Nice to see another topic making headlines rather than the same old evil which threatens to bring down the Canadian economy, mortgages. The topic dejour today is the strength of the Canadian one dollar coin. There’s a fair bit of hand wringing over the fact the Canadian dollar is today is worth $1.01 U.S. Individuals who pull the leavers of power in this country often remind us that a strong Canadian dollar negatively impacts our economy. Interesting position to take when one considers the reason why investors are flocking to the Canadian dollar. Factors like, government debt which is manageable, stable employment numbers and a sound banking system. Oh yeah, and free market economy.

Nice to see another topic making headlines rather than the same old evil which threatens to bring down the Canadian economy, mortgages. The topic dejour today is the strength of the Canadian one dollar coin. There’s a fair bit of hand wringing over the fact the Canadian dollar is today is worth $1.01 U.S. Individuals who pull the leavers of power in this country often remind us that a strong Canadian dollar negatively impacts our economy. Interesting position to take when one considers the reason why investors are flocking to the Canadian dollar. Factors like, government debt which is manageable, stable employment numbers and a sound banking system. Oh yeah, and free market economy.

There are those who are suggesting the Bank of Canada should intervene by easing monetary policy by lowering the overnight lending rate. Those who work in the mortgage industry know that will not happen for a while. There has to be clear evidence that housing market has cooled before the Bank of Canada would consider lowering the overnight rate. Besides, it’s estimated that if the Bank of Canada was to lower the overnight lending rate to zero, the net effect would be the Canadian dollar would be worth 98 cents U.S.

Given that the Canadian dollar will remain strong for the foreseeable future the press and government should turn their attention to a far more pressing issue, like our productivity. Canada spends approximately 1 per cent of GDP on research and development. That is approximately half of what the U.S. spends. The gap in productivity between our two countries is widening, and if we were on par with U.S. productivity the strength of the Canadian dollar would not be as worrisome.

Innovation drives productivity. Every industry will have to make significant investments in research and development if we want to compete with the giants. It’s not just about doing things faster and cheaper. We will have to compete on value, service and produce products which are unique. What drives productivity is a skilled workforce and this is an issue we all have to deal with. We now have to compete in a global economy which is knowledge based. Fundamental structural change is required in Canada if we all want to maintain our standard of living in the future. Government and industries both play a key role in this debate. It’s time to actually have one.

Until next time,

Cheers.

Read More Add a Comment

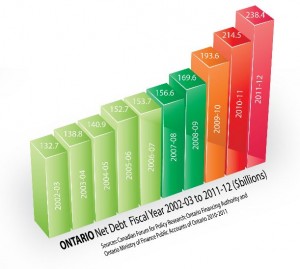

Surely some of this will stick to the Teflon Premier, the Premier of Ontario, Dalton McGuinty. Up to now he has done a masterful job of avoiding any full on body blows to his party and himself. This is demonstrated by the number of times he’s been reelected, 2003, 2007 and then again in 2011. Given the province of Ontario’s debt and overall economic performance since 2003, why wouldn’t he have a sense of invisibility. But there has to come a time when the electorate finally says, “enough already”. Every politician will eventually meet their Waterloo if they overstayed their welcome. There’s always a galvanizing moment for the voters. For the former Major of Toronto, David Miller, it was a garbage strike. His political career was based on the anger of the electorate over his handling of the garbage strike. For Premier McGuinty, it could be a story which the Canadian Press uncovered and published yesterday.

Surely some of this will stick to the Teflon Premier, the Premier of Ontario, Dalton McGuinty. Up to now he has done a masterful job of avoiding any full on body blows to his party and himself. This is demonstrated by the number of times he’s been reelected, 2003, 2007 and then again in 2011. Given the province of Ontario’s debt and overall economic performance since 2003, why wouldn’t he have a sense of invisibility. But there has to come a time when the electorate finally says, “enough already”. Every politician will eventually meet their Waterloo if they overstayed their welcome. There’s always a galvanizing moment for the voters. For the former Major of Toronto, David Miller, it was a garbage strike. His political career was based on the anger of the electorate over his handling of the garbage strike. For Premier McGuinty, it could be a story which the Canadian Press uncovered and published yesterday.

For those of you reading this post who reside outside of Ontario, the Premier of Ontario is beating the drums of fiscal restraint. Teachers and doctors are being told there has to be wage freezes. Everyone in the public sector will have to make sacrifices, and spending cuts are required across all departments. No argument from tax payers because this has long been overdue. What’s mind boggling is that the Canadian Press uncovered that 98 percent of eligible managers in the Ontario Public Service received a bonus last year. This information was not readily available. The Canadian Press used the freedom of information laws to uncover this, and one has to assume the government was hoping to bury this in the fine print. In today’s world, that in of itself is laughable. Did they really think that the someone in the press wasn’t going to find out? This is like blood in the water for the press, and the sharks are circling.

