up saying to myself, “I didn’t know that”. The man’s depth and breadth of knowledge of politics and the economy is impressive to say the last. I enjoyed his work so much that I decided to bring him in as a speaker to the Mortgage Forum in Montreal two years ago. In retrospect it probably wasn’t the right forum or audience. Speaking to an audience for fifty minutes is infinitely different than writing an article or providing forty five second sound bites on TV. That being said I wouldn’t hesitate to bring him back to a future conference, possibly as a member of a panel discussion.

I wanted to share Andrew’s most recent post because it speaks to the media coverage of our industry. I suspect his former employers at Maclean’s Magazine won’t be enamored with this story. It’s refreshing to read an article which is balanced, and speaks to the facts. If you’re like me there’s a good chance you’ll come across a word in one if his articles that you’re not 100% sure of its definition. The article below won’t disappoint. My new word is; “ Profligate”.

Definition of Profligate – wildly extravagant.

Until next time

Cheers,

Andrew Coyne Apr 10, 2012 – 6:00 AM ET | Last Updated: Apr 10, 2012 11:55 AM ET

Even by Maclean’s standards, the cover was alarming. “You’re about to get burned,” screamed the headline, over a picture of a house that was literally on fire. “Canada looks like the us before its devastating housing crash — maybe even worse.” And the kicker, for those still hesitating: “Why it’s officially time to panic.”

This last was doubtless something of a little in-joke. For my old colleagues at Canada’s newsweekly, it is always time to panic, especially about house prices. The magazine’s editors inhabit a world beset by all manner of hitherto undetected demons, from more expensive groceries (“sudden shortages, riots over prices, the world food crisis is about to hit home”) to insomnia (“the truth about a modern epidemic”) to, well, “The Return of Hitler.”

But nothing, nothing frightens the magazine or, it is hoped, its readers, more than real estate. For years Maclean’s has been shuddering in terror of the imminent collapse of the Canadian housing market. From the relative calm of its late 2007 cover story (“Buy? Sell? Panic?”), the magazine soon picked up signals of the coming apocalypse. “House prices start to fall,” the magazine announced the following summer. By autumn, with the world financial crisis in full swing, so was Maclean’s. “Canada’s Looming Real Estate Crisis,” the cover shouted: “Why house prices may soon fall through the floor.”

As the months wore on, and the cataclysm failed to arrive, Maclean’s remained ever hopeful of a real collapse. But durned if prices, after a brief dip, resumed rising. By June 2008, a grumpy Maclean’s was warning readers “Don’t believe the housing hype,” insisting there are “plenty of signs that the Canadian housing market is still on some very shaky ground,” even if “average home prices are up more than 16 per cent this year.”

Fast forward through several more stories in the same vein and by this year the magazine and others were in even less doubt: Canada was in a housing bubble. Why, just look at the numbers. For starters, there’s the oft-repeated fact that Canadians are carrying debts worth 153% of their annual income. That’s true: but other countries’ citizens manage much heavier debt loads, from the spendthrift Swiss (200%) to the feckless Dutch (260%) to the profligate Danes (320%). We may be carrying almost as much debt as the Americans before the crash, but with nothing like the same risk factors, from subprime mortgages to small regional banks, that made their economy such a firetrap. And if we’re mentioning how Canadians’ debts have grown, we should surely also mention that their assets have as well: still five times as large as their debts.

Mortgage costs, interests and principal combined, are currently running at about 30% of disposable income — again, higher than a few years ago, but barely half what they were in the early 1990s. Yes, house prices were still rising as of year-end, but more slowly than before, as even the Maclean’s piece acknowledges — though somehow it cites this as evidence for its doomsday thesis. But then, what doesn’t? If prices were rising quickly, that would be proof of housing “mania.” If they fell a little, that would be the bubble starting to burst. And if they fell a lot? Look out below!

