For many in our industry the ability to maintain margins is becoming increasingly difficult. There was a time when lenders were the loudest when it came to bemoaning the issue of margin compression. Now others in the industry have joined the chorus. Lenders have finally hit the wall and the days of increasing commissions are but a fond memory. Broker owners have been forced to reduce margins in the name of recruitment and retention. Mortgage brokers, who for years were sheltered from the margin compression storm, are now willing to forgo a portion of their fees to buy down interest rates in the name of competition. Everyone in our industry has been forced to adjust and deal with the changing dynamics and demands of the client. The next wave to hit is for many of our suppliers – realtors.

For many in our industry the ability to maintain margins is becoming increasingly difficult. There was a time when lenders were the loudest when it came to bemoaning the issue of margin compression. Now others in the industry have joined the chorus. Lenders have finally hit the wall and the days of increasing commissions are but a fond memory. Broker owners have been forced to reduce margins in the name of recruitment and retention. Mortgage brokers, who for years were sheltered from the margin compression storm, are now willing to forgo a portion of their fees to buy down interest rates in the name of competition. Everyone in our industry has been forced to adjust and deal with the changing dynamics and demands of the client. The next wave to hit is for many of our suppliers – realtors.

The real estate industry has done a masterful job protecting their own interest, and they deserve a tip of the hat for their ability to demand and justify their commissions. It was a great run but change is coming. The real estate industry will not go quietly into the night, as demonstrated by their recent battle with the Competition Bureau of Canada, but the genie is now out of the bottle and there’s no putting her back.

I came across an article in the  Financial Post by Erin Burry, which chronicled the evolution of a new start up in the reduced real estate commission business. Prior to reading this article I never heard of TheRedPin, a new entrant into the real estate game. After reading the article I checked out their website and I have to say it was rather slick, limited geographically, but it looked and felt like the way of the future. I was struck by a quote in the article from TheRedPins founder, Shayan Hamidi. Here’s what he said, “The real estate industry is built of massive franchises that simply license their brand to thousands of independent agents who run their own individual business. We only hire professional agents and they are non-commission. We pay them a salary and a bonus that’s based on customer satisfaction, so their interests are completely aligned with their clients.“ I do not profess to know if Mr. Hamidi’s claims are true, I’ve never used their services before, but I do believe he’s onto something. Over the past few years there’s been a number of new entrants into the reduced real estate commission space and they all seem to share a commonality, the vendor has to do all the work. For most people a real estate transaction can be intimidating and even with greater access to the MLS all the work still awaits. It appears that TheRedPin is taking a different approach, full service with a flat fee. In my opinion that’s been the missing link. Vendors want to pay less but still have the work done for them. That’s no different than most consumers, they want quality and they want it cheaper; a reflection of today’s reality, which applies to the real estate industry. They can fight it all they want but it’s a battle they’re going to lose. If it’s not TheRedPin it’s someone else who’s building a business model which will revolutionize the real estate industry, just like it’s happened in every other industry.

Financial Post by Erin Burry, which chronicled the evolution of a new start up in the reduced real estate commission business. Prior to reading this article I never heard of TheRedPin, a new entrant into the real estate game. After reading the article I checked out their website and I have to say it was rather slick, limited geographically, but it looked and felt like the way of the future. I was struck by a quote in the article from TheRedPins founder, Shayan Hamidi. Here’s what he said, “The real estate industry is built of massive franchises that simply license their brand to thousands of independent agents who run their own individual business. We only hire professional agents and they are non-commission. We pay them a salary and a bonus that’s based on customer satisfaction, so their interests are completely aligned with their clients.“ I do not profess to know if Mr. Hamidi’s claims are true, I’ve never used their services before, but I do believe he’s onto something. Over the past few years there’s been a number of new entrants into the reduced real estate commission space and they all seem to share a commonality, the vendor has to do all the work. For most people a real estate transaction can be intimidating and even with greater access to the MLS all the work still awaits. It appears that TheRedPin is taking a different approach, full service with a flat fee. In my opinion that’s been the missing link. Vendors want to pay less but still have the work done for them. That’s no different than most consumers, they want quality and they want it cheaper; a reflection of today’s reality, which applies to the real estate industry. They can fight it all they want but it’s a battle they’re going to lose. If it’s not TheRedPin it’s someone else who’s building a business model which will revolutionize the real estate industry, just like it’s happened in every other industry.

Until next time,

Cheers.