Sources: Canadian Forum for Policy Research; Ontario Financing Authority and Ontario Ministry of Finance Public Accounts of Ontario 2010-2011. CFPR http://researchforum.ca

I would never suggest that bonuses shouldn’t be paid. Extraordinary efforts and results should be rewarded. I suspect some managers in the Ontario Public Sector are deserving of a bonus. But almost all of them? Maybe the Liberals here in Ontario will hope for continued voter apathy and that no one will pay much attention to this. Maybe they’re banking on the fact that people on Ontario are focused more on squeezing every ounce of what’s left of summer. Someone else banked on that and it didn’t work out so well for him. Anyone seen or heard from David Miller recently?

Until next time,

Cheers.

Read More Add a Comment

“Shareholders are rethinking their position in Facebook”

On some level we all believe that certain companies and brands are a sure thing. We think this way without doing any in depth financial analysis. What influences our thinking is our perception of these companies and brands. If companies have been around long enough, and they master the art of brand awareness through advertising, we naturally assume these companies and brands are money makers. We can all name three companies, without damaging any brain cells, that we believe are a sure thing, Apple, Coke-Cola and McDonald’s. No deep contemplation required, it’s right there at the tip of the tongue. The reality is these companies have a storied history, and in Apple’s case, a history of ineptitude or at the very least questionable business decision making. Hard to imagine today by there was a time when you could point to Apple as an example of what not to do as a business. Clearly that’s not the case today, and Apple today is one of the most successful and recognizable brands in the world.

In today’s world brand recognition and awareness does not guarantee a sure thing. There’s been two recent examples of companies who bought into their own brand appeal, and concluded that investors would over-pay for the right to have a piece of the action. I enter into evidence Facebook as exhibit “ A”, and Manchester United as exhibit “B’.

One of the most anticipated IPO’s in recent memory was Facebook. Investors were salivating at the opportunity but not nearly as much as the principles of Facebook. Investment bankers representing Facebook believed that the Facebook brand would lead investors to set aside sound investment principals. It was assumed that investors would pay a premium because it was the Facebook brand. Hubris? Hype? Greed? They all played a part in Facebook initial IPO and present day values. Facebook stock took a major hit last week, and shareholders are rethinking their position in Facebook. Goldman Sachs has a stake worth $900m in Facebook, and they along with Microsoft can sell their stake as of August 16th. What to do? Well, they’ll have to think about Facebook loosing $38.8 billion in market value since the IPO. It’s also estimated that over the next 9 months about 1.9 billion shares will become available as compared to the the fewer than 500 million shares available today. Does the strength of the brand trump supply and demand principals? You don’t have to be Warren Buffet to come up with the right answer.

One of the most anticipated IPO’s in recent memory was Facebook. Investors were salivating at the opportunity but not nearly as much as the principles of Facebook. Investment bankers representing Facebook believed that the Facebook brand would lead investors to set aside sound investment principals. It was assumed that investors would pay a premium because it was the Facebook brand. Hubris? Hype? Greed? They all played a part in Facebook initial IPO and present day values. Facebook stock took a major hit last week, and shareholders are rethinking their position in Facebook. Goldman Sachs has a stake worth $900m in Facebook, and they along with Microsoft can sell their stake as of August 16th. What to do? Well, they’ll have to think about Facebook loosing $38.8 billion in market value since the IPO. It’s also estimated that over the next 9 months about 1.9 billion shares will become available as compared to the the fewer than 500 million shares available today. Does the strength of the brand trump supply and demand principals? You don’t have to be Warren Buffet to come up with the right answer.

Is there a sporting franchise with greater brand recognition than Manchester Untied? Soccer may not have the appeal in North America that it does on every other continent but there’s a good chance that even the uninitiated to the wonders of the beautiful game would recognize the name Manchester United. It’s been estimated that United is the most valuable franchise on the planet, get ready for this, worth an estimated $2.3 billion. As sure a thing as it gets. Almost. Manchester United debuted on the New York stock exchange on Friday, anticipating share value to range between $16 to $20. The market spoke and settled in at $14. A partly $100m less than what the owners anticipated, and they’ll have to settle on the $230m which was raised in the IPO. No one is going to shed any tears for the owners of Manchester United and the Tampa Bay Buccaneers of the NFL, the Glazer family. Other than the Glazer family maybe, a debt load of $661m for the soccer team alone is a big number to crack every month.

Is there a sporting franchise with greater brand recognition than Manchester Untied? Soccer may not have the appeal in North America that it does on every other continent but there’s a good chance that even the uninitiated to the wonders of the beautiful game would recognize the name Manchester United. It’s been estimated that United is the most valuable franchise on the planet, get ready for this, worth an estimated $2.3 billion. As sure a thing as it gets. Almost. Manchester United debuted on the New York stock exchange on Friday, anticipating share value to range between $16 to $20. The market spoke and settled in at $14. A partly $100m less than what the owners anticipated, and they’ll have to settle on the $230m which was raised in the IPO. No one is going to shed any tears for the owners of Manchester United and the Tampa Bay Buccaneers of the NFL, the Glazer family. Other than the Glazer family maybe, a debt load of $661m for the soccer team alone is a big number to crack every month.

So what will we make of Facebook and Manchester United’s foray into the world of IPO’s? Well, the principals are worth a lot of money and so are their respective companies. However, it’s clear that investors are not willing to pay an inflated priced for chic alone.