The truth is the real estate market is cooling slightly, helped by a modest tightening of lending regulations. It’s true that a rise in interest rates from current, historically low levels would put some homeowners in distress, but they’d have to spike a long way before the damage grew widespread — a concern, sure, but nowhere near as frightening as, say, the return of Hitler.

Posted in: Financial Post Magazine Tags: Canadian housing bubble, Maclean’s, real estate

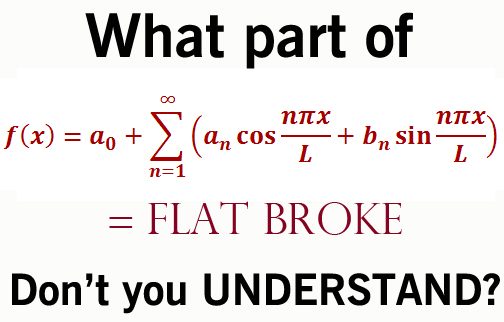

Read More Add a Comment This is time of year when many Canadians start to think about their RRSP. If you’re like me you’re also giving some thought to how much money you’re prepared to lose investing in Mutual Funds. I received an email this week from a financial planner at my bank reminding me that the deadline to contribute is February 29th. That was very thoughtful of him, and I guess I shouldn’t be surprised that he didn’t remind about how much I’ve lost in the last couple years. I guess they figure I should be happy because I’m only this far away (thumb and first finger about an inch apart) from breaking even. It’s gotten to the point today where breaking even is a reason to celebrate. (more…)

This is time of year when many Canadians start to think about their RRSP. If you’re like me you’re also giving some thought to how much money you’re prepared to lose investing in Mutual Funds. I received an email this week from a financial planner at my bank reminding me that the deadline to contribute is February 29th. That was very thoughtful of him, and I guess I shouldn’t be surprised that he didn’t remind about how much I’ve lost in the last couple years. I guess they figure I should be happy because I’m only this far away (thumb and first finger about an inch apart) from breaking even. It’s gotten to the point today where breaking even is a reason to celebrate. (more…)

This blog may appear to be self-serving but I can assure you that’s not my intention. Recently it’s become fashionable to debate executive compensation or more specifically the amount of said compensation. The chatter is everywhere and executives have become the new “whipping boy” by those that are disillusioned with the system.

This blog may appear to be self-serving but I can assure you that’s not my intention. Recently it’s become fashionable to debate executive compensation or more specifically the amount of said compensation. The chatter is everywhere and executives have become the new “whipping boy” by those that are disillusioned with the system.

That famous line was attributed to Jogi Berra, Hall of Fame New York Yankee baseball player. Besides being a great ball player, Berra was also known for malapropism, mangling the English language. Normally it’s done for comedic relief but in Berra’s case it was his standard way of speaking. I thought of this quote based on what’s been happening to the markets over the last week. It’s starting to feel like 2008 all over again. Back in 2008, the world faced an economic crisis. The news was stunning. How on earth could iconic companies such as Lehman Brothers and Bear Sterns fail? Yet that’s exactly what happened. The U.S. Government forced banks to take T.A.R.P. (Troubled Asset Relief Program) money to ensure that lending would continue. The ministers of the G7 countries rushed to Washington for emergency meetings because there was fear that the markets wouldn’t open. As events unfolded in 2008 we were all left wondering what’s next? It appears the other shoe has dropped.

One of the significant differences, relative to our present day situation, is the fact that back in 2008 nobody questioned America’s credit worthiness. That all changed last Friday when S & P (Standard and Poor’s) downgraded the US from AAA to AA Plus. Not since 1917 has the US been rated lower than AAA. Not surprisingly the Obama administration has come out swinging against S & P. The administration is questioning S & P calculations and motives for the downgrade. Funny how S & P’s motives were never questioned when the US had a AAA rating. I should note that the other two rating agencies, Moody’s and Fitch, have not downgraded the US. So the question is, which rating agency has it right? In time the answer will become clearer but I’ll say this about S & P, the move they made on Friday took a lot of chutzpa. That’s a Yiddish word for tenacity and guts. I suspect shirt collars are feeling a little tight today in the corporate offices at S & P.