Similar Posts: (click to view)

Mortgage and Housing Industry: It’s all about the timing

New Mortgage Rules: The Hidden Code

Australia’s Mortgage Industry: World’s Apart

Read More Add a Comment The long journey for our family is finally coming to an end. The journey I’m referring to is our move, which now feels like it’s been a year. The reality is it’s only been three weeks but when you live out of a suitcase, time seems to drag on. It’s one thing to do that while on vacation but it altogether different when it’s just another normal day or in our case, weeks. It is interesting how you adjust to your circumstances. I’ve learned that I’m clothes pig. It appears that two suits, two pairs of dress pants, 5 dress shirts and a few ties is more than enough. There’s going to be further purging when we move in on Friday, and in the not too distant future some homeless man will look pretty sharp.

The long journey for our family is finally coming to an end. The journey I’m referring to is our move, which now feels like it’s been a year. The reality is it’s only been three weeks but when you live out of a suitcase, time seems to drag on. It’s one thing to do that while on vacation but it altogether different when it’s just another normal day or in our case, weeks. It is interesting how you adjust to your circumstances. I’ve learned that I’m clothes pig. It appears that two suits, two pairs of dress pants, 5 dress shirts and a few ties is more than enough. There’s going to be further purging when we move in on Friday, and in the not too distant future some homeless man will look pretty sharp.

As to our new home or as we affectionately refer to it as, the money pit, there’s a fair bit of work that awaits us. You have to have some vision and imagination to buy a home where the redeeming quality is the lot and footprint. Everything else about the interior? Bye-Bye! It’s funny to walk around the house and say, hate this, hate that, that’s hideous, and what in god’s name were the previous owners thinking when they picked this? Feel free to insert doors, faucets, tiles, staircase, paint colour, light fixtures etc. Indeed, work awaits.

I’m thankful that the previous  owners spent less than five cents preparing their home for sale. Even more thankful is the painter we hired. In this day and age of HGTV, not knowing how to stage a home is because you just didn’t care to learn. That’s a mistake that many home owners make when selling their homes, and it costs them thousands of dollars. Most people have a difficult time seeing beyond people’s questionable taste but what will turn potential buyers off even more is if they think the house is not clean. A coat of paint does wonders. Every buyer will probably change the paint colour as soon as they move in but at least they’ll think the house is pristine. And if they’re trying to decide between two homes to buy, it can be the difference maker.

owners spent less than five cents preparing their home for sale. Even more thankful is the painter we hired. In this day and age of HGTV, not knowing how to stage a home is because you just didn’t care to learn. That’s a mistake that many home owners make when selling their homes, and it costs them thousands of dollars. Most people have a difficult time seeing beyond people’s questionable taste but what will turn potential buyers off even more is if they think the house is not clean. A coat of paint does wonders. Every buyer will probably change the paint colour as soon as they move in but at least they’ll think the house is pristine. And if they’re trying to decide between two homes to buy, it can be the difference maker.

Off to the store to buys some stuff because the money pit needs to be fed.

Until next time,

Cheers.

Read More Add a Comment Nice to see another topic making headlines rather than the same old evil which threatens to bring down the Canadian economy, mortgages. The topic dejour today is the strength of the Canadian one dollar coin. There’s a fair bit of hand wringing over the fact the Canadian dollar is today is worth $1.01 U.S. Individuals who pull the leavers of power in this country often remind us that a strong Canadian dollar negatively impacts our economy. Interesting position to take when one considers the reason why investors are flocking to the Canadian dollar. Factors like, government debt which is manageable, stable employment numbers and a sound banking system. Oh yeah, and free market economy.

Nice to see another topic making headlines rather than the same old evil which threatens to bring down the Canadian economy, mortgages. The topic dejour today is the strength of the Canadian one dollar coin. There’s a fair bit of hand wringing over the fact the Canadian dollar is today is worth $1.01 U.S. Individuals who pull the leavers of power in this country often remind us that a strong Canadian dollar negatively impacts our economy. Interesting position to take when one considers the reason why investors are flocking to the Canadian dollar. Factors like, government debt which is manageable, stable employment numbers and a sound banking system. Oh yeah, and free market economy.

There are those who are suggesting the Bank of Canada should intervene by easing monetary policy by lowering the overnight lending rate. Those who work in the mortgage industry know that will not happen for a while. There has to be clear evidence that housing market has cooled before the Bank of Canada would consider lowering the overnight rate. Besides, it’s estimated that if the Bank of Canada was to lower the overnight lending rate to zero, the net effect would be the Canadian dollar would be worth 98 cents U.S.