Until next time,

Cheers.

Read More Add a Comment Oh sure, we’re winning a few medals in London but the Olympics are fleeting. Before you know it the Olympics will be over and we can all go back to watching our favorite programs on T.V. Don’t get me wrong, we’re proud of our athletes but there something bigger happening which has brought our great nation together. Drinking beer!

Oh sure, we’re winning a few medals in London but the Olympics are fleeting. Before you know it the Olympics will be over and we can all go back to watching our favorite programs on T.V. Don’t get me wrong, we’re proud of our athletes but there something bigger happening which has brought our great nation together. Drinking beer!

Try as I might but I had difficulty finding a good news story about a company doing really well with a connection to Canada, until I came across this gem in the National Post. No one, and I do mean no one can convince me that we as Canadians didn’t play a part in the success of this company. It’s summer time in Canada, and it’s what we do. Just remember the next time you twist off the cap on a bottle of beer you might want to think of buying some stock. Like Pavlov’s dog.

Until next time

Cheers.

Molson Coors Brewing Co reported quarterly profit that blew past Wall Street estimates on Tuesday, helped by an improved performance in its U.S. business and the addition of operations in Europe.

The maker of Molson Canadian, Coors Light and Blue Moon beers reported net income of US$105.1 million, or 57 cents per share, in the second quarter, down from US$222.8 million, or US$1.18 per share, a year earlier. Excluding one-time items, including financing and acquisition-related charges, earnings were US$1.38 per share. On that basis, analysts, on average, were expecting US$1.19 a share, according to Thomson Reuters I/B/E/S. The company acquired East European brewer StarBev in June in a US$3.4 billion deal that expands its presence outside of its three core markets of Britain, Canada and the United States. Net sales were US$999.4 million, higher than US$933.6 million a year earlier and analysts’ estimate of US$934.8 million. The company sold 13.9 million hectoliters of beer, a 6.4% increase from the prior year.

Earlier Tuesday, MillerCoors – the combined U.S. operations of Molson Coors and SABMiller – posted a 9.1% rise in net income, driven by price increases, a move toward more expensive beers and continued cost savings.

© Thomson Reuters 2012

Read More Add a Comment We are quickly approaching a significant date, a date which had a profound impact on the global economy and our physchy. This August is the fifth anniversary of the beginning of the Global Financial Crisis, yes, it started a half decade ago. What were you doing five years ago? I suspect you were reading the headlines of the day wondering what does it all mean to me? It was unfathomable to think back then that sub-prime mortgages, ARM teaser rates, and new terms to the general public like derivatives and swaps, could nearly bring down the global economy. And yet here we are five years later, dealing with a fragile economy because aftershocks are still being felt because of the GFC, Global Financial Crisis.

We are quickly approaching a significant date, a date which had a profound impact on the global economy and our physchy. This August is the fifth anniversary of the beginning of the Global Financial Crisis, yes, it started a half decade ago. What were you doing five years ago? I suspect you were reading the headlines of the day wondering what does it all mean to me? It was unfathomable to think back then that sub-prime mortgages, ARM teaser rates, and new terms to the general public like derivatives and swaps, could nearly bring down the global economy. And yet here we are five years later, dealing with a fragile economy because aftershocks are still being felt because of the GFC, Global Financial Crisis.

Plenty has been and will continue to be written about the Global Financial Crisis and its aftershocks, example being the state of the U.S. economy and the European crisis. However, little has been written about the lingering affects of the crisis will have on our collective physchy. I see examples of it everywhere. You don’t have to look any further than the deep distrust and vitriol people have towards banks, and bankers. Mention Wall Street, executive compensations packages, stock markets and the like and most people will speak of these in contemptuous terms. That to me will be one of the most significant fallouts of the Global Financial Crisis; the demonization of success.

It has become fashionable to disparage and criticize success. What was once admired and encouraged is today scorned. You’re successful? You make a large sum of money? Shame on you. It really has become open season for those who are successful. Politicians and journalists have been exploiting this sentiment for the last five years and will continue to do so until consumer confidence returns in force. To be clear this not an attempt to justify million dollar comp packages. But I will say this, if it doesn’t bother you that Shea Weber of the NHL’s Nashville Predators just signed a 14 year contract for $110 million, why are we bothered by what business leaders earn? I understand the argument that the wealth gap between middle class and the affluent is widening but its too easy to suggest that fairness would be severed by simply making the affluent pay more. But it’s becoming fashionable to suggest that because if you’re successful, wealthy, well, you must have done something wrong to earn that wealth. And if you ‘re legit, you should have to pay more for the sins of your business brethren.

In some aspects I understand the cynicism towards business leaders, and bankers in particular. Why wouldn’t there be? Where are the indictments for those who perpetrated the Global Financial Crisis? Prosecutors made Bernard Madoff pay, and deservedly so. But his was school yard compared to those who nearly brought down the global economy. This injustice fuels the mistrust and demonization of those who are successful. I hope this doesn’t result in future generations saying to their children, “dream big, be average”.

Until next time.

Cheers.

Similar Posts:

Read More Add a Comment