One of the significant differences, relative to our present day situation, is the fact that back in 2008 nobody questioned America’s credit worthiness. That all changed last Friday when S & P (Standard and Poor’s) downgraded the US from AAA to AA Plus. Not since 1917 has the US been rated lower than AAA. Not surprisingly the Obama administration has come out swinging against S & P. The administration is questioning S & P calculations and motives for the downgrade. Funny how S & P’s motives were never questioned when the US had a AAA rating. I should note that the other two rating agencies, Moody’s and Fitch, have not downgraded the US. So the question is, which rating agency has it right? In time the answer will become clearer but I’ll say this about S & P, the move they made on Friday took a lot of chutzpa. That’s a Yiddish word for tenacity and guts. I suspect shirt collars are feeling a little tight today in the corporate offices at S & P.

Based on what’s happened in the last week, what does this mean for Canada? Firstly, no one can predict with any certainty. We’re in-uncharted waters here. Besides what’s happening in the US, numerous countries are in dire straits financially in Europe. All of these factors will have an impact on us. “Canada is not an island,” Finance Minister Jim Flaherty said late Friday in a statement. “We are a trading nation, with about a third of output generated by exports and deep linkages with the U.S. economy. The global economic recovery remains fragile and this uncertainty may eventually impact Canada”. One of the ways it may impact us is that if borrowing costs increase in the US, due to S & P’s downgrading, there could be further negative impact to the US economy. This impacts us because we export so much of our goods to the US. If the Americans are not spending, we feel it. There’s also predictions that the loonie will go higher relative to the US greenback. That of course makes our goods more expensive in the US and abroad.

Firstly, no one can predict with any certainty. We’re in-uncharted waters here. Besides what’s happening in the US, numerous countries are in dire straits financially in Europe. All of these factors will have an impact on us. “Canada is not an island,” Finance Minister Jim Flaherty said late Friday in a statement. “We are a trading nation, with about a third of output generated by exports and deep linkages with the U.S. economy. The global economic recovery remains fragile and this uncertainty may eventually impact Canada”. One of the ways it may impact us is that if borrowing costs increase in the US, due to S & P’s downgrading, there could be further negative impact to the US economy. This impacts us because we export so much of our goods to the US. If the Americans are not spending, we feel it. There’s also predictions that the loonie will go higher relative to the US greenback. That of course makes our goods more expensive in the US and abroad.

Conversely there’s been some positive speculation about Canada. Investors will look for a safe haven. There’s plenty of cash on balance sheets today but given the uncertainty of the market place cash is being hoarded. Eventually corporation will want a return on their capital, and Canada is a safe bet. Based on workforce, commodities, stable financial sector and fiscally responsible government, Canada should benefit. Countries which are AAA rated today will be in demand. S & P rates Germany, Britain, Austria, Denmark, Norway, Netherlands, Australia and Canada AAA. If Europe makes investors nervous, Canada’s a solid option.

It’s become fashionable in this country to pat ourselves on the back and say, “we’re so much smarter than the Americans”. Frankly, recent history clearly shows that we have managed our affairs far more effectively than our neighbours to the south. But things can change. In 1993, the Canadian Bond Rating Agency downgraded Canada from AAA to AA Plus. In a short period of time the other international rating agencies followed suite. How did we get our AAA rating back? The government attacked the deficit. If you recall back in the 90’s the Liberals, remember them, ran things in Ottawa. Under Finance Minister Paul Martin, programs were slashed, transfer payments reduced, and taxes were increased. This was done all in the name of deficit reduction, and it worked. Here we are in 2011, our deficit is too high and the Harper government will have to do something about it. Harper’s backed himself into a corner by campaigning that our taxes are too high, and increasing taxes is not the answer. He had me at hello. So then the only way to reduce our deficit is to cut spending. Don’t expect him to use a scalpel to cut programs. This may require a hatchet.

Until next time

Cheers

Read More Add a Comment