Given that the Canadian dollar will remain strong for the foreseeable future the press and government should turn their attention to a far more pressing issue, like our productivity. Canada spends approximately 1 per cent of GDP on research and development. That is approximately half of what the U.S. spends. The gap in productivity between our two countries is widening, and if we were on par with U.S. productivity the strength of the Canadian dollar would not be as worrisome.

Innovation drives productivity. Every industry will have to make significant investments in research and development if we want to compete with the giants. It’s not just about doing things faster and cheaper. We will have to compete on value, service and produce products which are unique. What drives productivity is a skilled workforce and this is an issue we all have to deal with. We now have to compete in a global economy which is knowledge based. Fundamental structural change is required in Canada if we all want to maintain our standard of living in the future. Government and industries both play a key role in this debate. It’s time to actually have one.

Until next time,

Cheers.

Read More Add a Comment

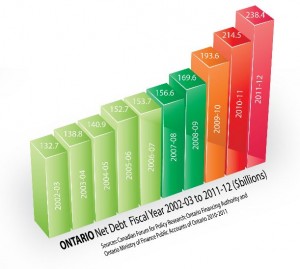

Surely some of this will stick to the Teflon Premier, the Premier of Ontario, Dalton McGuinty. Up to now he has done a masterful job of avoiding any full on body blows to his party and himself. This is demonstrated by the number of times he’s been reelected, 2003, 2007 and then again in 2011. Given the province of Ontario’s debt and overall economic performance since 2003, why wouldn’t he have a sense of invisibility. But there has to come a time when the electorate finally says, “enough already”. Every politician will eventually meet their Waterloo if they overstayed their welcome. There’s always a galvanizing moment for the voters. For the former Major of Toronto, David Miller, it was a garbage strike. His political career was based on the anger of the electorate over his handling of the garbage strike. For Premier McGuinty, it could be a story which the Canadian Press uncovered and published yesterday.

Surely some of this will stick to the Teflon Premier, the Premier of Ontario, Dalton McGuinty. Up to now he has done a masterful job of avoiding any full on body blows to his party and himself. This is demonstrated by the number of times he’s been reelected, 2003, 2007 and then again in 2011. Given the province of Ontario’s debt and overall economic performance since 2003, why wouldn’t he have a sense of invisibility. But there has to come a time when the electorate finally says, “enough already”. Every politician will eventually meet their Waterloo if they overstayed their welcome. There’s always a galvanizing moment for the voters. For the former Major of Toronto, David Miller, it was a garbage strike. His political career was based on the anger of the electorate over his handling of the garbage strike. For Premier McGuinty, it could be a story which the Canadian Press uncovered and published yesterday.

For those of you reading this post who reside outside of Ontario, the Premier of Ontario is beating the drums of fiscal restraint. Teachers and doctors are being told there has to be wage freezes. Everyone in the public sector will have to make sacrifices, and spending cuts are required across all departments. No argument from tax payers because this has long been overdue. What’s mind boggling is that the Canadian Press uncovered that 98 percent of eligible managers in the Ontario Public Service received a bonus last year. This information was not readily available. The Canadian Press used the freedom of information laws to uncover this, and one has to assume the government was hoping to bury this in the fine print. In today’s world, that in of itself is laughable. Did they really think that the someone in the press wasn’t going to find out? This is like blood in the water for the press, and the sharks are circling.

Sources: Canadian Forum for Policy Research; Ontario Financing Authority and Ontario Ministry of Finance Public Accounts of Ontario 2010-2011. CFPR http://researchforum.ca

I would never suggest that bonuses shouldn’t be paid. Extraordinary efforts and results should be rewarded. I suspect some managers in the Ontario Public Sector are deserving of a bonus. But almost all of them? Maybe the Liberals here in Ontario will hope for continued voter apathy and that no one will pay much attention to this. Maybe they’re banking on the fact that people on Ontario are focused more on squeezing every ounce of what’s left of summer. Someone else banked on that and it didn’t work out so well for him. Anyone seen or heard from David Miller recently?

Until next time,

Cheers.

Read More Add a Comment

“Shareholders are rethinking their position in Facebook”

On some level we all believe that certain companies and brands are a sure thing. We think this way without doing any in depth financial analysis. What influences our thinking is our perception of these companies and brands. If companies have been around long enough, and they master the art of brand awareness through advertising, we naturally assume these companies and brands are money makers. We can all name three companies, without damaging any brain cells, that we believe are a sure thing, Apple, Coke-Cola and McDonald’s. No deep contemplation required, it’s right there at the tip of the tongue. The reality is these companies have a storied history, and in Apple’s case, a history of ineptitude or at the very least questionable business decision making. Hard to imagine today by there was a time when you could point to Apple as an example of what not to do as a business. Clearly that’s not the case today, and Apple today is one of the most successful and recognizable brands in the world.

In today’s world brand recognition and awareness does not guarantee a sure thing. There’s been two recent examples of companies who bought into their own brand appeal, and concluded that investors would over-pay for the right to have a piece of the action. I enter into evidence Facebook as exhibit “ A”, and Manchester United as exhibit “B’.

One of the most anticipated IPO’s in recent memory was Facebook. Investors were salivating at the opportunity but not nearly as much as the principles of Facebook. Investment bankers representing Facebook believed that the Facebook brand would lead investors to set aside sound investment principals. It was assumed that investors would pay a premium because it was the Facebook brand. Hubris? Hype? Greed? They all played a part in Facebook initial IPO and present day values. Facebook stock took a major hit last week, and shareholders are rethinking their position in Facebook. Goldman Sachs has a stake worth $900m in Facebook, and they along with Microsoft can sell their stake as of August 16th. What to do? Well, they’ll have to think about Facebook loosing $38.8 billion in market value since the IPO. It’s also estimated that over the next 9 months about 1.9 billion shares will become available as compared to the the fewer than 500 million shares available today. Does the strength of the brand trump supply and demand principals? You don’t have to be Warren Buffet to come up with the right answer.

One of the most anticipated IPO’s in recent memory was Facebook. Investors were salivating at the opportunity but not nearly as much as the principles of Facebook. Investment bankers representing Facebook believed that the Facebook brand would lead investors to set aside sound investment principals. It was assumed that investors would pay a premium because it was the Facebook brand. Hubris? Hype? Greed? They all played a part in Facebook initial IPO and present day values. Facebook stock took a major hit last week, and shareholders are rethinking their position in Facebook. Goldman Sachs has a stake worth $900m in Facebook, and they along with Microsoft can sell their stake as of August 16th. What to do? Well, they’ll have to think about Facebook loosing $38.8 billion in market value since the IPO. It’s also estimated that over the next 9 months about 1.9 billion shares will become available as compared to the the fewer than 500 million shares available today. Does the strength of the brand trump supply and demand principals? You don’t have to be Warren Buffet to come up with the right answer.

Is there a sporting franchise with greater brand recognition than Manchester Untied? Soccer may not have the appeal in North America that it does on every other continent but there’s a good chance that even the uninitiated to the wonders of the beautiful game would recognize the name Manchester United. It’s been estimated that United is the most valuable franchise on the planet, get ready for this, worth an estimated $2.3 billion. As sure a thing as it gets. Almost. Manchester United debuted on the New York stock exchange on Friday, anticipating share value to range between $16 to $20. The market spoke and settled in at $14. A partly $100m less than what the owners anticipated, and they’ll have to settle on the $230m which was raised in the IPO. No one is going to shed any tears for the owners of Manchester United and the Tampa Bay Buccaneers of the NFL, the Glazer family. Other than the Glazer family maybe, a debt load of $661m for the soccer team alone is a big number to crack every month.

Is there a sporting franchise with greater brand recognition than Manchester Untied? Soccer may not have the appeal in North America that it does on every other continent but there’s a good chance that even the uninitiated to the wonders of the beautiful game would recognize the name Manchester United. It’s been estimated that United is the most valuable franchise on the planet, get ready for this, worth an estimated $2.3 billion. As sure a thing as it gets. Almost. Manchester United debuted on the New York stock exchange on Friday, anticipating share value to range between $16 to $20. The market spoke and settled in at $14. A partly $100m less than what the owners anticipated, and they’ll have to settle on the $230m which was raised in the IPO. No one is going to shed any tears for the owners of Manchester United and the Tampa Bay Buccaneers of the NFL, the Glazer family. Other than the Glazer family maybe, a debt load of $661m for the soccer team alone is a big number to crack every month.

So what will we make of Facebook and Manchester United’s foray into the world of IPO’s? Well, the principals are worth a lot of money and so are their respective companies. However, it’s clear that investors are not willing to pay an inflated priced for chic alone.

Until next time,

Cheers.

Read More Add a CommentYour request has been sent.